We’re Stuck

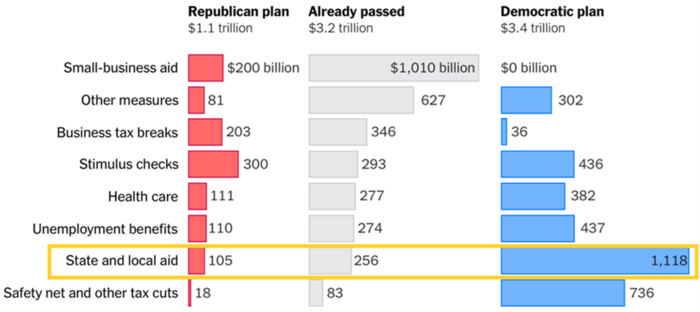

Critical COVID-19 legislation is on hold as both sides of the aisle bicker over who gets what in the next round of stimulus, with the two sides far apart on the critical question of state funding. [i]

Democrats want over $1 trillion in the next round of COVID-19 stimulus for states while Republicans want just over $100 billion.

First, let’s establish a baseline of the economic impact from this for government spending.

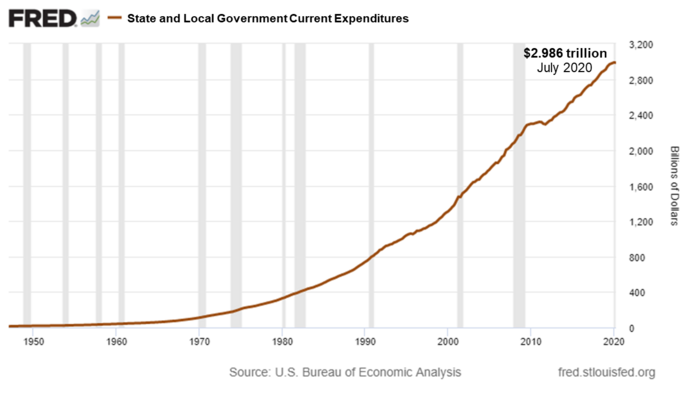

Currently, state and local governments spend about $3 trillion. [ii]

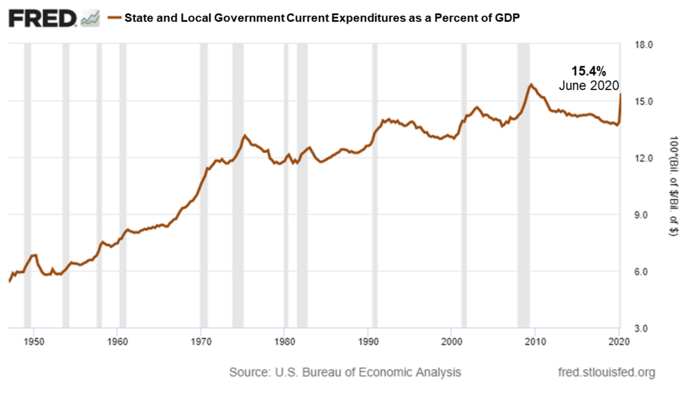

That’s 15.4% of our GDP. [iii]

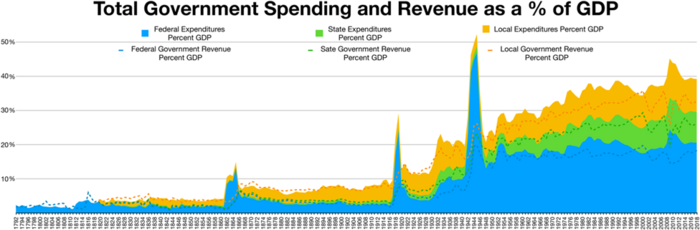

Breaking down the numbers even further, state spending represents approximately 7.2% of GDP while local government spending represents about 8.2% of GDP. [iv]

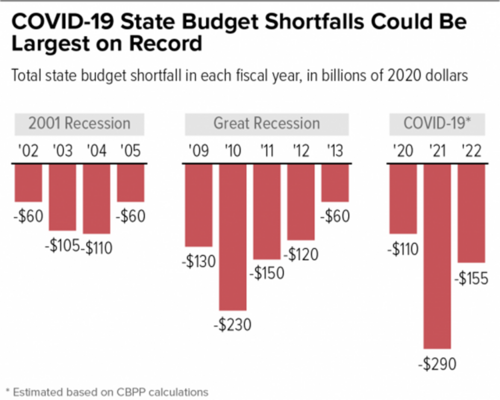

While some of the impact from COVID-19 will be felt in fiscal year 2020, most states have a June fiscal year-end so, much of the budget impact will not be felt until fiscal year 2021. Further, almost all states have fewer fiscal options as they must constitutionally balance their budgets each year.

So, without fiscal support from the federal government directly to the states, you might expect more than $100 billion in cuts coming from state and local budgets. [v]

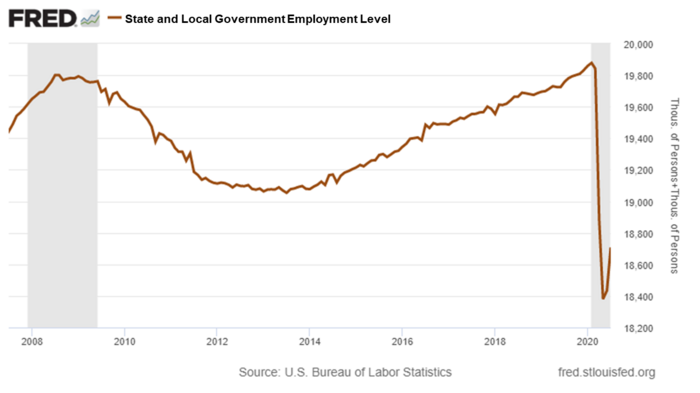

Further, with no federal support, expectations are for state and local governments to continue laying off employees. [vi]

Again, all of this will lead to a drag on economic growth.

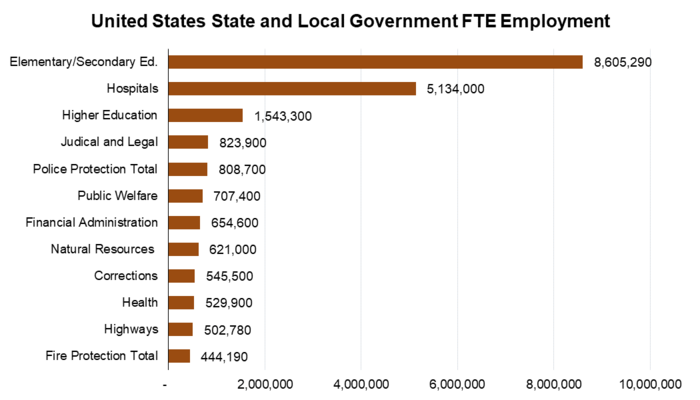

After all, state and local governments represent 18 million jobs – about 12.5% of total employment and $1.07 billion in payroll. [vii]

Realize overall government spending represents over 20% of our GDP.

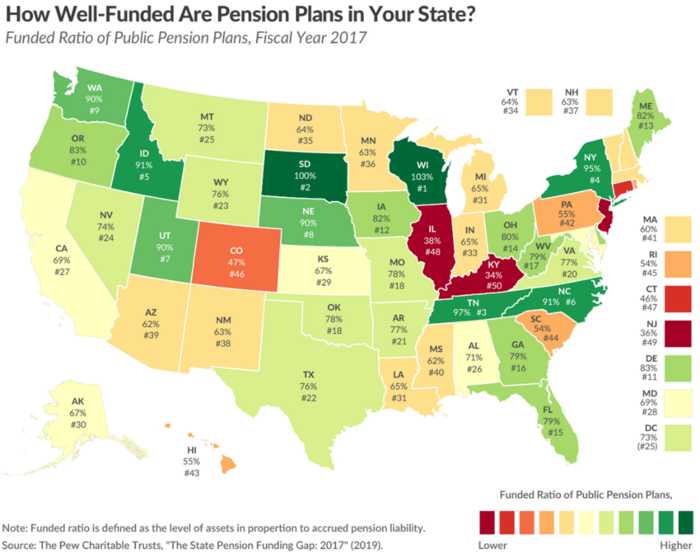

Republicans are concerned much of this money will be used to patch up major holes in pension funding. [viii]

While important, those holes can continue for a substantial period of time and we certainly don’t want stimulus money sitting in a pension funding account as it would not be immediately stimulative.

Concurrently, patching the employment gap on the state level while they prepare for budget cuts would be critical in the shape of the recovery.

We cannot continue with this recovery without backfilling the states, regardless of our politics. We need to keep backfilling schoolteachers, hospitals, police, and, yes, university professors, too.

A little PPP for teachers may not be a bad idea right now to avoid states making immediate and irreparable cuts that will damage our economy. Let’s watch this carefully as markets have likely already anticipated the passage of a package that includes support for the states.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.nytimes.com/interactive/2020/07/30/upshot/coronavirus-stimulus-bill.html

ii. https://fred.stlouisfed.org/series/SLEXPND

iii. https://fred.stlouisfed.org/graph/?g=ul1k

iv. https://www.urban.org/policy-centers/cross-center-initiatives/state-and-local-finance-initiative/state-and-local-backgrounders/state-and-local-expenditures

v. https://www.cbpp.org/research/state-budget-and-tax/states-continue-to-face-large-shortfalls-due-to-covid-19-effects

vi. https://fred.stlouisfed.org/graph/?g=ulfa

vii. https://www.bls.gov/ooh/home.htm

viii. https://taxfoundation.org/state-public-pension-plan-funding-coronavirus/