What to Expect?

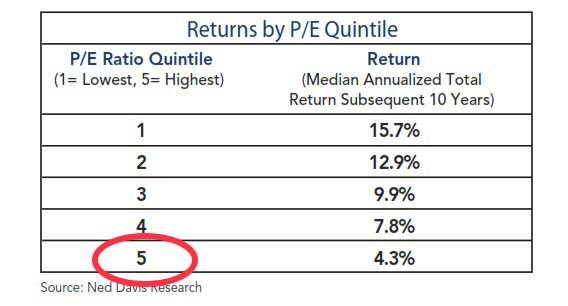

With the major U.S. equity market indices at or near all-time highs and valuations appearing stretched, you might be wondering what’s possible for the future of returns. Based upon where we are now with price-to-earnings (P/E) ratios, future equity returns appear to be muted. [i]

On a purely P/E basis, we remain solidly in fifth quartile and subsequent 10-year annualized returns look pretty languid at just 4.3%.

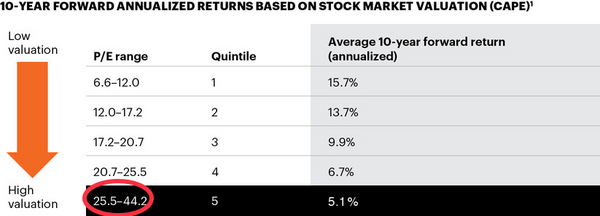

The inflation-adjusted P/E ratio gives a similar reading: [ii]

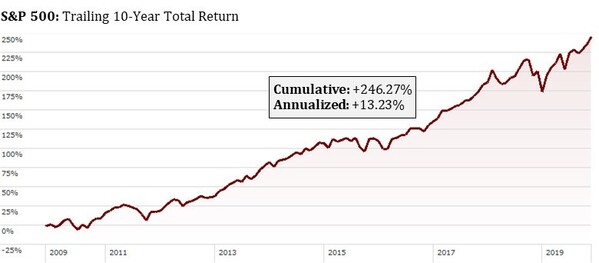

Similar to the non-inflation-adjusted P/E, the forward 10-year annualized return looks to be about 5%. Intuitively, we know future returns should be muted because we’ve just finished a 10-year period of phenomenal equity returns. [iii]

None of this means there will be an imminent crash—nor does it mean there won’t be—as there are a lot of ways for valuations to revert to historical norms:

- Earnings could grow markedly, and stock prices could stay the same

- Stock prices could fall in a normal manner (between 10% and 20%) and earnings could grow, accelerating the mean reversion

- Stock prices could decline precipitously, and earnings could also fall at a modest rate.

The point being, there are many ways to get back to normal and those ways are hard to predict.

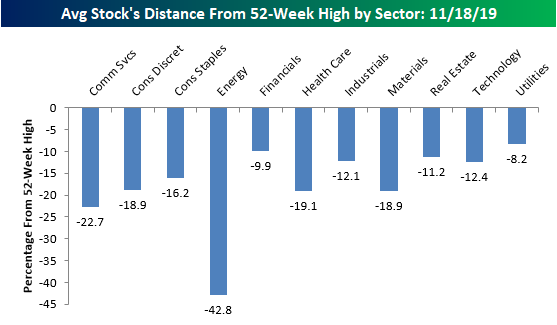

One thing is for certain though: On average, stocks are still well off their respective highs. [iv]

Sectors like Energy are over 40% off their 52-week high while Utilities are only around 8% from their 52-week highs. Again, this is the average within each sector and it is important to realize the indexes that are trading near their all-time highs do not necessarily represent the average.

Looking across the globe, there are other asset classes that are trading with favorable valuations.

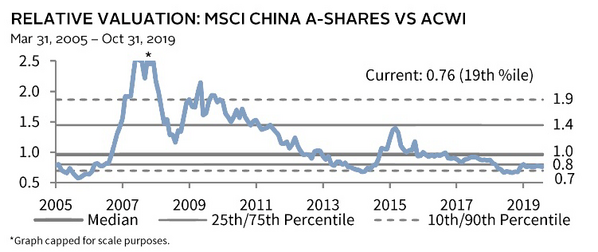

China A shares are priced at a 24% discount to global equities, and that’s after an impressive 27% return over the last 12 months. [v]

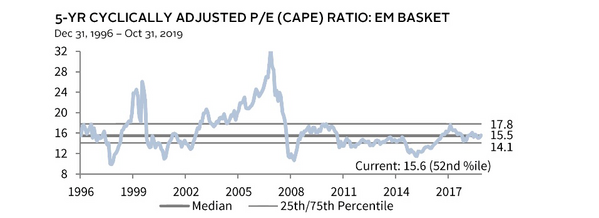

Concurrently, emerging markets as a whole are trading at a 35% valuation discount to developed markets and on an inflation-adjusted P/E basis they are trading at a 48% discount to the S&P 500. [v]

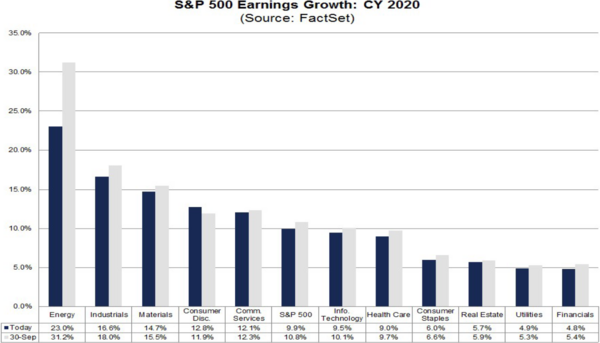

My expectation is for muted returns in 2020 while S&P 500 companies return to modest EPS growth. As of Friday, composite full-year 2020 EPS growth estimates for the S&P 500 stand at 9.9% according to FactSet. [vi]

If that occurs, we could see valuations revert noticeably to the mean.

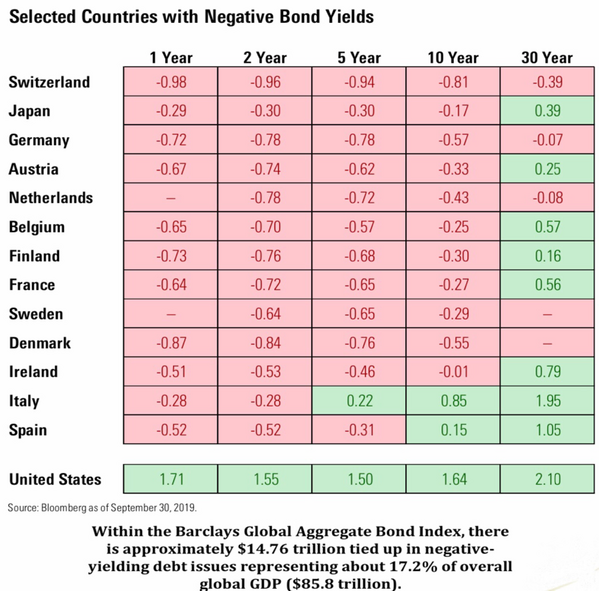

One caveat to all of this is the fact that the world is awash in negative interest rates. Take a look at a table from our Q4 2019 Look Ahead (click here to listen to the narrative). [vii]

Where is all this money going to go? Likely, it will come onto our shores invested in fixed income instruments which still have positive nominal yields and perhaps in U.S. equities. It’s hard to say, other than who wants to invest for negative returns?

The simple strategy should be to rebalance portfolios to the extent you can stomach the capital gains taxes. Equities have been up over 200% since the start of this bull market and that certainly has tax implications. Rebalancing is a legitimate strategy, but if you can’t stomach the taxes you can always dollar-cost average new money into some of the cheaper-valued asset classes like Energy and China A shares.

Expecting the worst may not be reasonable, nor is it a good strategy.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://soundmindinvesting.com/articles/view/stock-market-valuation-review

ii. https://fsinvestments.com/learn/articles/PE-ratios

iii. https://www.morningstar.com/etfs/arcx/spy/quote

iv. https://www.bespokepremium.com/interactive/posts/think-big-blog/which-of-these-sectors-is-not-like-the-other

v. https://www.cambridgeassociates.com/research/

vi. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_112219.pdf

vii. https://phillipsandco.com/files/8615/7046/8807/Look_Ahead_-_2019Q4_-_Final_-_No_Audio.pdf