Watch the Friday Charts!

This week, all eyes are on the Personal Consumption Expenditures (PCE) Index, the Federal Reserve's preferred inflation gauge, with the January 2025 data set to drop on Friday, February 28th. As of today, economists and market watchers are buzzing with expectations – and for good reason. Inflation trends shape Fed policy, stock valuations, bond yields, and even the U.S. dollar's strength. Let's break down what's anticipated and how markets might react.

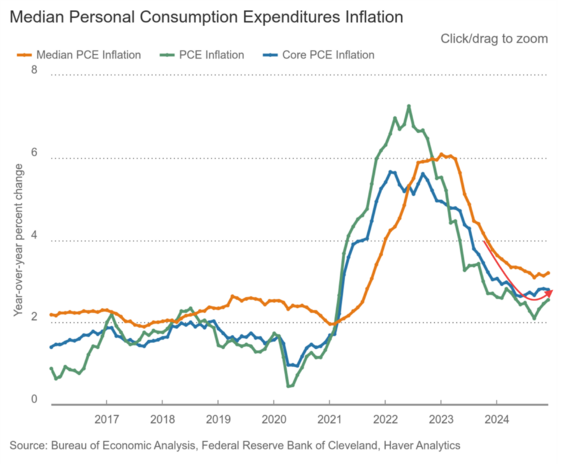

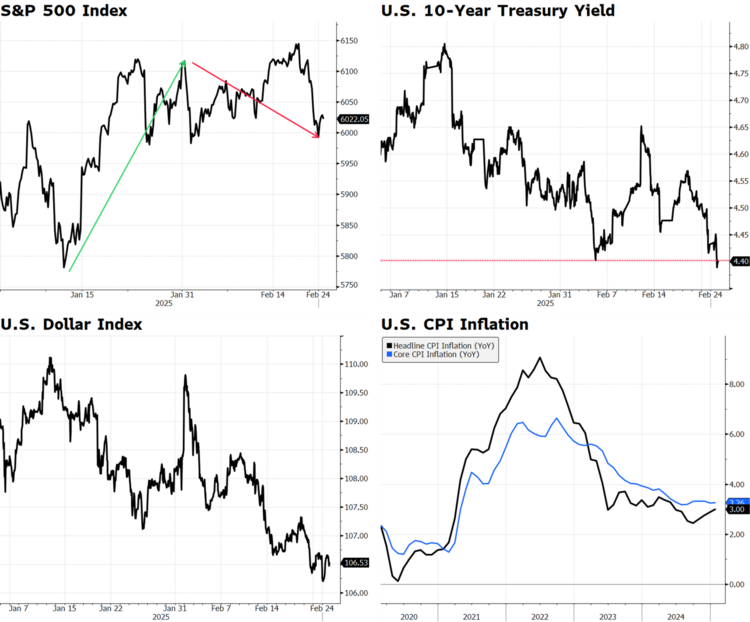

The current macro narrative is that inflation has stalled at a higher than comfortable level for the U.S. Consumer. The latest reading on PCE was higher than anticipated and was followed by cautious interest rate commentary by the Federal Reserve. 1 2 3

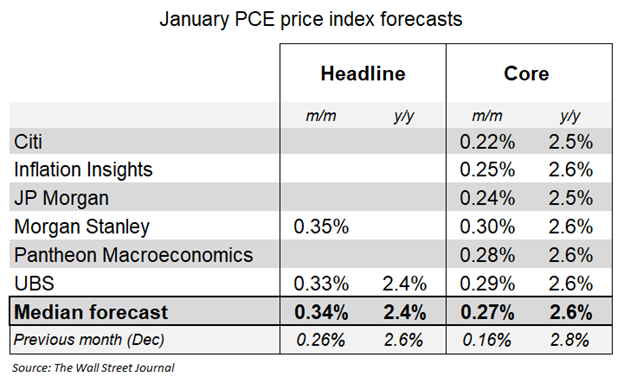

The PCE report, released monthly by the Bureau of Economic Analysis, tracks price changes across a broad swath of consumer goods and services. Analysts' forecasts suggest the headline PCE inflation rate for January could dip to 2.4% year-over-year, down from December's 2.6% reading. Core PCE, which excludes volatile food and energy prices, is projected to ease to 2.6% from 2.8%. These numbers, if accurate, would mark the lowest core PCE reading in seven months, hinting at a cooling inflation trend. 4

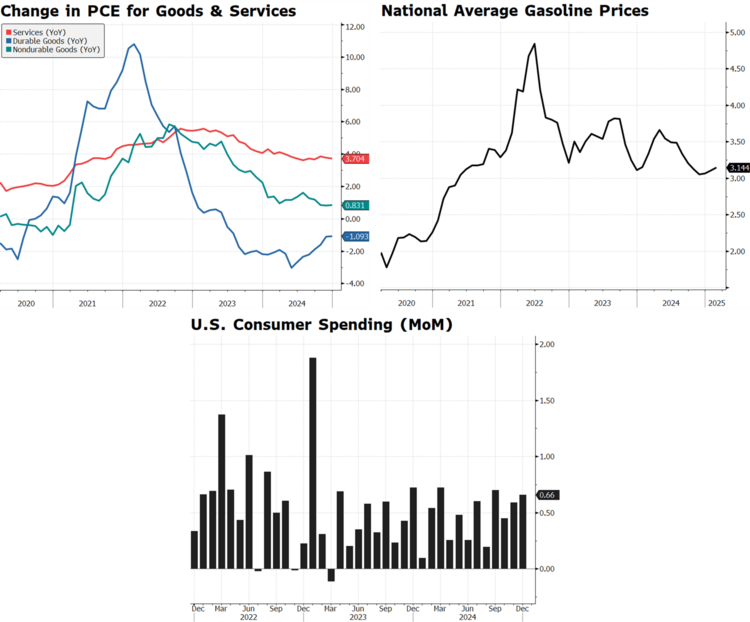

Why the drop? Falling goods prices and moderating service costs, like housing, are the likely drivers. Gas prices, a big wildcard in 2024, have stabilized recently, giving headline PCE some breathing room. But the Fed's 2% target remains elusive, and this "last mile" of disinflation is proving sticky. Consumer spending, up 0.7% in December, might also show resilience in January, adding complexity to the Fed's rate-cut calculus. 5

Markets are jittery after a mixed start to 2025. The S&P 500 hit record highs in January but has stumbled in February amid tariff fears and Fed hawkishness. Bond yields, with the 10-year Treasury hovering near 4.4%, are perched at a critical support level. The dollar's strength has wavered, reflecting uncertainty over rate cuts. Last week's hotter-than-expected CPI (3% year-over-year) spooked investors, pushing the odds of a March rate cut below 50%. This week's PCE report could either calm nerves or stoke volatility. 5

What to Watch

- Stocks: A PCE print at or below expectations (2.4% headline, 2.6% core) could boost equities, especially the tech-heavy Nasdaq, as lower inflation fuels rate-cut bets. But if core PCE sticks at 2.8% or higher, expect a sell-off.

- Bonds: The 10-year yield is at a tipping point. A benign PCE print could push it below 4.4%, signaling a bond rally. A sticky core reading might lift yields, pressuring growth stocks.

The Fed cut rates by 25 basis points in December 2024, bringing the benchmark to 4.25%-4.5%. This week's PCE will shape the March 18-19 Federal Open Market Committee meeting. A cooling 2.6% core PCE reading keeps a quarter-point cut in play – say, 35% odds. But if inflation surprises upward, a pause becomes likely, with markets pricing in steady rates through mid-2025. Fed Chair Powell's post-report comments will be gold, and any hawkish tilt could spark a risk-off move.

Volatility Ahead?

This week's PCE report isn't just another data point – it's a litmus test for 2025's trajectory. A soft landing is still in sight if inflation keeps cooling, but sticky core prices could reignite debate over tighter policy. Markets are primed for a jolt either way. Keep your eyes on those charts Friday morning.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.clevelandfed.org/indicators-and-data/median-pce-inflation

- https://www.reuters.com/markets/us/us-rate-futures-price-fed-hold-january-two-cuts-2025-lseg-estimates-2024-12-18/

- https://apnews.com/article/inflation-economy-jobs-federal-reserve-7f174d13518f7ab8a49fa284e869dab9

- https://x.com/NickTimiraos/status/1890057499098911076

- Bloomberg

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.