Weekly CEO Commentary 9-10-12

A Housing Head Fake?

Weekly CEO Commentary 9-10-12

Tim Phillips, Phillips and Company

Last Friday's jobs report almost guaranteed additional monetary intervention by the Federal Reserve to come this week at the end of their meeting on the 13th. As I mentioned in last week’s blog, that could be a catalyst for a sell off. After all, we are still staring down a weak economy, right?

Well, not so fast. Besides the data we presented last week on the underlying strength in our economy, the housing market has been showing signs of life as well. Let's run through the numbers:

- In July, private residential construction spending decreased 1.6% from June, but it’s 19% higher than a year ago according to the US Department of Commerce.

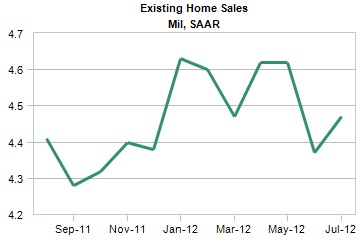

- In July, existing home sales increased by 2.3%, and it’s 10.4% higher than a year ago according to the National Association of Realtors.

- The median price of homes sold rose 9.4% from a year ago and had its sharpest increase since 2006 according to the National Association of Realtors.

- In July, housing inventory decreased 23% from a year ago. This is the 17th consecutive month for a year-over-year decrease according to the National Association of Realtors.

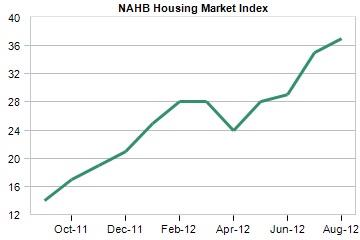

- In August, homebuilder confidence climbed to the highest level in more than five years according to the National Association of Home Builders/Wells Fargo Builder Confidence Index.

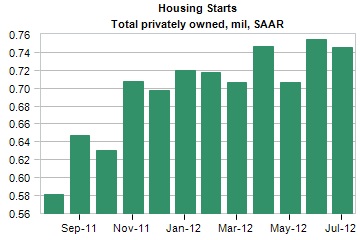

- New Residential Construction is running at 746,000 annualized units. Housing starts in July are also up nearly 22% compared with July 2011 and on pace to be up about 20% for the year from 2011 according to the Census Bureau.

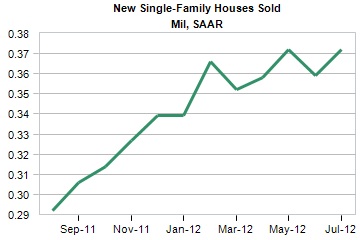

- New single-family home sales for July came in at 372,000, a rise of 3.6%. Single-family home sales are now up 25.3% over the year. Sales rebounded to their fastest pace since May according to the Commerce Department.

Finally, looking at publicly traded home builders certainly suggest things have improved. The S&P Homebuilder Index, a basket of home building companies, is up 44.15% for the year.

Where’s the Beef?

Unfortunately, we are still missing the economic growth and job creation normally associated with a housing recovery.

In 2005, housing represented 6.1% of GDP when you factor in the construction as well as the associated spending that comes when we buy homes. It now only represents 2.7% of GDP According to the National Association of Home Builders. Clearly, an improvement in housing and its associated components would be very beneficial to our economy.

If the housing industry reached its historical average, it could add almost 3 million jobs and economic growth could double. (Remember more jobs = higher wages = higher consumption = higher GDP = more jobs) according to the Bipartisan Policy Center.

Will this trickle into the rest of the economy or is the recent data just an industry head fake fooling new homeowners?

I can’t be certain either way, but I am seeing more underlying positive trends in the US economy than last year as the US is beginning to lead the world out of this global recession. Certainly a recovery in the housing market would continue to benefit the United States by creating more jobs, higher wages, and drive more consumption.

That’s why our portfolios are overweight US equities, but we still maintain a global asset allocation. Housing head fake? We will soon find out.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can Email me directly.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Adam Gulledge, Associate – Phillips & Company

Alex Cook, Associate – Phillips & Company