What’s Next?

It's intuitively hard to invest when valuations on stocks are at record highs. Under normal circumstances, you would think that investments made at these levels would produce negative returns. According to J.P. Morgan, it’s quite the opposite. Historically, investing at all-time highs has produced returns greater than 5% across every time period measured other than the truly short term. 1 2

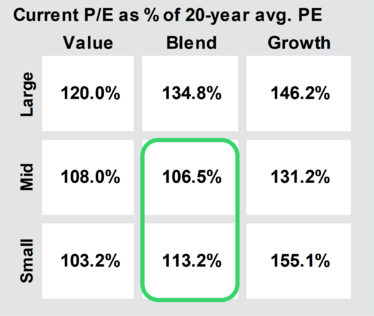

The counterintuitive nature of investing is always a fascination for me even after 35+ years of professional investing. While S&P 500 valuations are elevated, there are other areas to consider when it comes to valuations – especially if you think we are entering a period of “America First” investing.

Small and mid cap valuations are only slightly elevated compared to a 20-year historic look back period, but at much lower valuation premiums than large caps. 3

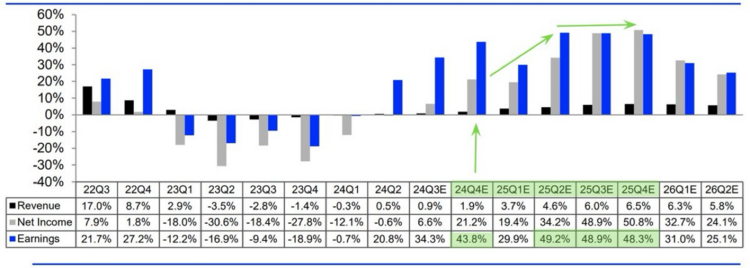

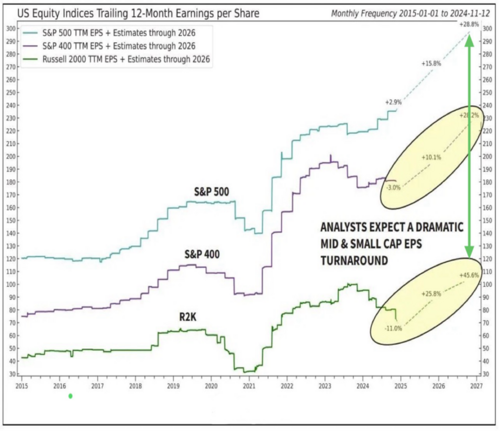

Considering U.S. small cap companies are also going to benefit from some explosive earnings growth, it’s possible these stocks can trade even higher. The chart below shows the earnings expectations for small caps for Q4 2024 and 2025. Growth rates exceeding 40% are remarkable and might be the catalyst to pull small caps higher. 4

Compared to the S&P 500, small cap and mid cap growth rates look promising – especially for small caps which are U.S. earnings centric. 5

“America First” poses some unique opportunities for small caps, driven by the basic nature of small cap companies. Here are some benefits for small caps, although not exclusive to small caps alone:

- Domestic Revenue Focus: U.S. small-cap companies derive approximately 80% of their revenue domestically, making them prime beneficiaries of “America First” policies that emphasize domestic growth and shield them from global trade disruptions.

- Boost from Government Spending: Infrastructure projects and local procurement initiatives often direct funds to small cap firms, especially in construction and industrials.

- Tax Incentives: Policies favoring domestic businesses with tax breaks disproportionately benefit smaller companies that lack the global tax strategies of large corporations.

- Reduced Regulatory Burdens: Deregulation and pro-business policies alleviate compliance costs, giving small caps a competitive edge.

- Local Consumer Growth: Stimulus measures that boost domestic spending directly support small caps that cater to local markets.

- Reshoring Opportunities: Incentives to bring manufacturing back to the U.S. create new opportunities for small caps as suppliers and service providers.

Don’t be surprised if you see us adding more allocation to small caps and adjusting down our allocation to emerging markets. That’s what’s next.

I'm also very excited to announce we will soon be partnering with Charles Schwab for custodial services. Their amazing technology platform with its excellent banking integrations and exciting reporting features will allow you to see your portfolio with a more holistic approach. Connect with your advisor to hear about the other benefits that we will be able to offer you through Schwab. That too is what's next.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=investing-principles/gtm-investingalltimehighs

- Bloomberg

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=equities/gtm-retvalbystyle

- https://lipperalpha.refinitiv.com/wp-content/uploads/2024/11/TRPR_82000_20241121.pdf

- https://x.com/WarrenPies/status/1858529789885178119

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.