What’s Changed?

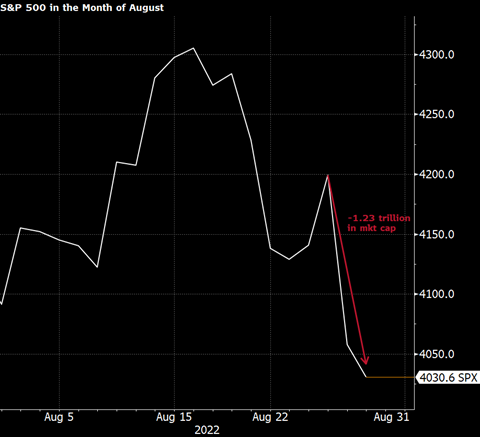

Equity markets reacted violently to Fed Chairman Powell’s recent comments. U.S. equity markets shed over $1.2 trillion in one day when participants decided to reprice the trajectory and pace of interest rates. 1

The summary of what he said should not have been shocking; yet it was.

The Fed is going to:

- Raise rates until inflation cools down

- They will impact demand and have no real impact on supply

- There will be some economic pain in accomplishing their inflation target

- Rates may stay elevated longer than expected

This has been the broad investment landscape for well over a year. However, it’s the nuance in the comments that certainly spooked investors on Friday. Take a look at some of his statements: (emphasis added) 2

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth.”

“We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent.”

“…higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation.”

While reflecting on inflation in the 1970s he stated: 2

“a lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.”

Forcefully, sufficiently restrictive pain, unfortunate costs, and resolve are all key words that scare investors when it comes to higher interest rates. That’s exactly what the Fed did on Friday, spook investors.

It’s likely this standing statement will continue to spook investors as they view this as some kind of interest rate regime change.

Let’s look at the data and see how the Fed is doing so far with their pain program.

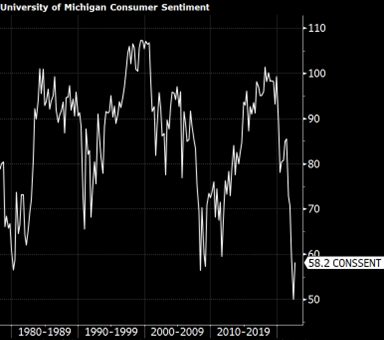

Consumer sentiment is at still at record lows in spite of bouncing off the bottom in June. 3

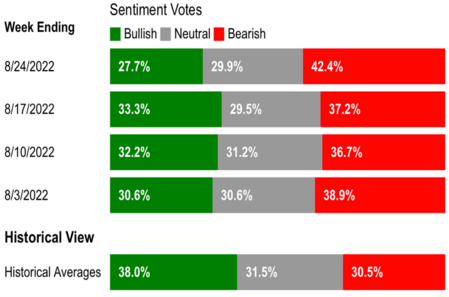

Investor sentiment is more bearish than historical averages, according to AAII. 4

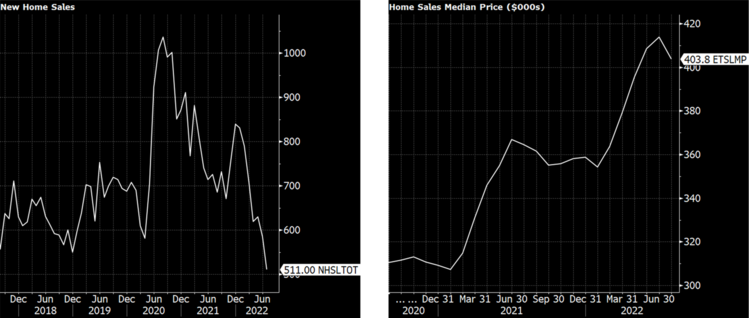

Home sales and prices have declined in the last couple of months. 5 6

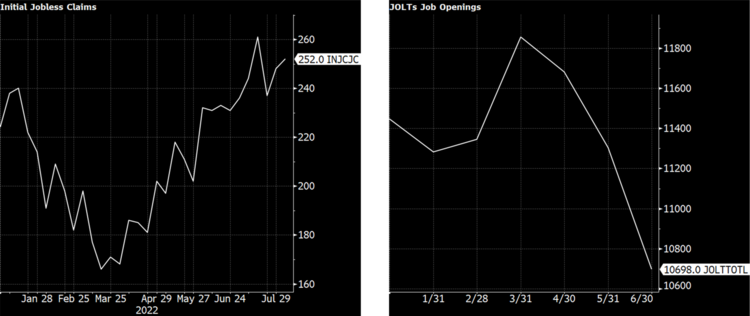

Jobless claims have been on the rise the last few months and job openings have been on the decline. 7 8

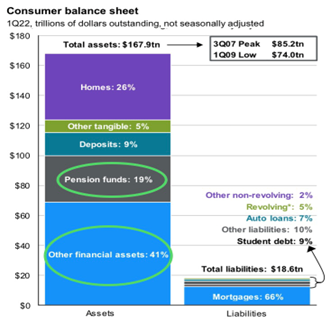

Finally with Powell’s pain speech wiping out over $2 trillion in wealth; that hits at the core of the U.S. consumer balance sheet. Sixty percent of our collective wealth resides in other financial assets and retirement plans tied to stock and bond prices. 9

All of this is moderating inflation, according to the latest reading of the Personal Consumption Expenditures (PCE) index. 10

Apparently most investors missed some of Chairman Powell’s other comments like: 2

“…current high inflation in the United States is the product of strong demand and constrained supply, and that the Fed's tools work principally on aggregate demand.”

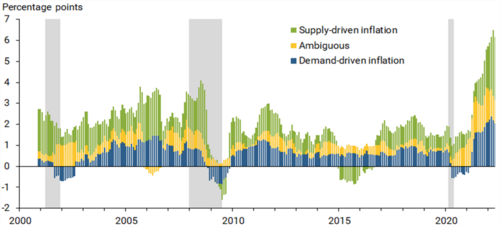

As the Fed pointed out in a recent study, much of what we are experiencing with inflation is still supply side driven. 11

“At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.”

The concept of rational inattention.

The Fed wants to wipe high inflation from our memories as the concept of rational inattention suggests we cannot absorb all data but, likely, the most relevant data to us. In our current case that’s high inflation. If inflation persists, we as consumers, will make decisions based upon high inflation and that could have dramatic consequences on our consumption patterns. Here is what Powell said: 2

“When inflation is persistently high, households and businesses must pay close attention and incorporate inflation into their economic decisions. When inflation is low and stable, they (consumers) are freer to focus their attention elsewhere.”

“If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will.”

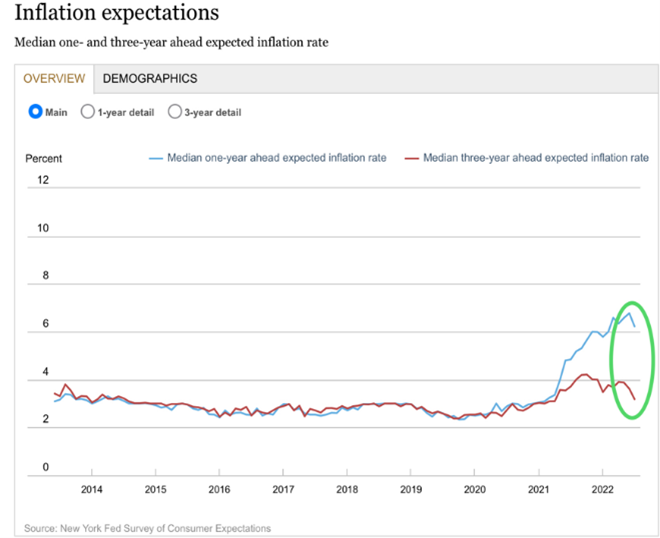

With lower gas prices, consumer inflation expectations have been trending down according to the New York Fed’s consumer inflation expectation survey. In fact, 3-year forward inflation expectations are drifting back to the Fed’s target of 2%. 1 2

It’s my view we are still in the midst of an economic growth detour and the Fed will moderate the pace and intensity of interest rates as soon as we see more relief of the supply chain and a bit more demand destruction in housing.

Investors should continue to review target returns, tax efficiently rebalance, and capture some short-term yield on rate spikes.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg terminal

- https://www.kansascityfed.org/research/jackson-hole-economic-symposium/

- http://www.sca.isr.umich.edu/

- https://www.aaii.com/sentimentsurvey

- https://www.census.gov/construction/nrs/

- https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

- https://www.dol.gov/ui/data.pdf

- https://www.bls.gov/jlt/

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

- https://www.bea.gov/data/personal-consumption-expenditures-price-index

- https://www.frbsf.org/economic-research/indicators-data/supply-and-demand-driven-pce-inflation/

- https://www.newyorkfed.org/microeconomics/sce#/