What’s the Smartest Thing an Investor Can Do?

Almost always, advisors and investment managers focus on generating returns for their clients. That’s the general emphasis when you hire someone to help you.

To that end, one generally expects over long periods of time to have a pie chart with a various mix of stocks (equities) and bonds (fixed income) that are likely to produce returns looking something like this:

However, I would contend that in conjunction with the various mix of returns above, advisors should be helping you generate a return on your investments as well as a return of your investments. Of course, you need a return on your investments over a long period of time; however, in my opinion, it’s far more important to combine that return on your investments with a return of your investments. Why? It’s simple—taxes.

Let’s look at the mix of federal income tax rates and brackets for 2018. [i]

Now let’s look at the capital gains tax rates for 2018. [ii]

Keep in mind that long-term capital gains and most dividends are taxed at the above long-term capital gains tax rates. However, to complicate things just a bit, short-term capital gains, taxable interest, and certain kinds of dividends are taxed at ordinary tax rates or the federal income tax rates for your particular tax bracket. One last wrench to throw in: if you live in a state that has state income tax, you have an additional state income tax bracket on top of what you pay federally.

And further, complexity may occur at retirement when most begin taking withdrawals from their investment accounts to support their lifestyle—they may get stuck with a fairly large and unexpected tax bill.

One of our long-term holdings, the Schwab Fundamental Weight Large Cap Index Fund, is one small example that illustrates my point. On a $100k investment that we made ten years ago in the fund, barring any other circumstances to reduce the tax liability, you would pay approximately $28k in taxes if your income was in the top tier of income tax brackets. [iii]

However, if you were in the lowest income tax bracket, the capital gains taxes would be approximately $21k. [iii] That’s a 25 percent reduction in taxes, meaning potentially 25 percent more in your pocket at the end of the day. Based on the ten-year annualized return of 9.2 percent on that particular holding, you would need almost three years to add that sort of cumulative return to that investment. [iii] That’s a major difference worth focusing on.

Optimizing the return of your investments makes sense when you can optimize the portion of your taxable income to a lower level.

Regrettably, the story only gets more complicated if you have a 401(k) or IRA, which will have required minimum distributions. [iv]

When you mix the desire to lower your income—while returning money to you in the form of investment withdrawals—with required minimum distributions and Social Security, you can now easily end up in a much higher income tax bracket, which is likely to result in higher capital gains tax rates, along with a higher overall marginal tax rate.

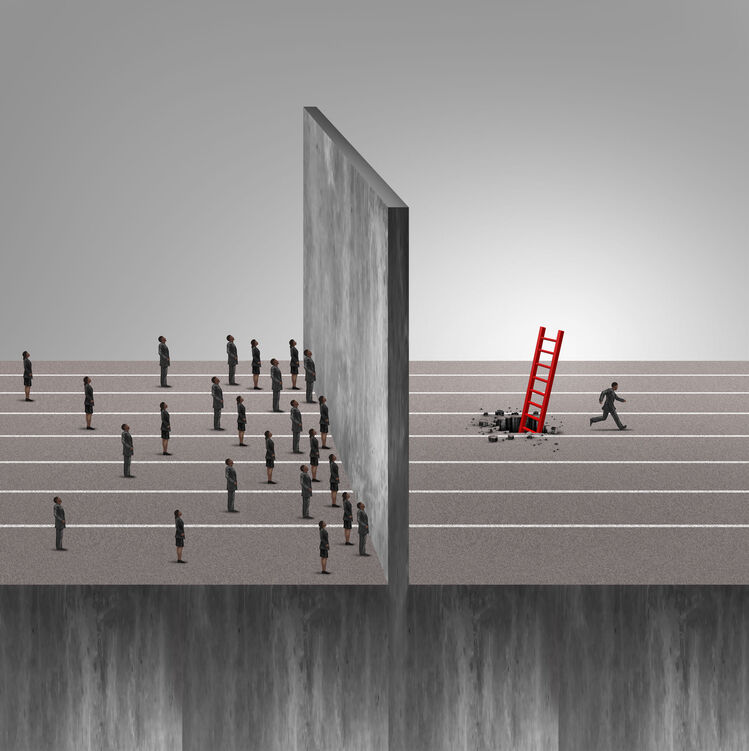

Wall Street and almost all advisors don’t want to tell you the dirty little secret that they don’t get paid to return your money to you; in fact, they usually get paid to keep it. Traditionally, your tax problem is your problem, not theirs.

However, with the latest technology we have added at Phillips & Company, we can now compare all the permutations and variables to return your capital to you at the lowest optimized tax rate. [v]

The above chart outlines a real-world example in which we were effectively able to model a reduction in a client’s taxable ordinary income down to zero while helping the client’s forecasted income reach almost $150k per year during that seventeen-year period.

The outcome is simple. The more money you have available to invest over longer periods of time, the more your life, and your family’s lives, can potentially improve.

While most people focus on returns, valuations, and nicely colored pie charts, I implore you to focus on the most erosive aspect of your wealth—taxes.

Don’t focus on what everyone else around you is doing. Do the smartest thing you can do and have us help you get your money back in the most tax-sensitive way possible.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://files.taxfoundation.org/20180207142513/TaxFoundation-FF567-Updated.pdf

ii. https://www.fool.com/taxes/2017/12/22/your-guide-to-capital-gains-taxes-in-2018.aspx

iii. Morningstar Direct

iv. https://www.irs.gov/pub/irs-tege/uniform_rmd_wksht.pdf

v. Phillips & Co Withdrawal Strategy Report