Weekly CEO Commentary 11-5-12

Does It Matter

Weekly CEO Commentary 11-5-2012

Tim Phillips, CEO – Phillips and Company

Of all the times to not be political, now is one of the best. In what looks like a very close election and polls suggesting an evenly divided country, I am sure emotions are running very high. Out of respect for our equally divided and diverse client base, I think its best I focus on what we all are: The Investor Class.

If you have a 401(k) with your company and we provide advice, you’re part of the Investor Class. If you’re a CEO and we manage your wealth, you’re part of the Investor Class. If you sit on one of the many committees for the foundations or endowments we advise, you’re part of the Investor Class.

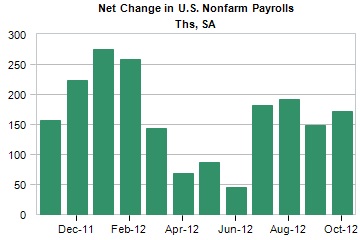

The most important thing to the Investor Class is the macro environment in which we operate. The overall economy is slowly improving. We added 184,000 private sector jobs in October which was spread across several sectors according to the BLS:

- Construction

- Manufacturing

- Retail

- Professional and Business Services

- Leisure and Hospitality

Especially helpful were those jobs added in construction and manufacturing, 17,000 and 13,000 respectively.

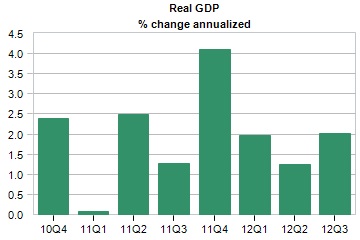

US GDP grew at an annualized rate of 2% in the last quarter according to the BEA. By all measures, this will not create enough jobs to dramatically reduce the 7.9% unemployment rate; however, it will keep us from slipping into a recession.

In fact, at the current rate of new jobs (184,000) it will take almost 4 years to see the unemployment rate drop to 5.5%. Don't take my word for it; the Federal Reserve has a pretty nice calculator to help figure it out.

Unfortunately, trying to forecast the future based on historical data is a bit like driving while looking in the rear view mirror. As we have discussed in past posts, earnings are what really drive equity performance and in our current case, earnings are coming in very weak.

According to FactSet, the S&P 500 blended earnings growth for the third quarter this year is -0.5%. If this number remains negative it will mark the end of the eleven-quarter streak of earnings growth for the index.

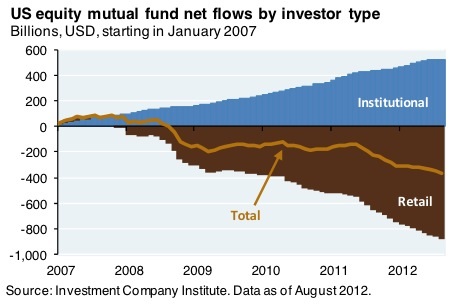

There’s plenty to drive the retail investor crazy with concern. In fact, it's just the thing short-term money does: go crazy and run for the exits. You can see from the chart below, institutional investors have been adding equities while the retail investor has been selling. No wonder the S&P 500 is up over 125% since the March 2009 lows, when you saw the retail investor run for the exit.

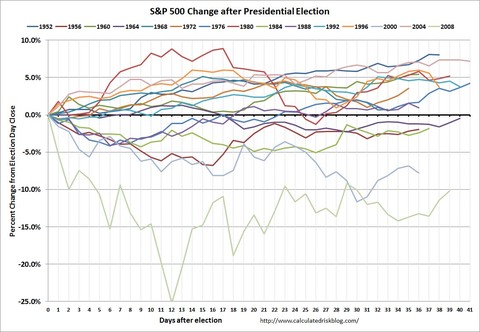

Below is a chart of the S&P 500 after Presidential Elections provided by Calculated Risk and as you can see, it would be futile to make a prediction using this type of short-term data. If you even look at slightly longer data than one or two days – perhaps something as long as 3 months – you can see elections matter, but how much?

As part of the Investor Class, we might face some short term pain. We might face the median outcome of all elections which is 3.6% until the end of the year. We might face even more upside through the end of the year. It's especially important to keep one simple fact in mind. For as long as business and government co-existed in our country, business and government have both thrived. I believe businesses will continue to innovate and find ways to grow earnings and benefit the Investor Class. The one thing the Investor Class could really benefit from is a stable tax policy from whoever lives in the White House.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can Email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Adam Gulledge, Associate – Phillips & Company

Alex Cook, Associate – Phillips & Company