What Are We Missing?

Part of our work as advisors is to constantly question our assumptions, biases, and beliefs. Beyond the first principals of investing that are clearly grounded in our practice, we form views around macroeconomic outcomes.

Simply stated, our current views are:

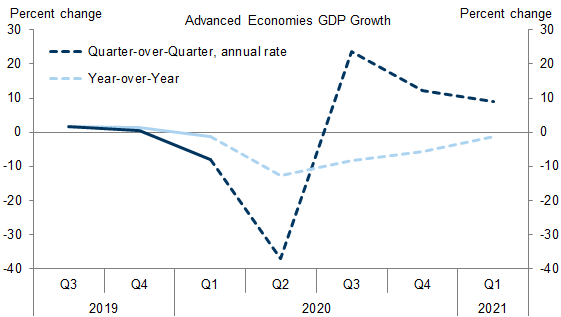

Economic vitality will return in the coming year [i]

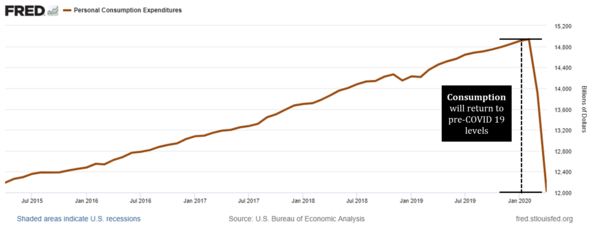

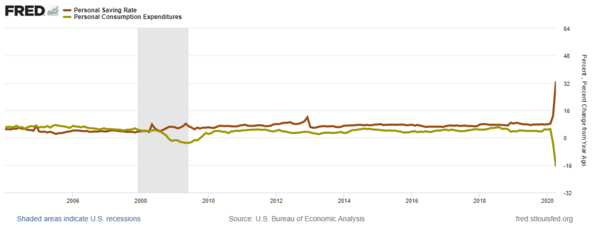

Consumption will return to pre-COVID-19 levels, albeit in different areas of priority. [ii]

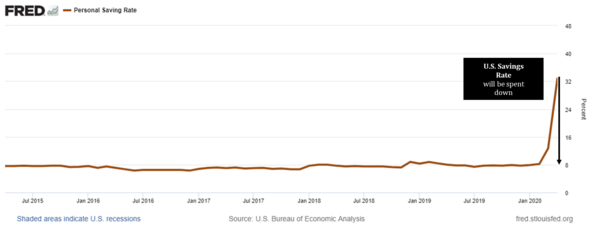

The U.S. savings rate will be spent down back to pre-pandemic levels, adding approximately $3 trillion to the U.S. economy. [iii]

U.S. employment will recover at least 90% of prior peak levels by Q4 2020. [iv]

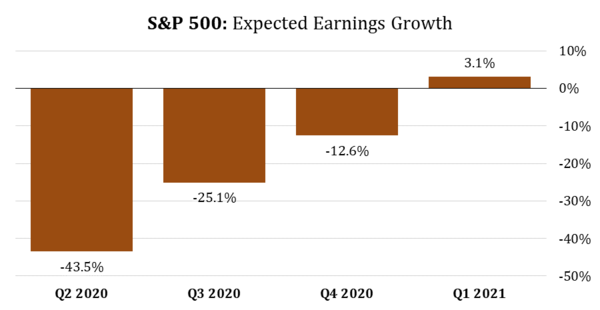

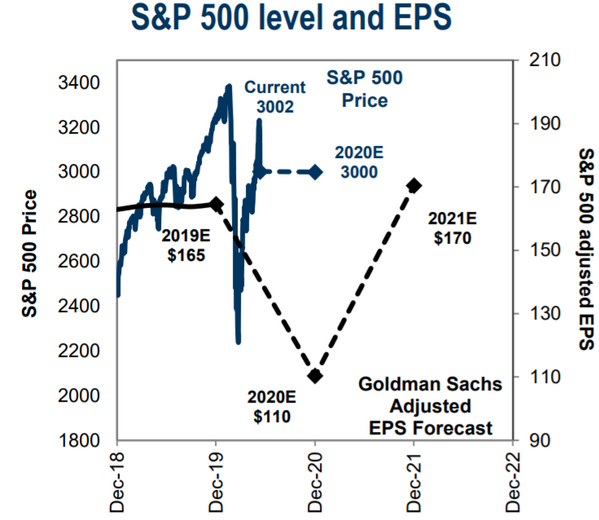

Corporate earnings will resume growth on a year-over-year basis beginning in Q1 2021. [v]

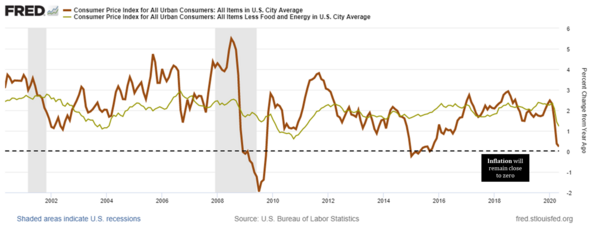

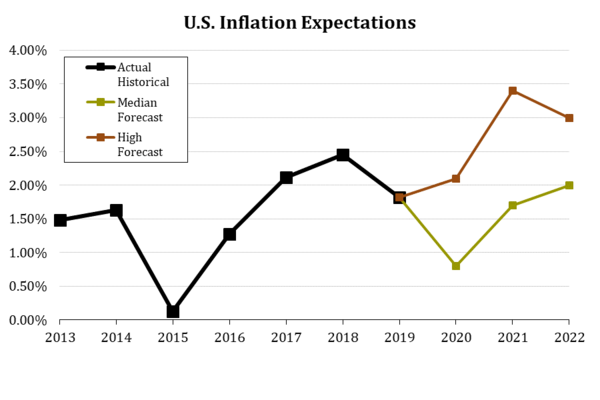

Inflation in the short-term and intermediate-term will remain close to nonexistent. [vi]

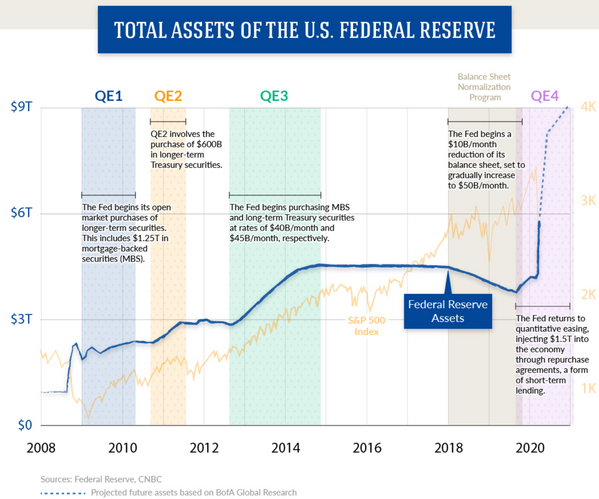

The Federal Reserve will inflate their balance sheet to fight deflationary pressures at any cost. [vii]

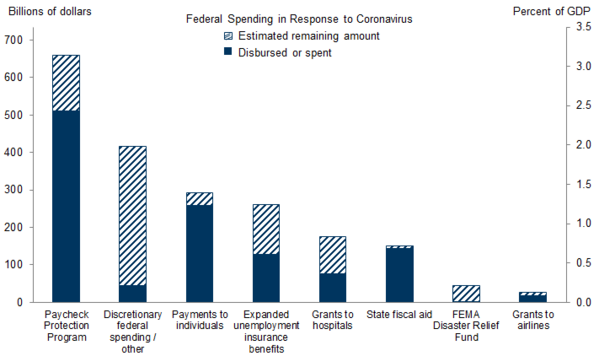

U.S. fiscal policy will add another $1 trillion to our economic output in some fashion (state and local government transfer payments, extended unemployment benefits, payroll tax cuts, medical subsidies, etc.) [i]

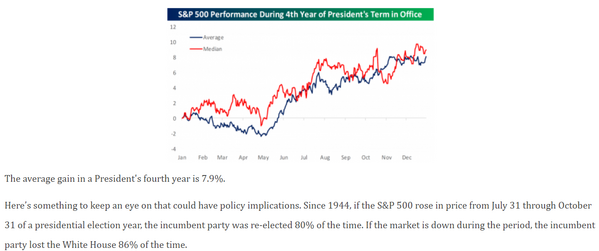

Trump will push to spike the economic punchbowl with more juice to hold the economy together through November’s election—he knows a bad stock market historically equals an 86% chance of him losing. [viii]

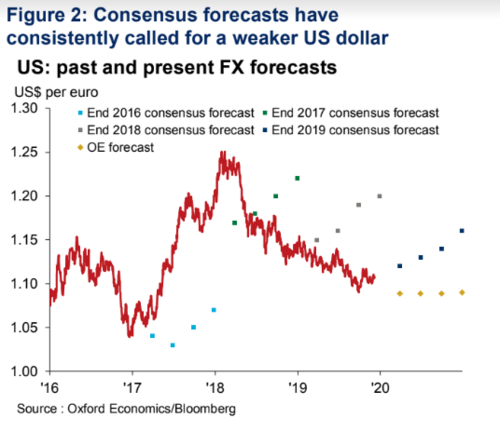

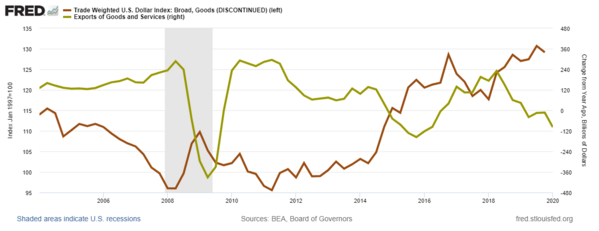

A weaker U.S. dollar will fuel export growth. [ix]

Here’s what we might be missing:

The S&P 500 has already rallied 38% off the March lows, making up about 70% of the losses incurred. [x]

Investors are anticipating a quicker recovery in earnings growth than what we are expecting. [i]

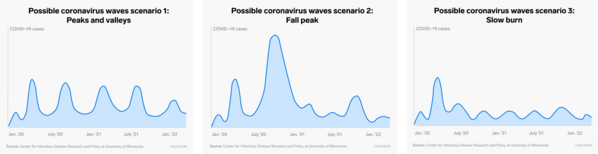

A potential second wave of COVID-19 could force another national shutdown and a second massive collapse in corporate revenue and earnings. [xi]

Inflation in the short-term and intermediate-term may spike based upon the congressional authorization of new debt (some call this printing money). [xii]

There is no next round of stimulus or relief to state and local governments, forcing mass layoffs. [xiii]

Consumers hoard their savings and crimp U.S. consumption. [xiv]

The U.S. dollar spikes higher, creating a drag on U.S. exports and manufacturing jobs. [xv]

While we are aware of what drives our views and what we believe will not occur, there is room for doubt as we know anything can happen when forecasting, and usually does.

For that reason, we turn to our core principals of investing: (See our presentation on those here)

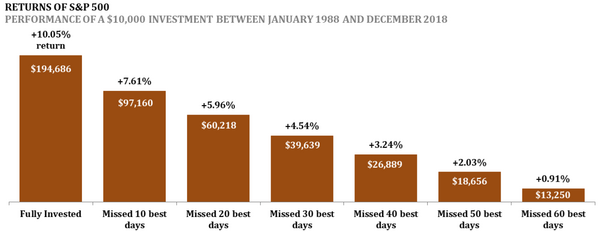

Markets move in brief bursts and if you miss just a few days, you lose almost all of the advantage. [xvi]

Time shapes risk and holding your assets over longer periods of time can minimize the downside. [xvi]

Your plan should dictate your needed rates of return and you should match your portfolio to that rate of return—assuming you believe, like we do, that there is always a trade-off between risk and return.

Rebalancing your portfolio to your target return and plan is of utmost importance.

Share with us what you think we are missing. We are always better when we think as broadly as possible. You can email me using the link below.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://research.gs.com/

ii. https://fred.stlouisfed.org/series/PCE

iii. https://fred.stlouisfed.org/series/PSAVERT

iv. https://fred.stlouisfed.org/series/CE16OV

v. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_061220.pdf

vi. https://fred.stlouisfed.org/series/CPIAUCSL

vii. https://www.visualcapitalist.com/the-feds-balance-sheet-the-other-exponential-curve/

viii. https://www.bespokepremium.com/

ix. https://www.marketwatch.com/story/why-us-dollar-bears-could-be-thwarted-in-2020-2019-12-31

x. https://stockcharts.com/h-sc/ui

xi. https://stockcharts.com/h-sc/ui

xii. https://www.bloomberg.com/quote/CPI%20YOY:IND

xiii. https://www.motherjones.com/kevin-drum/2020/06/stimulus-we-desperately-need-it-for-state-and-local-governments/

xiv. https://fred.stlouisfed.org/series/PSAVERT#0

xv. https://fred.stlouisfed.org/series/PSAVERT#0

xvi. https://phillipsandco.com/files/4715/8395/6151/The_5_Basic_Rules_Equity_Investors_Need_to_Know_-_20200311.pdf