We Will Find Out

Market performance last week was the most consequential in years and at the same time it was like nothing occurred. If you went on a media vacation for the week, you would have hardly noticed any change in the major indexes. The S&P 500 had a precipitous drop on Monday yet churned higher during the week to end almost exactly where it started. 1

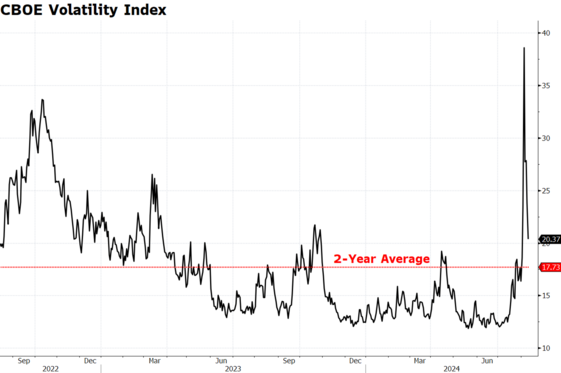

It’s hard to put the massive increase in volatility into the right context, however, it’s worth considering some implications. 1

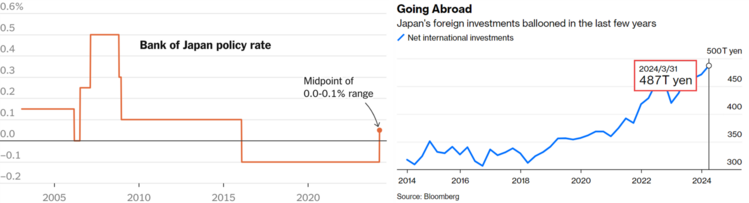

Primarily, the surprise rate increase from the Bank of Japan triggered a flood of selling tied to extended leverage using loans from Japanese banks. When you consider the flood of capital into the Japanese equity markets over the years you can come to grips with the threat to Yen based investments by higher rates. 2 3

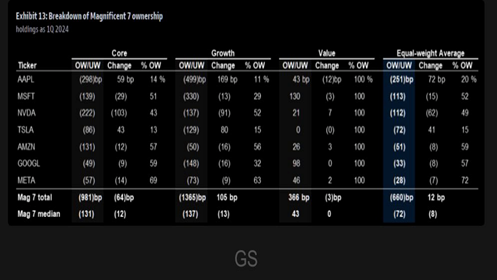

Certainly, the headline that Warrant Buffett sold a massive amount of Apple stock was a contributing factor to the volatility. 4

It is understandable to want to react to this news, but it turns out it’s not likely a reflection of his view on Apple. Buffett’s stated concern about higher capital gains tax rates in the future may have something to do with his trade. Interestingly, his massive Apple holding created some issues for index funds, and they opted to reduce their natural weightings by his large concentration. Indexes may have been more than 2.5% underweight in Apple (5% for growth indexes) due to discounting Buffett's shares. They might now rebalance Apple back to its proper weighting. 5

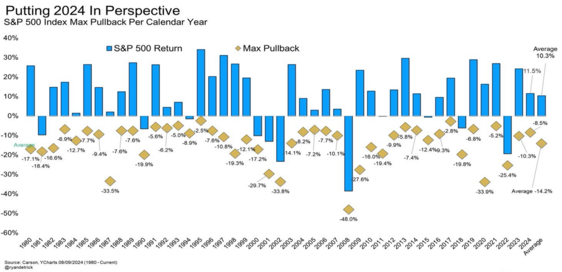

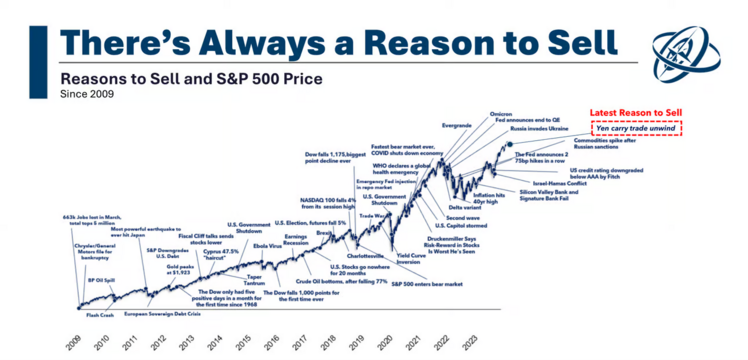

It should be clear by now that drawdowns are a regular occurrence in the market. Equity investors live in the world of drawdowns from previous highs. The massive drawdowns within the indexes would lead one to believe that equity investing is a game of chaos, and it can be. The average intra-year drawdown is about -14%, yet the markets still have positive annual outcomes in most cases. Let’s keep that in mind just in case we lose sight of the short-term risks. 6

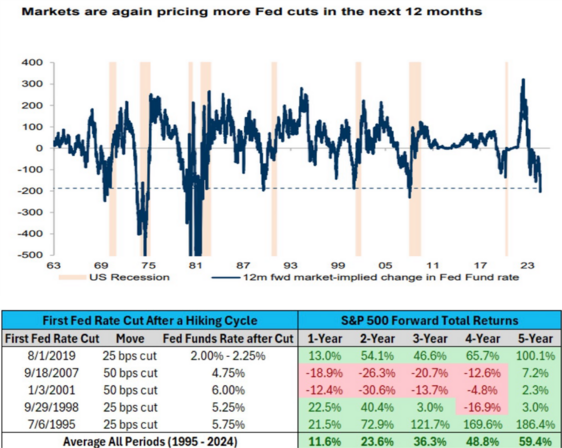

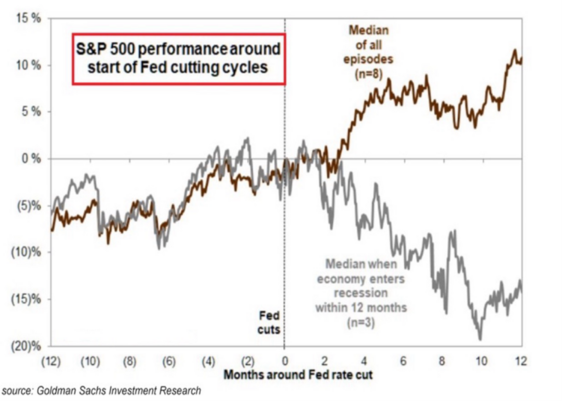

With expectations for interest rate cuts to begin in September and continue for the next 12 months, the opportunity for positive equity market returns looks likely. 7

It’s important to note rate cuts that occur with a recession have a materially different outcome than the average returns. Again, drawdowns shape our world, and we have to be able to withstand those pesky reminders of risk. 5

That’s likely the real issue surrounding the recent spat of volatility. Will we have a recession with interest rate cuts or will we not? It’s going to give all of us a reason to react, yet my personal view has been there are always reasons to sell but overall it’s rarely paid off. 8

We will continue to have more drawdowns and rallies as we creep our way to rate cuts and clarity around a weakening economy. Will we have a recession associated with rate cuts? We will find out!

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg

- https://www.nytimes.com/2024/03/18/business/bank-of-japan-interest-rates.html

- https://www.bloomberg.com/opinion/articles/2024-08-06/how-big-is-the-yen-carry-trade-really

- https://www.bloomberg.com/news/articles/2024-08-03/berkshire-hathaway-s-cash-pile-soars-to-record-276-9-billion

- https://publishing.gs.com/

- https://x.com/RyanDetrick/status/1822639954134004120

- https://thedailyshot.com/

- https://www.theirrelevantinvestor.com/p/thoughts-selloff