What's Not Being Talked About

One of my customs is to read at least twenty and perhaps closer to thirty earnings reports a quarter. The management commentary is a literal treasure trove of great macroeconomic data as CEO’s and CFO’s often comment on their business and what’s helped and what’s hurt.

One thing I’ve noticed missing recently from earnings reports has been comments relating to the strength or weakness of the U.S. dollar.

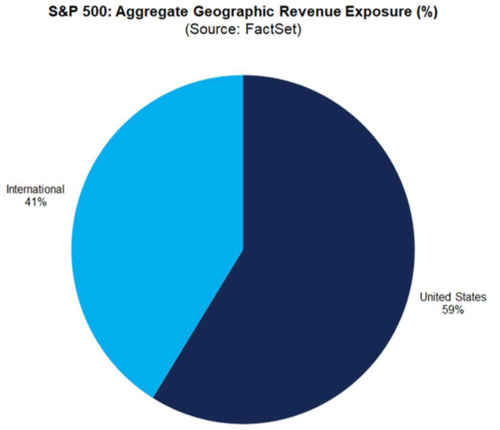

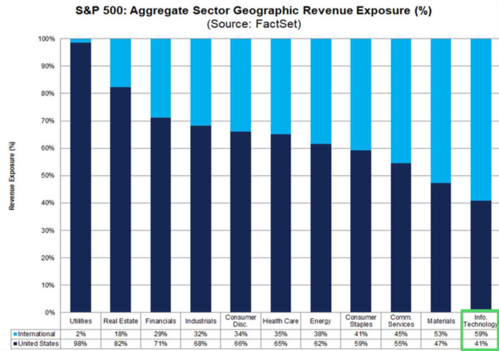

The weak U.S. dollar was only mentioned 37 times in S&P 500 earnings reports for Q2 2023. A weak U.S. dollar boost profits for companies that have large overseas revenue exposure as it makes their exports cheaper. With 41% of S&P 500 companies’ revenue generated from international sources, a weak dollar can be a significant boost to future corporate earnings. 1

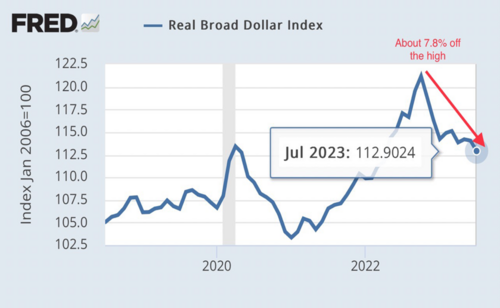

It has clearly not been a large boost to earnings in Q2 and that is not necessarily surprising. The U.S. Dollar has just recently started selling off, primarily due to rising rates and the risk of the U.S. economy slipping into a recession. Yet, the dollar trading down 8% off its high can have a significant boost to future earnings. 2

Not surprisingly, major U.S. technology companies have the largest exposure to foreign sources of revenue and perhaps will benefit the most from the weakening of the US dollar. 1

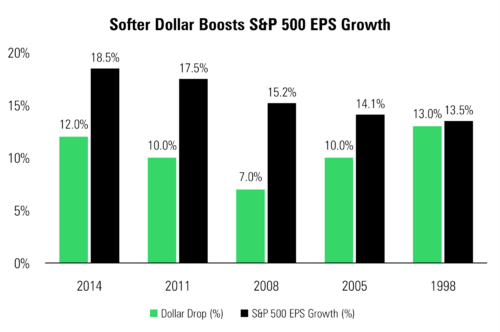

According to data compiled by Bloomberg Intelligence, when the dollar drops by more than 8% in a year, 12-month earnings-per-share (EPS) growth for the S&P 500 averages nearly 19% the following year. That's more than double the S&P 500's long-term rolling average EPS growth of 8.3%. 3

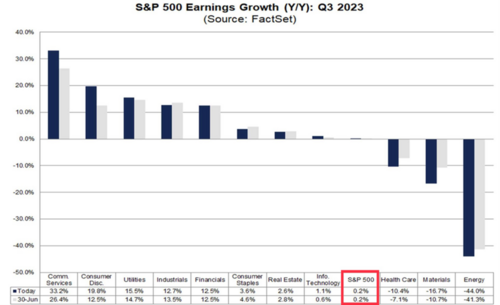

According to FactSet, expectations for Q3 S&P 500 earnings are a paltry 0.2%. 1

Can a weak dollar have a positive boost to earnings? That seems highly likely. Will it be 19% in Q3? Not likely. However, over the course of the next 12 months a weak dollar can boost earnings significantly and that may not be factored into earnings estimates.

What’s not being talked about this month may soon be talked about as early as October and the upcoming earnings reporting season. A surprise, by definition, is made from what we don’t talk about.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: