What Really Counts?

We’re just a day away from electing a President, and the headline economy is performing very well.

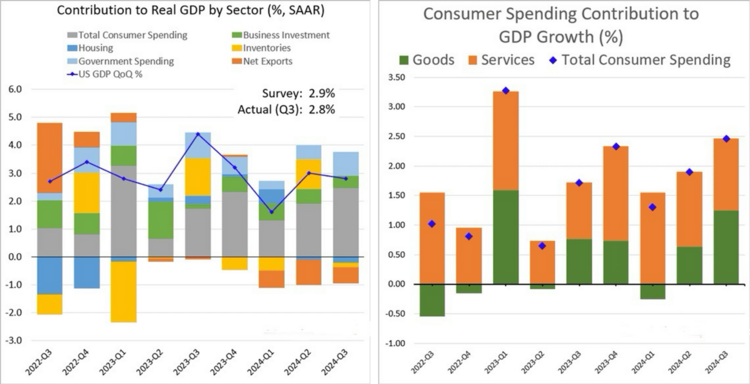

The U.S. economy expanded in Q3, with 2.8% GDP growth and consumer spending constituting 3.7% of that growth. This represents the highest consumer growth rate since Q1 2023. We are also seeing a significant bump in goods consumption vs. services. 1

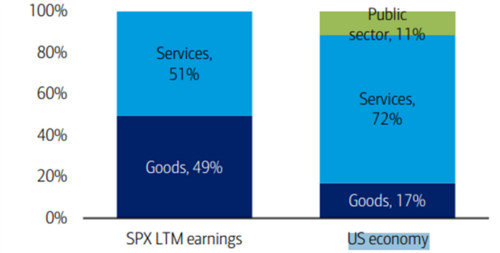

Consumers contributed 2.5 percentage points of the 2.8% GDP growth – that’s around 90% of GDP growth vs. the historical average of 70%. The U.S. consumer is overperforming, which will drive earnings growth (see our post from two weeks ago), especially when you consider which companies make up the S&P 500. The economy is service-oriented, but the S&P 500 is much more equally balanced between goods and services. 2

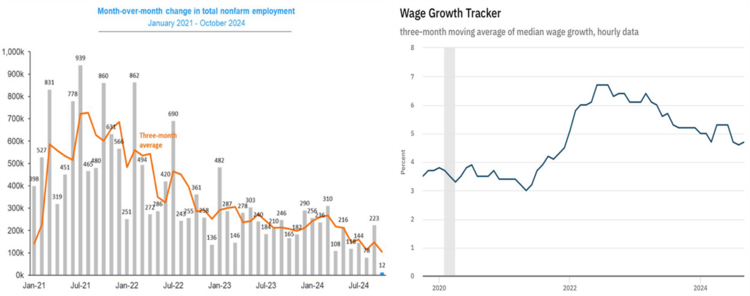

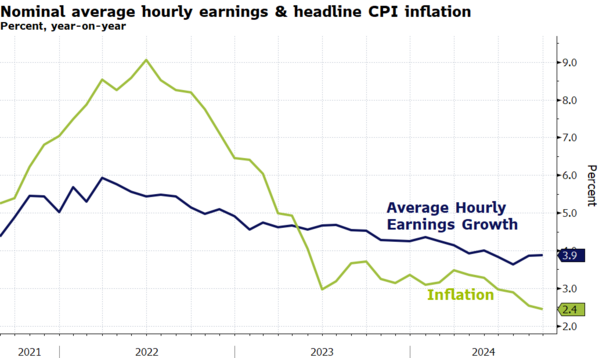

Job growth and wages have also expanded over the last four years. While the rate of change has moderated, there is little doubt that we are far from a recession. 3 4

Do Americans suffer from economic amnesia? They do, and this tendency to forget enables us to resume earning and spending after traumatic events like the Great Financial Crisis and COVID-19.

As Americans select a President tomorrow, they will likely not remember the recent good times but the current pain points.

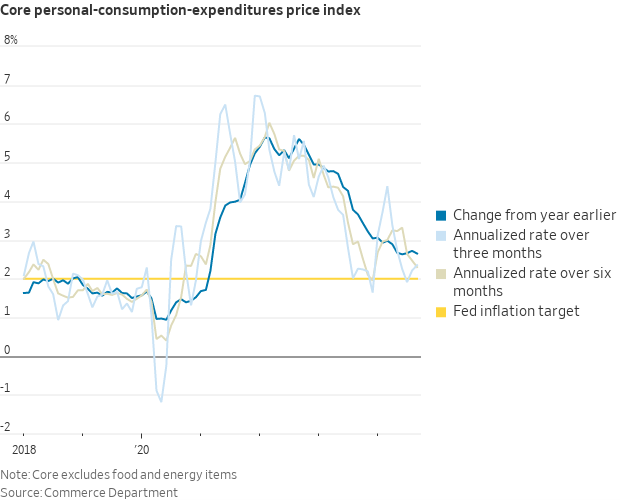

This election is close in my estimation because of one thing we know in real time in our lives: inflation, or should I say high prices. It’s a fact that inflation is moderating and approaching the Federal Reserve’s target of 2%. 5

However, few consumers understand inflation (which is a rate of change in prices). What they do know is prices went up and they have not – and likely will not – come down any time soon. This has created a very sour mood (see our post on that) across our country, and Americans want this to change.

Consider this: wages have been growing faster than inflation for several months and that’s great news for the consumer. They should be feeling that. 6

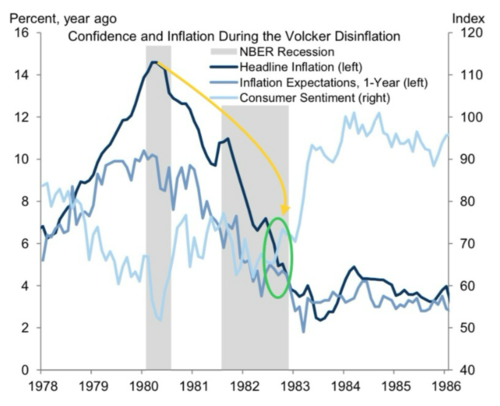

However, when I looked at the last persistent inflationary period in the 1980s, it took a while for the consumer to get over their sour mood post-inflationary episodes. Consumer sentiment took approximately two and a half years after inflation moderated before the mood turned. That’s why this election is closer than the current economic performance would suggest. 7

Trading lessons for elections!

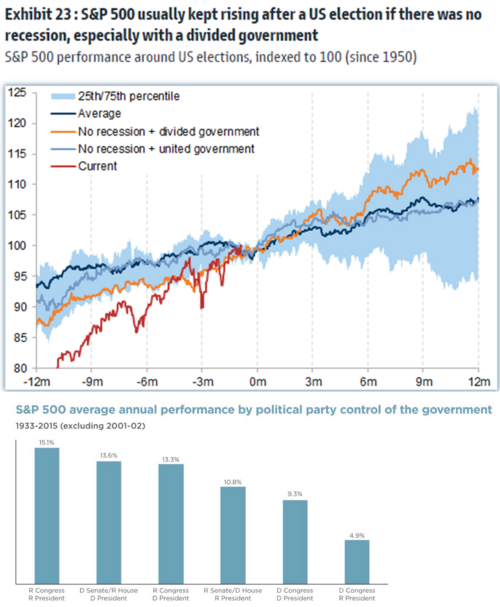

In any case, whatever the results are for this election, the outcomes are not that bad for the investor class, especially if there is no recession. 7 8

Even in politics, it is important to know what really counts with the voters.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://thedailyshot.com/2024/10/31/us-gdp-growth-remains-robust/

- https://x.com/MikeZaccardi/status/1810623800074998053

- https://x.com/GregDaco/status/1852340264678887577

- https://www.atlantafed.org/chcs/wage-growth-tracker

- https://x.com/NickTimiraos/status/1851966032920887679

- Bloomberg

- https://publishing.gs.com/

- https://www.strategasrp.com/

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.