What’s Lurking in the Shadows

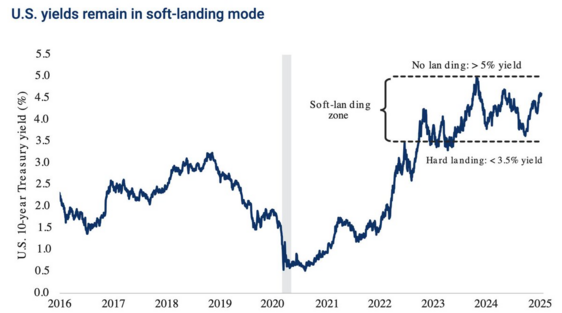

Bond yields have been rising at an alarming rate recently, especially considering the Federal Reserve has been cutting short-term interest rates. 1

The Fed Funds rate is 100 bps lower, yet the 10-year Treasury yield is just over 100 bps higher.

That’s certainly not what was expected when the Fed started their rate cutting cycle.

So, what’s going on?

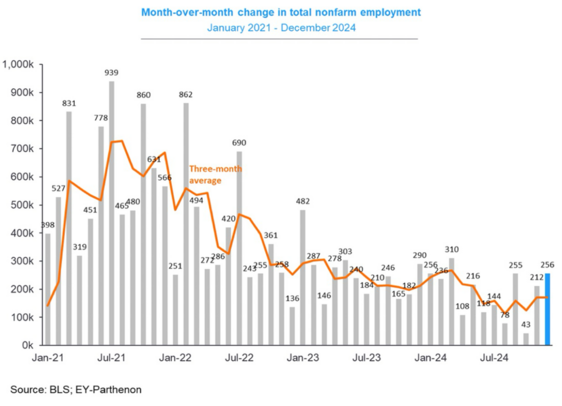

First and probably most obvious is the U.S. economy is much stronger than anticipated. What began as a “soft economic landing” narrative when the Fed started cutting rates has evolved into what some investors now view as a re-growth economic expansion. The recent jobs report is a prime example of the resilience in the economy, with 256,000 jobs added in December. 2

I caution that the jobs trend is still moderating, but recent data suggests the U.S. consumer is doing just fine. However, when you peel back the covers, you start to see what’s driving this jobs growth trend of late. 3

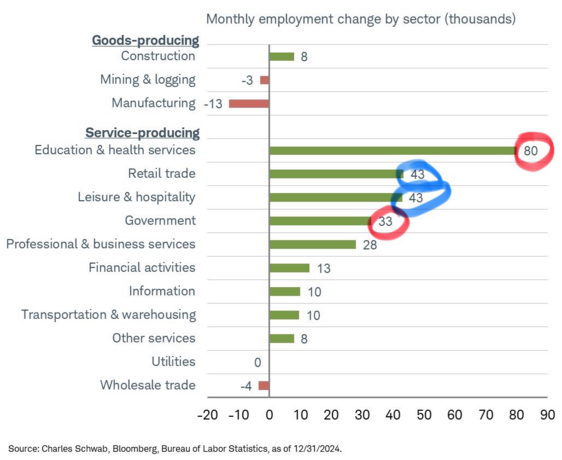

December growth was primarily concentrated in health care and government (red) along with the seasonal holiday retail, leisure, and hospitality industries (blue).

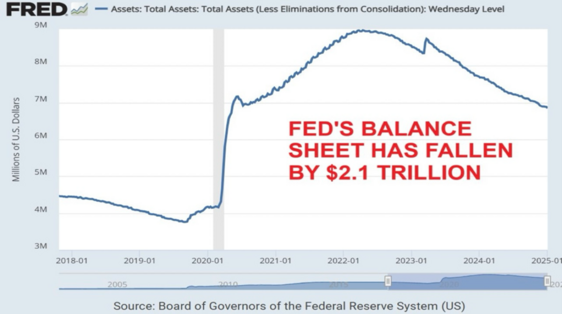

Another large contributing factor in driving longer duration yields higher is the Federal Reserve’s desire to trim their bloated balance sheet. Their balance sheet is primarily made up of mortgages and treasuries. 4

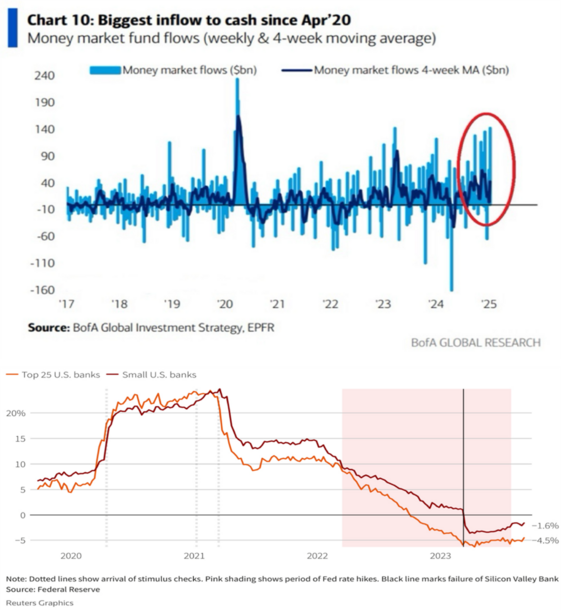

They’ve been allowing these bonds to wind down and clearly are not in the market to buy more treasuries at this stage. Since the Fed is not in the market buying up our debt, that leaves it to other investors, like money market funds, to buy treasuries. These investors are demanding higher yields, resulting in capital flows from bank balance sheets into money market funds. 5 6

While we are still in the soft landing/re-growth cycle of the U.S. economy, treasury yields can’t run much higher without an adverse consequence to the U.S. economy. 7

Credit matters a lot in our economy, and banking system liquidity remains vitally important. The Fed will stay watchful and perhaps start buying treasuries again if our economy needs it. I don’t see a credit crisis as a base case but it’s lurking in the shadows.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg

- https://x.com/GregDaco/status/1877732854672580765

- https://international.schwab.com/story/weekly-traders-outlook

- https://fred.stlouisfed.org/graph/?g=1CSmr

- https://www.reuters.com/business/finance/us-banks-hold-33-trillion-cash-amid-banking-crisis-slowdown-worries-2023-09-05/

- https://www.reuters.com/business/finance/us-banks-hold-33-trillion-cash-amid-banking-crisis-slowdown-worries-2023-09-05/

- https://x.com/SethCL/status/1878446252926373929

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.