What's all the Fuss?

By now, I think it’s safe to say investors have been sufficiently tortured by what’s happening in the European economy. The moment Greece moved off the headlines, Italy took center stage. Once the media gets tired of Italy and the markets adjust, they will probably move on to the next victim country.

What’s not talked about is how this may directly impact the US economy and our GDP.

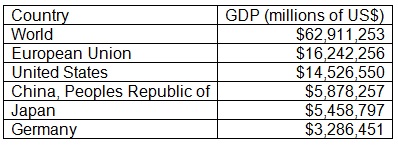

First, the European Union is the largest Economy in the world. The European Union combined with the United States represents almost 50% of the entire World’s GDP.

Clearly Europe matters, the question is, how much does Europe matter? Over the last 12 months we have exported approximately $324 billion dollars to the European Union in goods and services. We also import more from Europe than we export; therefore we have a negative trade balance which subtracts from our total GDP. This negative gap could grow significantly if we continue to import goods from Europe and we are not able to increase our export goods.

As a quick rule of thumb, every $140 billion in economic activity is 1% of our GDP (1% of $14 trillion is $140 billion). With that in mind, a 10% drop in exports to the European Union would be a decline of $32.4 billion in US GDP (about ¼ of 1% of our GDP). Under normal economic conditions that wouldn’t mean much. However, under current circumstances 1/4 of 1% means something.

Last week, we highlighted the Federal Reserve’s economic forecast where they slashed their 2011 United States GDP growth from a range of 3.3%-3.7% down to 2%-2.5%. Under current circumstances, a 0.25% drop in GDP would be 10% of our growth.

The International Monetary Fund has trimmed its European growth forecasts to 1.4% and I believe the markets are expecting a European Recession. It's not hard to imagine their economy slipping into negative growth if there are no bold policy considerations for bailing out irresponsible, socialistic member countries of the European Union. As I have said several times in presentations, this is the price for leisure.

I believe most of the bad news is already built into our markets, which is good news to me. Looking at export numbers year to year, exports to Europe peaked in 2008, fell steeply in 2009 and rebounded in 2010. Year to Date, 2011 looks to be better than 2010, but not quite as good as 2008 leaving more upside for US exports to the European Union in 2012.

When we get all the nasty headlines about Europe try to look past the emotion and perhaps we won't lose export ground as much as some pundits believe. If this is indeed the case we could see a nice upside surprise to our markets. Now that would be something to fuss over!

If you have questions or comments please let us know as we always appreciate all your feedback. You can get in touch with us via Twitter, Facebook, or you can Email me directly.

Tim Phillips, CEO – Phillips & Company