We Can’t Predict But We Can Prepare

Regardless of what economic, geopolitical, corporate, Trump tweet, or market-moving event occurs, all equity investors need to be prepared for risk.

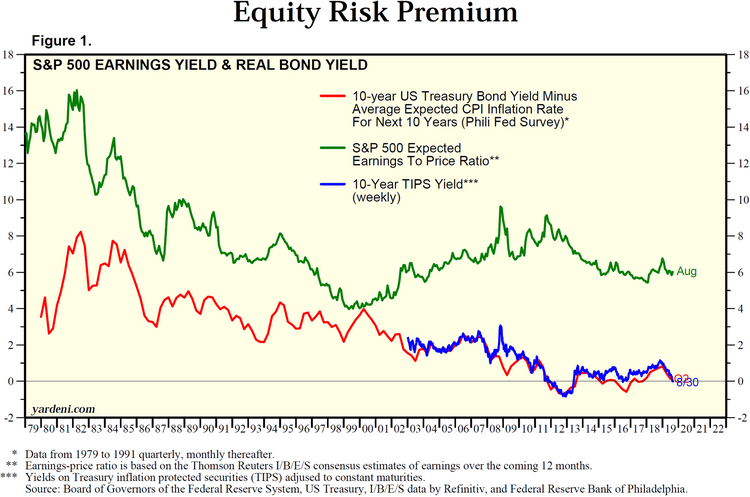

Risk is the underlying ingredient that creates excess returns over “risk-free” assets like government bonds.

Here’s a look at the current risk premium over various asset classes. [i]

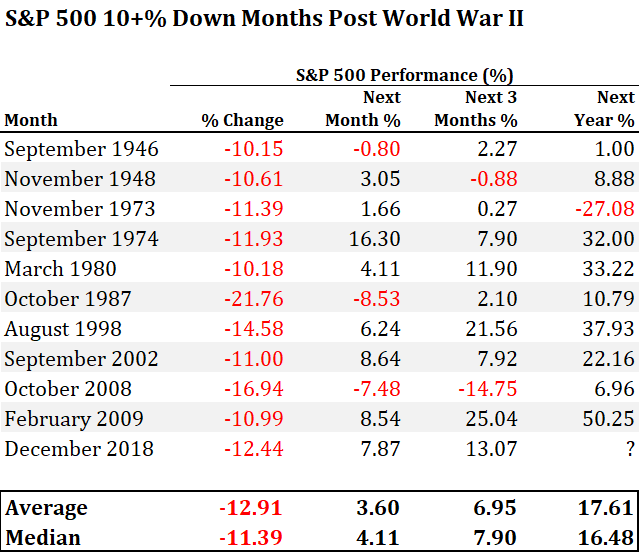

Risk will show up at various times in an investment cycle; usually, it’s highly unpredictable. [ii]

While risk is necessary and inherent in equity investing, it doesn’t have to equate to losses.

I use a simple formula when managing risk: Time shapes risk.

That’s it; that’s the whole formula.

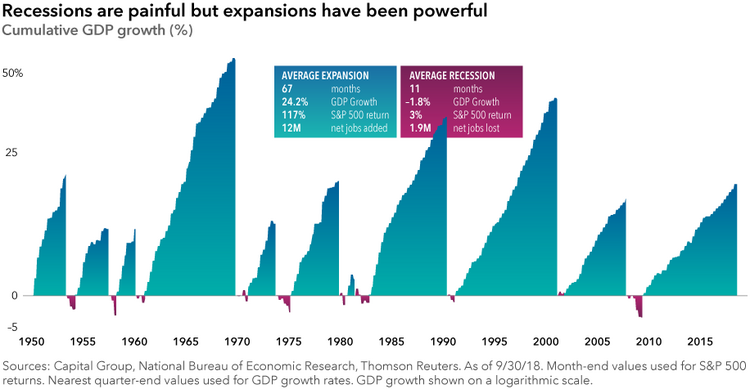

Recessions, which most investors equate with risk, are simply not long-lasting events. On average, recessions last approximately 11 months. [iii]

If you equate negative returns with recessions, you are creating counterfactual connections. On average, recessions correspond to muted returns of around 3% on the S&P 500, but certainly not guaranteed negative returns.

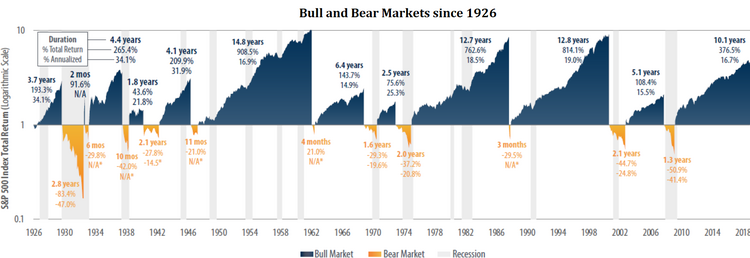

When it comes to bear markets, they too simply don’t last that long. [iv]

Look at how small the periods of time are in a bear market (down 20% or more). For those of us that suffer from recency bias, our last experience in a bear market was the 1.3 years during the financial crisis. While painful, with a 51% drawdown, the bear market wasn’t actually as long as it probably felt.

Time does shape risk if you can withstand the real-world pressures and pain of holding on.

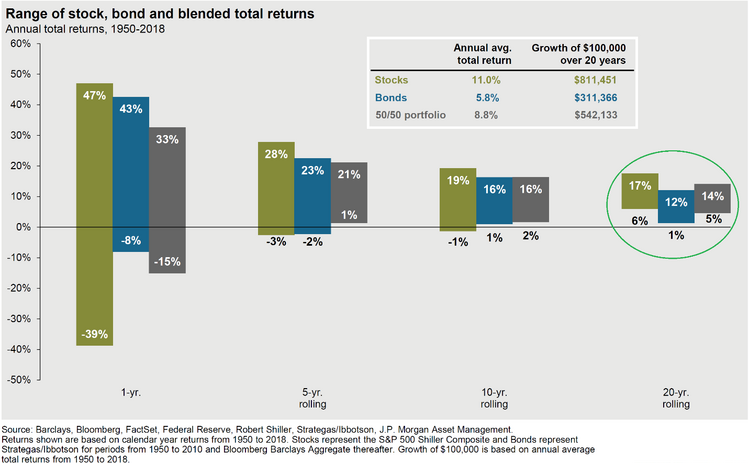

In fact, losses can disappear altogether if you hold assets long enough. In the chart below, you can see the range of returns over a 20-year period. Over shorter time frames, risk can be pretty significant, such as 39% for stocks. However, holding for 20 years reduces the risk on stocks to +6%. Thus, time shapes risk! [v]

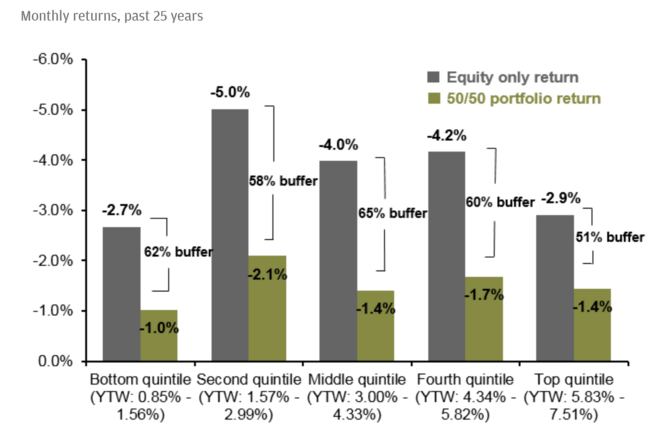

One final point on risk is that adding some fixed income to a portfolio does indeed muffle it to some extent. When looking at negative total returns on a monthly basis, you can see a stock-only portfolio carries much larger risks than a 50/50 blend of stocks and treasuries. [vi]

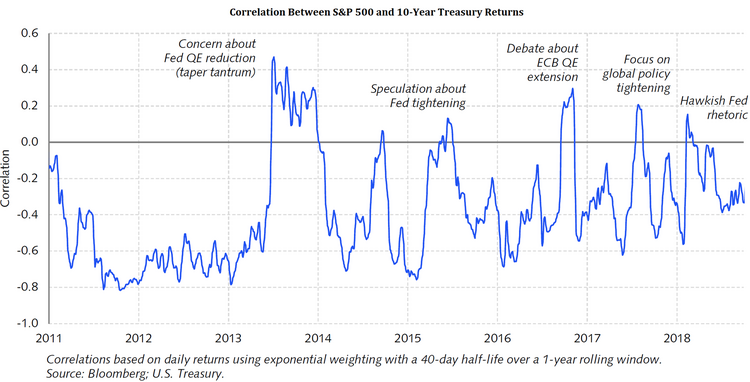

We don’t want to ignore one simple lesson we all learned during the financial crisis. When events are extreme, assets classes like stocks and bonds tend to move together. That simply means there is little shelter from the short-term storm. [vii]

As we work our way through this global economic growth trough we need to be prepared to hold for a period of time.

We suggest doing a few simple things with your advisor:

- Evaluate your targeted rates of return and evaluate if you need those returns or if you would be satisfied with a lower rate.

- Evaluate your investment time horizons to determine how much money you will need and when you will need it; when equity markets are down 50%, withdrawing money to fund life’s necessities can be far more costly.

- Evaluate your maximum pain threshold; this is more emotional than mathematical, so ask yourself, “If my portfolio was down 10%, 20%, or 50%, would it cause me to lose sleep at night? What level would cause me to sell? Is it a dollar amount or percentage?”

- Finally, share your findings to the above with us so that we can partner with, and help prepare you, for the risks.

We can’t predict when markets will adjust, but we can prepare for it, as can you.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.yardeni.com/pub/stockmktequityrisk.pdf

ii. https://www.bespokepremium.com/get/2019_Annual_Outlook.pdf (Login required)

iii. https://www.capitalgroup.com/advisor/ca/en/insights/content/articles/5-keys-to-investing-in-2019.html

iv. https://mgstn.ly/2k88SYt

v. https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/guide-to-the-markets

vi. https://am.jpmorgan.com/us/en/asset-management/gim/per/insights/market-insights/market-downturn

vii. https://www.deshaw.com/assets/articles/DESCO_Market_Insights_20190208_1.pdf