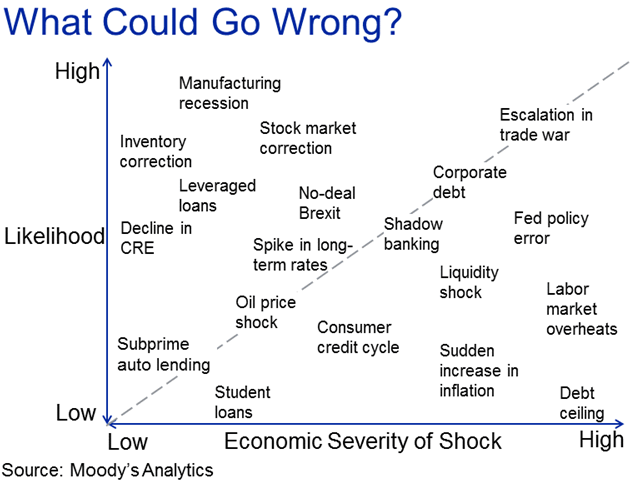

What Else Can Go Wrong?

The old adage of Murphy’s law states, “Anything that can go wrong will go wrong.” This probably applies to our current season of worry. Moody’s Chief Economist Mark Zandi sums it up well with the following chart. [i]

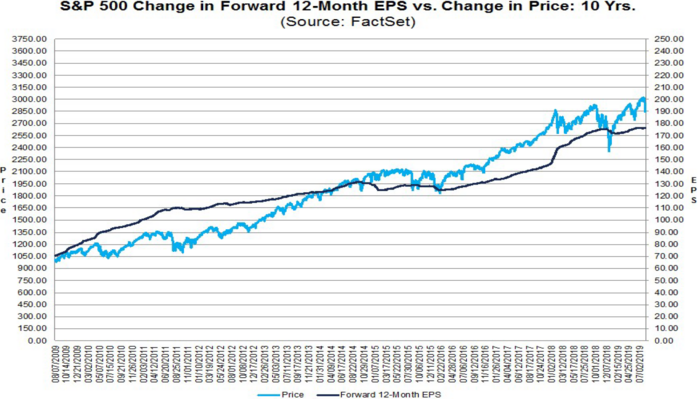

It’s not surprising to see the equity markets flutter in weakness, especially as Q2 earnings season sputters to a close. Ninety percent of S&P 500 companies have reported earnings, collectively posting a decline of 0.7% year-over-year (YoY), while the S&P 500 is 3.7% off its late July highs. [ii]

We will likely enter an earnings recession when all is said and done at the end of this earnings season.

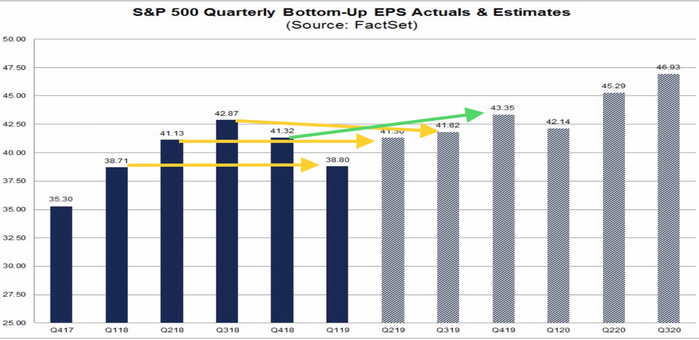

You can see from the chart below YoY earnings have been dismal, albeit working off some pretty high comparisons from last year due to tax cuts. [ii]

In fact, we likely won’t see a recovery in YoY earnings growth until Q4 2019.

Trump’s trade and currency war with China notwithstanding, there will be a few events this week that could spook already nervous equity investors.

The world’s largest retailers, Alibaba and Walmart, both report earnings this week. [iii] [iv]

China’s largest retailer, Alibaba, is poised to report tremendous estimated growth of 71.2% while analysts are predicting Walmart to post a YoY decline of 6.2%. Results from these two companies will give a peek into the retail consumer’s mindset across the globe.

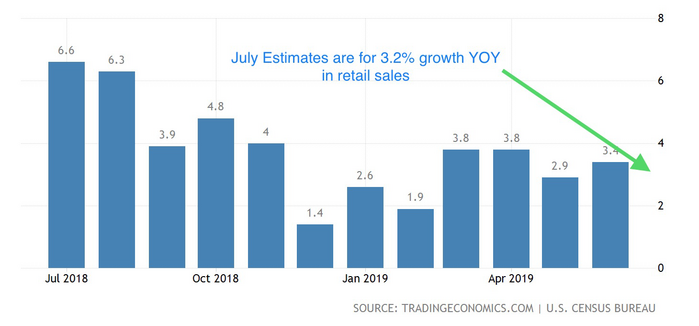

Additionally, U.S. retail sales will be reported on Thursday and expectations are for the U.S. consumer to continue shopping and spending. This will certainly be a critical forward-looking indicator for equity investors. [v]

Germany reports second-quarter GDP on Wednesday. While most analysts are expecting a small uptick, I believe Germany will show a slowdown in economic activity, signaling the start of a recessionary trend in Europe’s largest economy. Some of this is driven by softness in auto sales, with uncertainty around Brexit also adding to the weakness. [vi]

Keep in mind, a lot can go wrong in the very near-term. Cycles exist across various timeframes and equity markets react accordingly. The overwhelming question I always ask our clients is how will they react? What time horizon do you have for your investments?

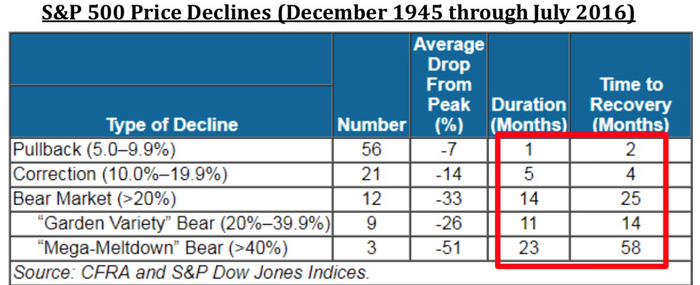

Whatever your time frame, it’s critical to accept the cyclical nature of equity investing by understanding that contractions and bear markets do occur across long-term investment cycles. [vii]

Short-term pullbacks of 5% to 10% occur quite frequently and the recovery periods are historically short. Corrections of 10% to 20%, while less frequent, certainly require more patience. And bear market corrections of 20% or more require resilience and commitment to your investment program as they can historically last upwards of two years before recovering.

There’s no doubt that a lot can go wrong when investing across multiple economic cycles and there is little that can be done about that as an investor. The only things you can control are your investment time horizon and ability to withstand the emotional toll that comes with volatile markets.

Let’s be ready for that!

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.economy.com/dismal/analysis/commentary/352558/US-Macro-Outlook-A-Fragile-Place/ (Paywall)

ii. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_080919.pdf

iii. https://www.barchart.com/stocks/quotes/BABA/earnings-estimates

iv. https://www.barchart.com/stocks/quotes/WMT/earnings-estimates

v. https://tradingeconomics.com/united-states/retail-sales-annual

vi. https://tradingeconomics.com/germany/gdp-growth

vii. https://www.aaii.com/journal/article/stock-market-retreats-and-recoveries.touch (Paywall)