What If This Isn’t a Bubble

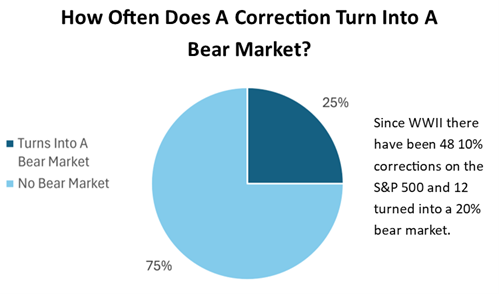

Market pullbacks tend to make more noise in the headlines than in history. Since World War II, the S&P 500 has seen 48 corrections of 10% or more—but only 25% of those ever became true bear markets. That means three out of four times, investors who tuned out the noise and stayed invested came out ahead.

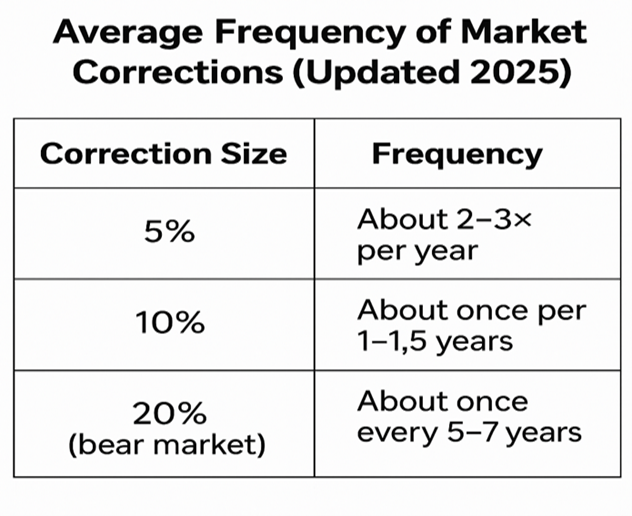

And while a 20% bear market may sound catastrophic, history shows they tend to happen about once every five to seven years, not with every news cycle. (Didn’t we just finish a near-20% correction this past spring?). Five percent and ten percent drops — the “normal turbulence” of markets — happen several times a year and are better seen as a feature than a flaw of long-term investing.

Corrections, in other words, are the market’s way of catching its breath — not a sign it’s about to fall apart.

So where are we in the cycle? Investor emotions tend to follow a predictable curve — optimism, euphoria, denial, fear, panic, and finally, hope and recovery. (If you’ve ever looked at your account during a correction and thought, “How could I have been so wrong?” — congratulations, you’re human.)

Right now, much of the concern around “A.I. Valuations” looks less like euphoria and more like healthy anxiety in mid-cycle expansion, according to the CNN Fear and Greed index. This is often the moment investors worry the most just before long-term opportunity compounds the fastest.

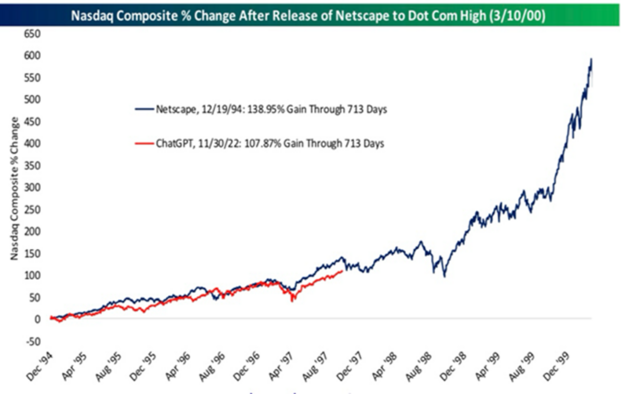

Today’s rally has been fueled by tangible, revenue-generating innovations: cloud infrastructure, semiconductor demand, and A.I. implementation across industries.

And if history mirrors itself, the Nasdaq’s trajectory since ChatGPT’s release in November 2022 looks much like its path after Netscape’s 1994 launch — the dawn of the Internet Age. Back then, the market rose for years before peaking in 2000. The analogy isn’t perfect, but it suggests we’re more likely in the middle innings of this A.I. cycle, not the ninth.

Fundamentals still matter and I’m looking at these key drivers.

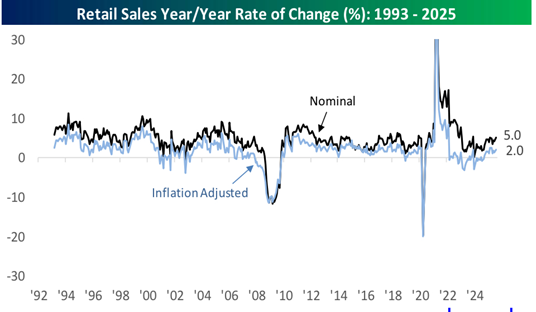

- Consumers remain resilient. Real retail sales are up 2% year-over-year, aided by record home equity and stable gas prices.

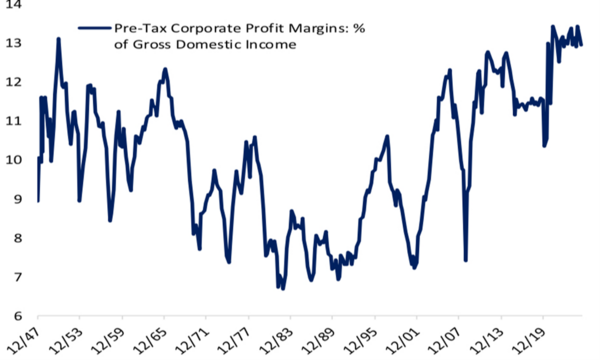

- Corporate margins, while easing slightly from tariffs, remain near multi-decade highs.

- Rates are trending lower. The Fed’s projected easing into 2026 suggests policy is shifting from restrictive to supportive. The old adage, “you don’t fight the Fed” should apply.

In short, fundamentals continue to support risk assets — not because of hype, but because of earnings strength, balance sheet health, and an increasingly accommodative policy outlook.

The market isn’t a machine, even in an era driven by algorithms. It remains a living reflection of human optimism, fear, and resilience. Investors who stay grounded — recognizing that volatility and progress are two sides of the same coin — are usually the ones who come out stronger. The key is to stay patient, stay diversified and remember that fear is often just an opportunity in disguise. And if we’re all still anxious about the markets, chances are it’s not a bubble at all.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.