What’s Coming Next

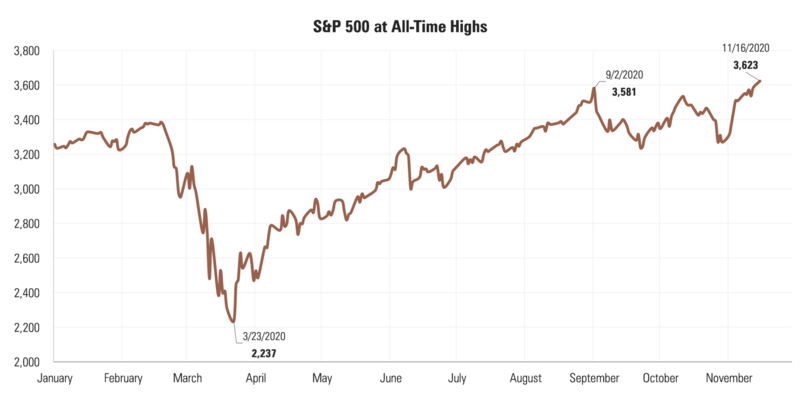

It would be hard to contemplate the S&P 500 hitting an all-time high in the wake of a Presidential election that has a clear winner and loser. Yet, that is exactly what the S&P 500 is doing. [i]

The political analysis of President Trump’s moves are hard to conceive. He might win one state—Georgia – on a hand recount, as that vote was within 14,000 votes or 0.3%. However, he would also have to win either Pennsylvania, Arizona, or Nevada; which seems highly improbable.

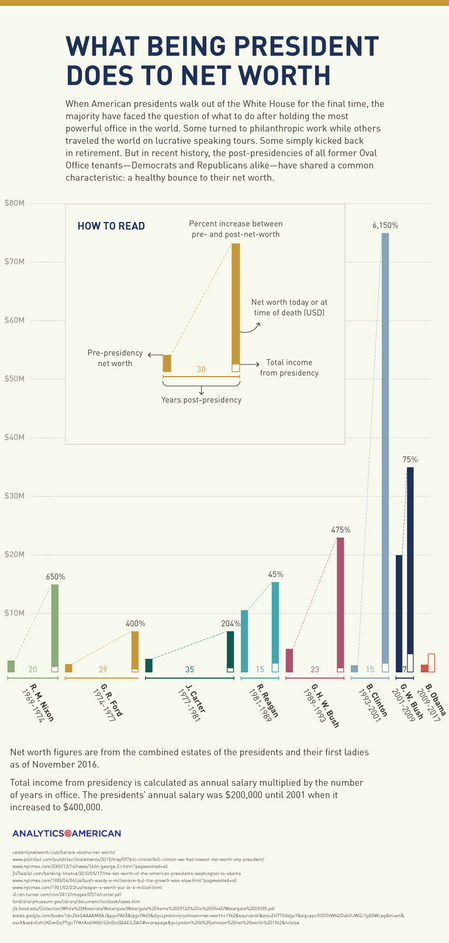

Likely, the political calculus in fighting for a win—especially in Georgia—is to help the Trump brand post-Presidency. Trump TV, Trump Broadcasting, or a host of other enterprises await his reception. [ii]

For Republicans, a thorough review of ballots in Georgia might create enough energy and anger to drive more of their voters to the polls in January. The two Senate runoff races that will be decided on January 5th will also determine control of the Senate and the direction of our country for the next four years.

Proving corruption or widespread cheating won’t overturn the Presidential election outcome but, it may drive a populist rejection of the Democratic establishment in Georgia.

Just look at some of the current headlines in Georgia about voter corruption: [iii]

“Pro-Biden Bug Suspected in Georgia's Vote-Counting Software”

“Software appears to have thrown votes from Trump to Biden”

“Suspects a variety of factors, including that votes were ‘artificially inflated’ for Biden”

“There’s always the chance it was an inside job”

Corruption or not, President-elect Biden will win and find a lane in the middle to get a few things done for a few reasons:

• With the current COVID outbreak, there is no place to hide for political gamesmanship as cities and states reimplement lockdowns—especially with two critical Senate races up for grabs in January.

• We should expect a large yet, compromised, stimulus/relief bill to pass congress, with President Trump signing it and basking in his success.

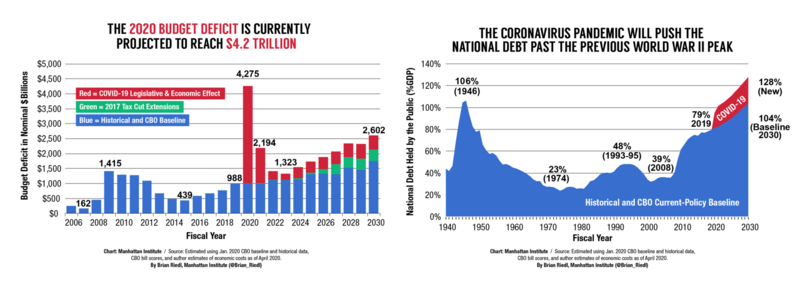

• Deficit reduction is a game from the past. There will be no ‘Tea Party’ revolt in the coming years over the excessive deficit spending needed to lift our economy out of the depths of the pandemic. [iv]

• A President Biden will not face much scrutiny for supporting future stimulus in the form of middle-class tax cuts or infrastructure spending to improve rural connectivity and education.

The political center of gravity lies with the Republican moderates—Senators Mitt Romney, Susan Collins, and Lisa Murkowski. They will not be the obedient servants Majority Leader McConnell hopes for. While they won’t support tax increases (as those are unpopular in their states) they will support tax cuts for the middle class and other spending on healthcare, education, and infrastructure.

Lastly, the Republican controlled Senate (assuming they win at least one Georgia seat) will have to do this all over again in 2022. They have 21 seats up for grabs, with the most contentions in Florida, North Carolina, Wisconsin, Ohio, Georgia and Pennsylvania—all critical states that were very close in this last election.

Passing moderate stimulus spending to help lower-income and middle-income workers over the next two years will support incumbent candidates. Things like middle-income tax cuts, the earned income tax credit, child tax credits, family medical leave, pandemic unemployment pay, health care support, and increasing the minimum wage are all in the realm of possibility.

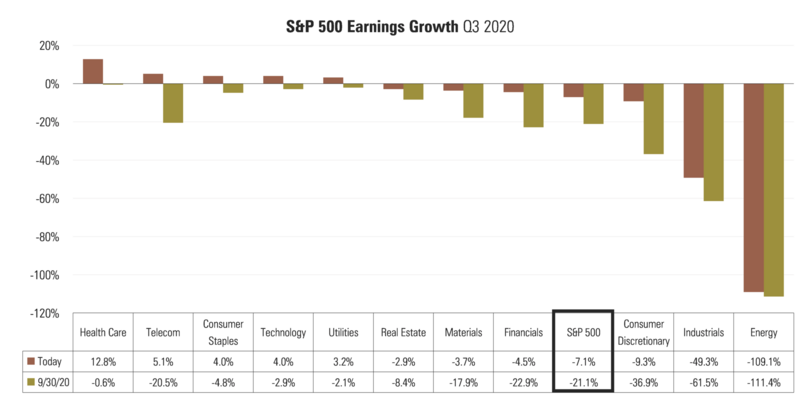

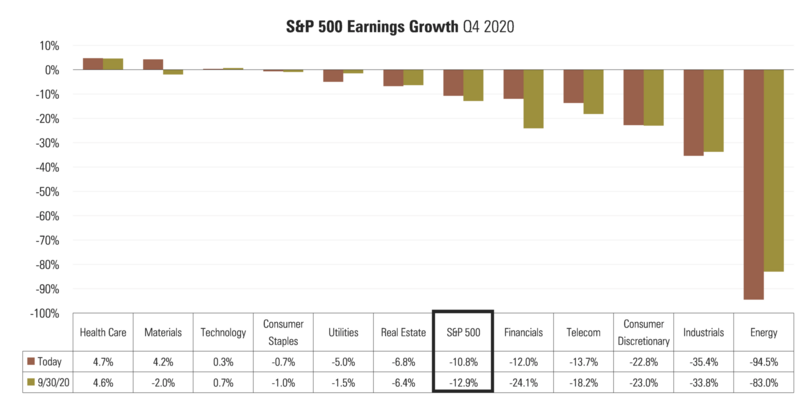

Beyond politics, we will see a conclusion to the Q3 2020 earnings season soon and it looks promising. [v]

Next, investors will begin to anticipate Q4 2020 earnings and those also look to be improving. [v]

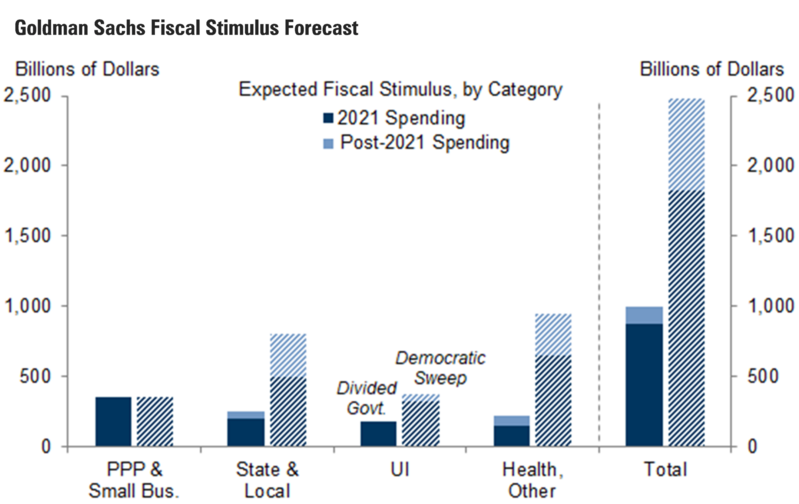

After that, depending on the nature and makeup of any pandemic relief, we could see Q1 2021 earnings get a supercharged boost. As shown below, Goldman Sachs expects a further $1 trillion in stimulus to pass in December or early in 2021 which could be a big boost to disposable income. [vi]

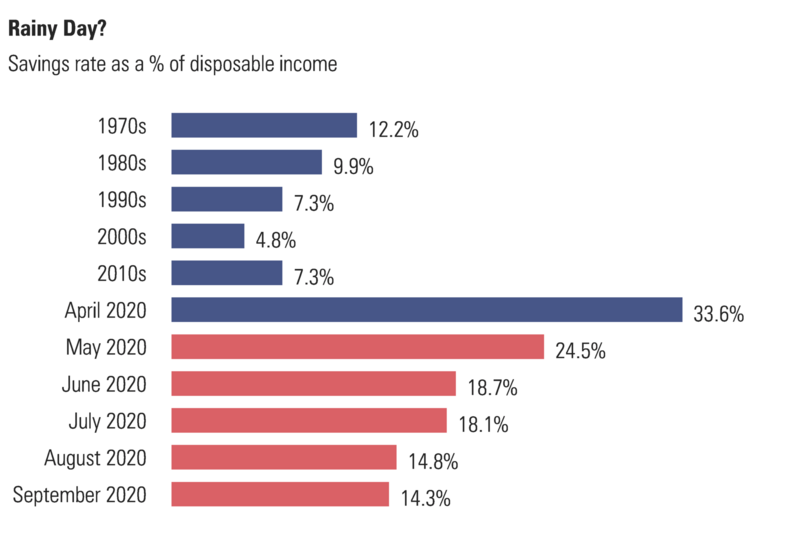

Finally, with a vaccine approval later this year or early in 2021, we could begin to see the U.S. consumer spend down their considerable precautionary savings. [vii]

If the U.S. consumer were to spend down their savings to pre-pandemic levels, it could potentially add about $1.12 trillion to 2020 GDP growth or 6%.

What’s on deck looks to be very good for the U.S. worker consumer, and investor even as we face difficult times in the short-run with the explosion in new COVID-19 cases.

*Upcoming Phillips & Co. Webinar: Q&A with Morgan Housel*

Join us on December 10th at 10:00 a.m. Pacific

Tim will interview Morgan on his new book, "The Psychology of Money"

They will explore topics like: Luck & Risk, Compounding, Getting Wealthy & Staying Wealth

Click here to Register

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/SPX:IND

ii. https://onlinebusiness.american.edu/blog/presidents-net-worth/

iii. https://www.realclearinvestigations.com/articles/2020/11/13/pro-biden_bug_also_suspected_in_georgias_vote-counting_software__125995.html

iv. https://www.manhattan-institute.org/coronavirus-cbo-budget-deficit-projection

v. https://insight.factset.com/topic/earnings

vi. https://research.gs.com/

vii. https://fred.stlouisfed.org/series/PSAVERT