What the So-Called “Experts” Got Wrong

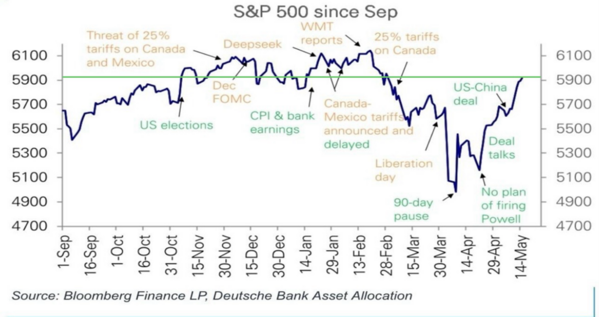

We are only about 3% below the all-time highs on the S&P 500. Who could have imagined we would be back at these levels so quickly with all that is going on?1

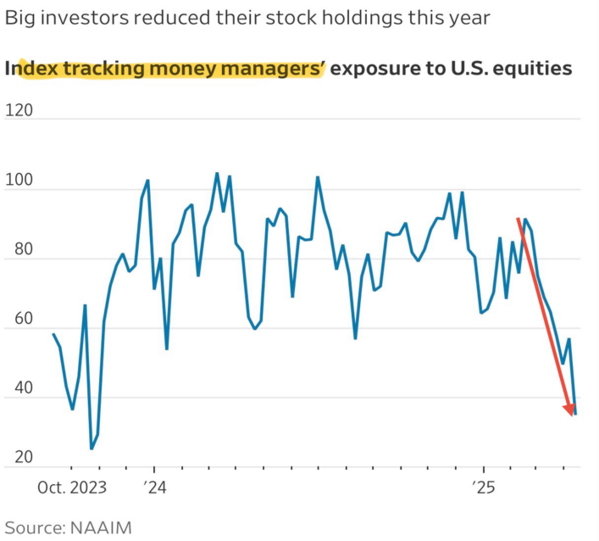

You and I did! That’s right, the average investor held their resolve and stayed invested while the so-called Wall Street “experts” or institutional investors ran for cover. They lowered their exposure to equites and perhaps missed the recent run back up in the S&P 500.2

Even the Wall Street Journal noted the ability gap with the “experts”. 3

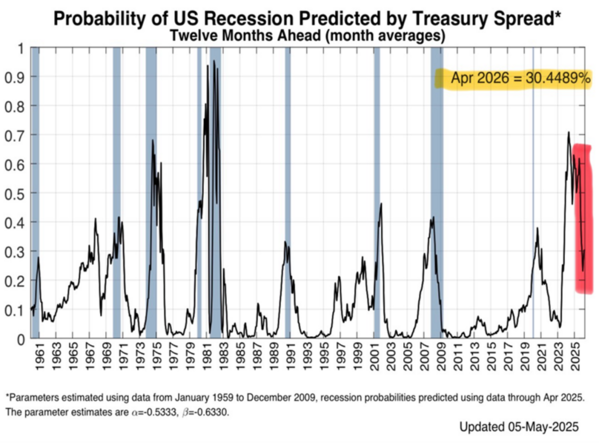

What else could they get wrong at this point? For one, the risk of a recession. As little as a two weeks ago the “experts” had the risk of recession at 50% (Moody’s Analytics-Mark Zandi) and now the same institutional investors have reduced their risk of recession to only 30%. It would appear these “experts” are subject to the same emotions as the rest of us.4

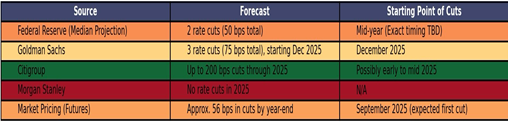

The “experts” will also have their rate cut forecasts wrong. Afterall, they can hardly agree.5

The “experts” will also have their rate cut forecasts wrong. Afterall, they can hardly agree.5

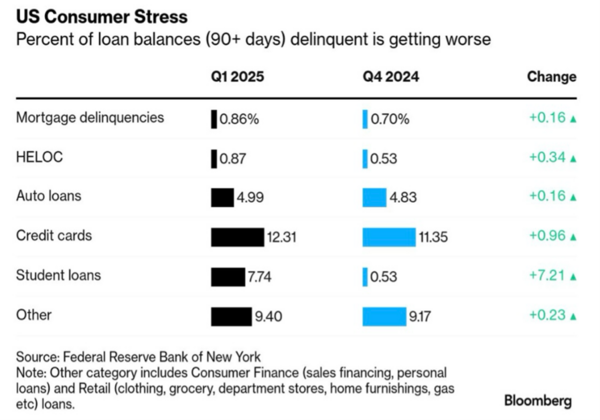

The consumer, while still spending, is showing some signs of strain with credit. The Fed might need to cut rates much sooner than the “experts” and Goldman Sachs suggest, particularly considering the US credit downgrade by Moody’s.6

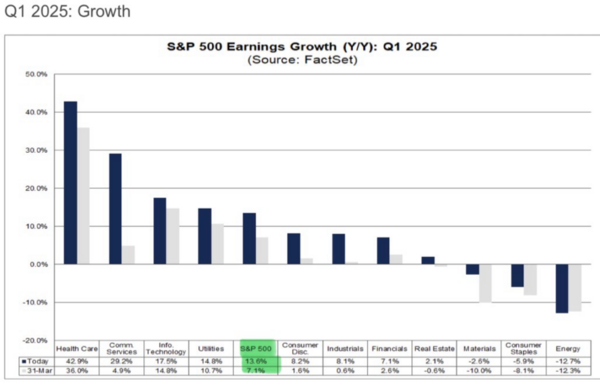

Another thing the analyst class got wrong were Q1 2025 earnings. With 97% of S&P 500 companies now reported, the earnings season far exceeded “expert expectations”.7

FactSet’s bottoms up survey projected companies would report EPS growth at 7.1%, when in fact they reported nearly double that growth rate.

So why do we have an advantage over the “experts”?

Individual investors care about paying taxes on their gains. Wall Street’s institutional investors don’t necessarily care, as they get their performance bonuses gross of taxes.

Individual investors have learned their lesson over lengthy periods of market cycles: staying invested matters. Wall Street’s institutional investors seem to be missing that point as they get evaluated every quarter against a benchmark, while your retirement or investment plan should be your benchmark.

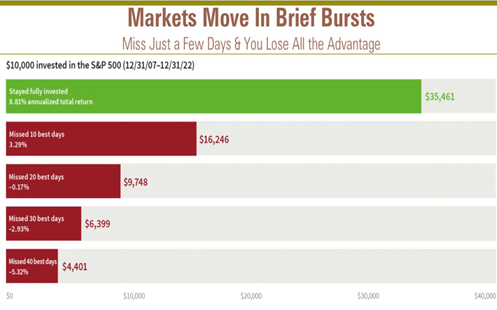

We have learned that missing just a few days of market activity can cost you all the advantages of equity investing. I have published this chart many times:8

Just overlay this with the recent rally and the current world matches the past world.

The S&P 500 set a low on April 7th, down over 20% and we have now rallied back to make up those losses. Markets do move in brief bursts and the so-called “experts” seem to be missing that point.

The lesson for us non-Wall Street types is to stick to our plan, not Wall Street’s plan for you.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

2.) Forget The S&P 500: The Great Dividend Rotation Has Begun | Seeking Alpha

3.) https://x.com/CacheThatCheque/status/1916057605019255182

4.) 14 Charts Show Why a Recession Is Imminent for US Economy - Business Insider

5.) Major brokerages retain US rate-cut view after soft inflation data | Reuters

6.) Volatility Rules The Day Now - by Anthony Pompliano

8.) Market Timing Does Not Work For These 3 Reasons - Dupree Financial

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.