Weekly CEO Commentary 9-24-12

Wealth Does Not Equal Consumption: How Long Can This Last?

Weekly CEO Commentary 9-24-12

Tim Phillips, CEO – Phillips and Company

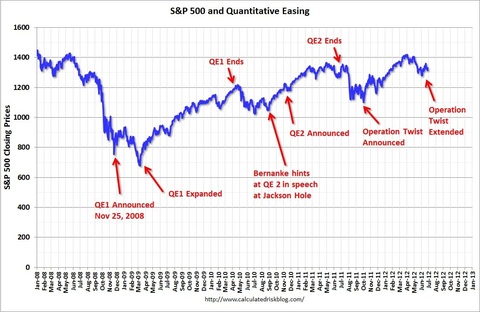

It's abundantly clear that Chairman Bernanke has been hard at work, and his actions have now had a positive impact on investors.

As we have written in the past, the only thing monetary intervention might be creating is a bit of the wealth effect. Based upon the chart above, those that have investments should be feeling wealthier since the Federal Reserve began quantitative easing.

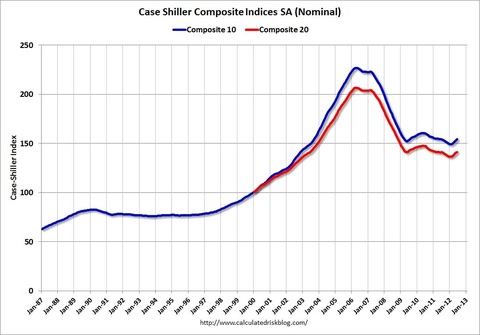

Further, those with homes might be feeling less poor with a recent upturn in housing prices according to the Case-Shiller Composite Indices.

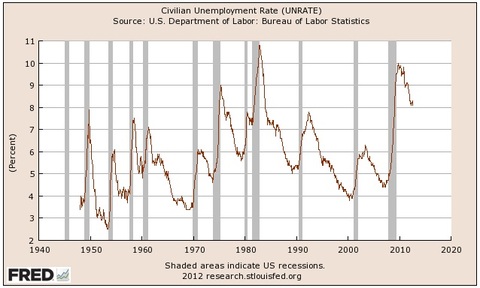

Unfortunately, the end goal of all of this monetary intervention is to stimulate end demand (consumption) and create job growth, not increase asset prices. The consequences of all of this market distortion will be felt most likely in some outlying years, 2016 and beyond.

As for creating job growth today, unemployment appears to remain stubbornly above 8% and weekly initial unemployment claims have been moving sideways most of the year according to the Bureau of Labor Statistics.

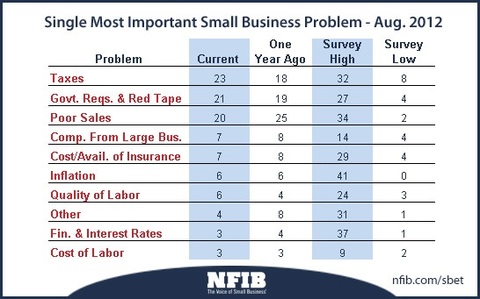

In order to create job growth, we need to focus on addressing real concerns that affect businesses. A recent NFIB (National Federation of Independent Businesses) survey clearly shows small business wants more demand (Poor Sales-20) much more than they want lower interest rates (Fin. & Interest Rates-3).

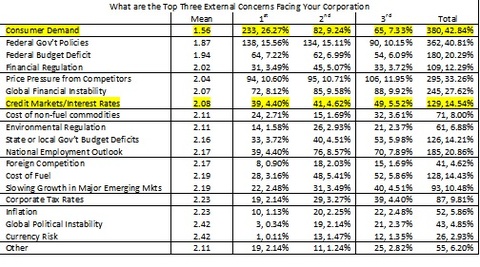

In addition, a recent survey by Duke University showed 43% of CEOs are most concerned about consumer demand while only 15% are worried about interest rates.

What you might notice, besides the disparity between consumer demand and interest rates, is how much concern there is over high government regulations, red tape and federal government policies.

Unfortunately, no matter how good it feels to investors today, no matter how misguided recent Fed policy might appear, and no matter what CEO's say, we might be in for a long haul.

Carmen Reinhart and Kenneth Rogoff wrote one of the best history books on financial crises called This Time Is Different. In a recent paper titled, Public Debt Overhangs: Advanced-Economy Episodes Since 1800, they looked at countries since 1800 with 90% public debt to GDP for 5 years or longer, which now includes the United States. Their study concluded:

- The average duration of the debt overhang is 23 years.

- The debt slows down economic growth and losing even 1 percentage point per year from the growth rate will produced a substantial decline in output.

- The average annual growth rate is 1.2 percentage points lower in periods of high debt (90% debt/GDP ratio).

It's not clear what causes high debt countries to find themselves in their high debt situation. The reasons include war, excessive borrowing for social programs, and simulative efforts to avoid depressions, to name a few. It is clear, however, that the time it takes to resolve these behaviors massively distorts markets.

The good news in all of this is that stock markets are not entirely correlated to US or World GDP in the short run. So, perhaps we can grow our wealth at the same time people consume less. I have a funny feeling this can't last long though.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can Email me directly.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Adam Gulledge, Associate – Phillips & Company

Alex Cook, Associate – Phillips & Company