What to Expect

Third quarter earnings season is upon us and perhaps it is time to take stock of what to expect. There is a lot of noise that makes it hard for investors to separate the “wheat from the chaff.”

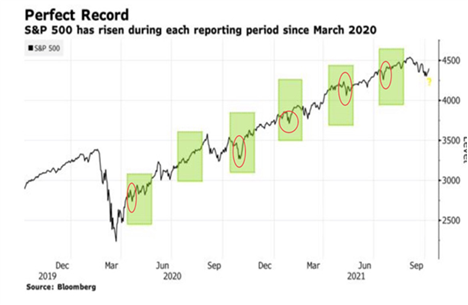

One thing is certain, earnings season has mattered most during the pandemic. According to Bloomberg, the equity markets have responded favorably during earnings season. While I highlight some bouts of volatility (red) at the end of each earnings season, equity prices were higher. Earnings matter! [i]

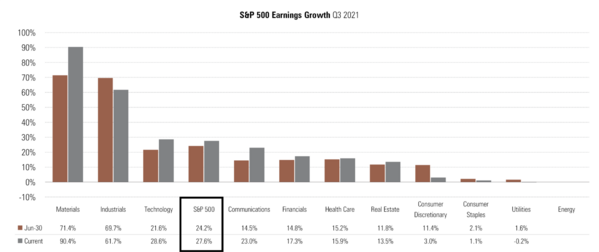

This week we will start hearing earnings reports that will officially start the data onslaught. Expectations are still for S&P 500 earnings to surpass 27%. [ii]

That’s an improvement of 340 basis points compared to expectations at the start of Q3.

If these numbers play out over the coming weeks, perhaps the equity markets will stabilize. However, there are some signs of over-optimism in the data.

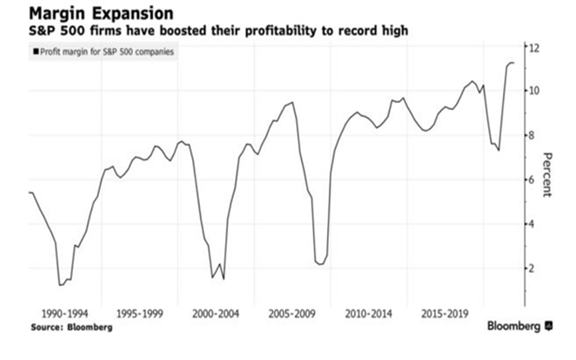

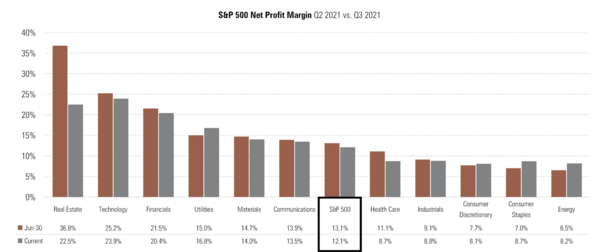

Profit margins have been expanding at record levels during the pandemic as fiscal stimulus has found its way into corporate coffers. [i]

As of late, some cracks have emerged in corporate profit margins. Our Q4 Look Ahead highlighted that trend. [ii]

What could most impact profit margins? Wages, commodity prices, and available labor.

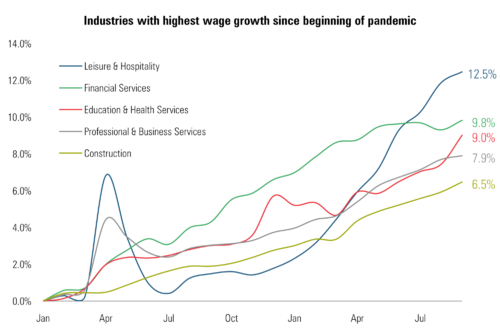

Wages have been on the rise in an effort to pull more workers off the sidelines and back to work. In the recent BLS labor report, you can see the increase in wages across various industries. [iii]

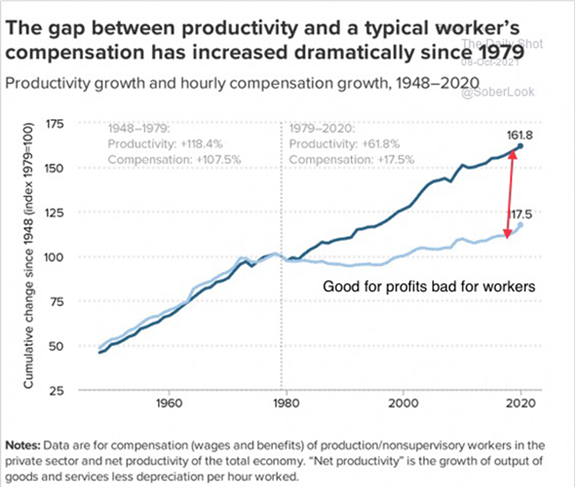

Realize, the long-term corporate trend is to drive more productivity beyond wage increases. That is what creates profit margin expansion. It may not occur in the short run but, it’s a long-term trend that will likely persist. [iv]

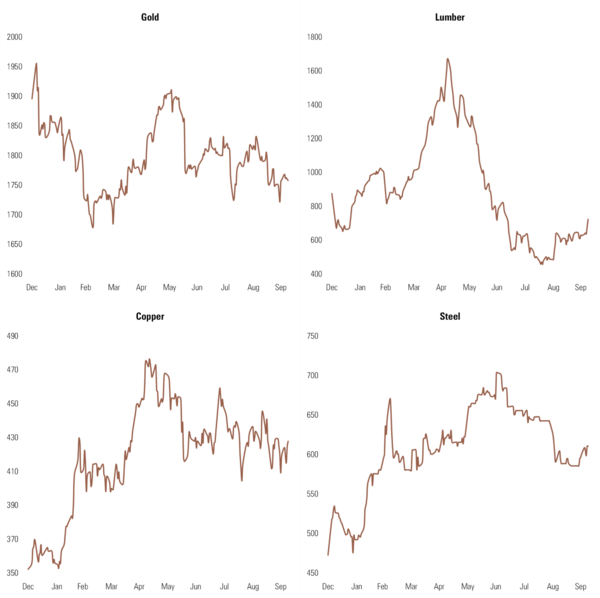

Commodities prices were also on the rise in Q2 and early Q3 but, have since abated to some degree. [v]

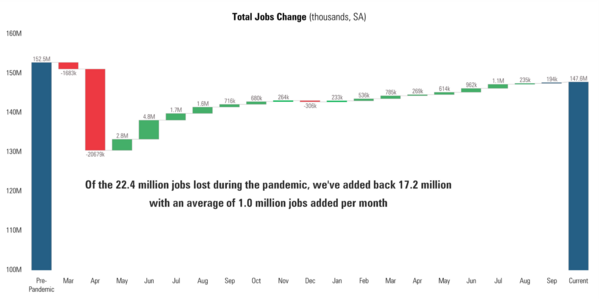

Labor supply might be the most challenging headwind we hear of in Q3 earnings reports. While we continue to make progress in adding back jobs lost during COVID, we still have a lot of room to go. The U.S. economy added 195k jobs during September and that was one of the weakest months since the pandemic started. [iii]

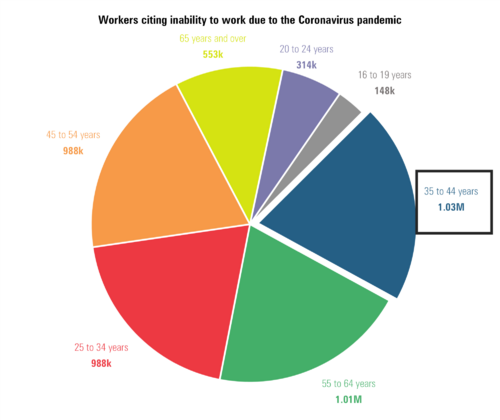

In September, there were over 5 million people that reported they were unable to work due to pandemic-related reasons. Of those 5 million, over 1 million were in the prime working age cohort of 35-44. [iii]

Perhaps that was due to business closures, illness, lack of day care for children, or fear. In any case, the Delta variant has had an impact on employment and labor supply. As the Delta variant subsides, we should see these folks return to the work force quickly.

So, let’s watch earnings, profit margins, and, if margin compression continues, what is driving that contraction. If the driver is input costs, that is something that likely will abate in 2022. If the driver is demand weakening, that will be an entirely different picture.

It is hard to decipher what matters, but it’s my view that earnings and profit margins are the “wheat and not the chaff.”

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/news/articles/2021-10-09/profit-panacea-is-badly-needed-in-this-stressed-out-stock-market

ii. https://insight.factset.com/topic/earnings

iii. https://www.bls.gov/news.release/empsit.nr0.htm

iv. https://www.epi.org/

v. https://www.bloomberg.com/markets/commodities