Weekly CEO Commentary 10-15-12

Q4 2012 Look Ahead: Look Beyond 66 Days

Weekly CEO Commentary 10-15-12

Tim Phillips, CEO – Phillips and Company

Every quarter for the last several years, I have presented a “Look Ahead” for the coming quarter during my committee meetings with institutional clients. I have summarized the presentation below, and provided a link to follow along with the full presentation.

Click here to access full Phillips & Company Q4 Look Ahead

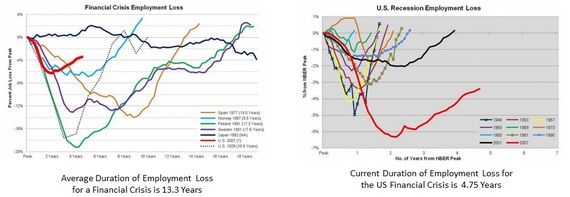

Many have called this a “jobless recovery” because it has been almost five years since it began, and we have only recovered half of the 9.8 million jobs lost. However, when you compare the loss of employment to other financial crises, it’s not that unusual. In fact, it’s actually been one of the smallest losses of employment during a financial crisis.

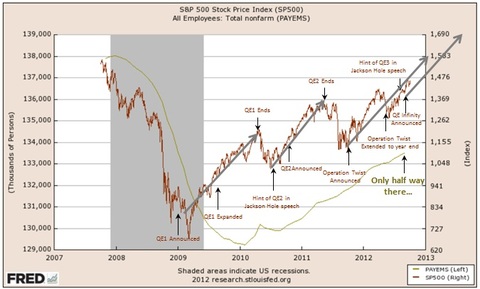

It’s clear the Federal Reserve’s use of unconventional monetary tools has helped in lifting asset prices. With the Federal Reserve’s latest round of quantitative easing having an unlimited time horizon there is no reason to believe it will end anytime soon. The question is now, “Will it ever lead to job creation?”

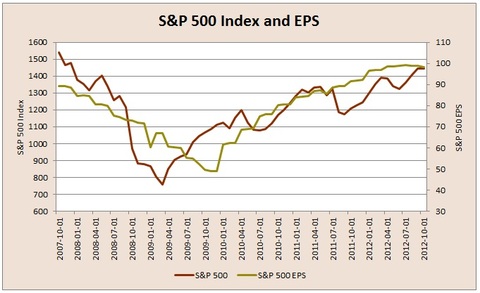

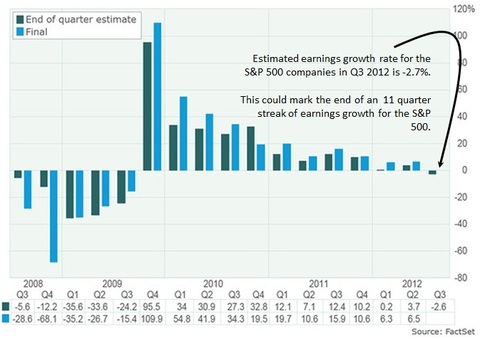

The Federal Reserve can use all the monetary tools it wants, but at the end of the day, earnings drive prices. Despite the day-to-day volatility you see in the news, earnings are what matter over the long run when you are investing in equities.

This is concerning because corporate earnings for the S&P 500 are expected to shrink by 2.7% this quarter. It would mark the end of an 11 quarter streak of earnings growth for the S&P 500. Further, expectations for next quarter might be too optimistic with a growth rate near double digits.

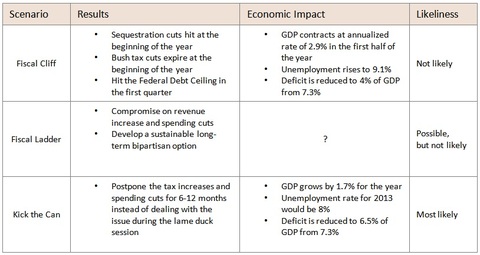

If we go over the fiscal cliff in 2013, the economy is expected to contract by 2.9% in the first half of the year according the CBO. We don’t see that as the most likely outcome, and based on the performance of defense stocks (mentioned last week), the market doesn’t either.

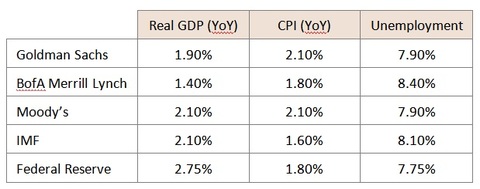

Overall the outlook for 2013 is similar to this year: low growth, low inflation, and continued high unemployment.

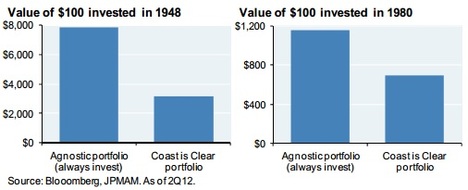

Now before you consider selling everything you own, buying gold and burying it in your back yard, it's important to consider how and when returns are generated. It’s not from timing the market and it’s not always when the coast is clear according to a study by Michael Cembalest at JP Morgan. To summarize his study, if you invested $100 and only stayed invested when times were good as defined by:

- Attractive Valuations: Market P/E of 17 or less

- Not in a Recession: Unemployment below 6% and manufacturing expanding

- Stable Inflation: Inflation below 4%

You would generate an annualized return of about 5.67% since 1980 and 5.36% since 1948. However, if you stayed invested no matter what, you would generate an annualized return of 7.50% since 1980 and 7.01% since 1948. Almost 200bps of additional annualized return by simply staying invested.

There are signs of stress as we look ahead this quarter, but it’s important for you to put this in the context of the time horizon of your portfolio. If you’re a foundation, endowment, or pension then you can probably look past short term volatility as you have a perpetual investment mandate. If you’re an individual or family then you need to consistently be recalibrating your portfolio to account for the changes in your investment time horizon and liquidity needs. Generating returns involves taking risks and time is a key component in shaping those risks.

Of course, if you think the world will end in 66 days with the Mayan Calendar on December 21, 2012 then you might want to sell everything anyway and have fun with the money.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can Email me directly.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Adam Gulledge, Associate – Phillips & Company

Alex Cook, Associate – Phillips & Company