When Bulls and Bears Align

During any trend transition from growth to contraction, and back to growth, investors are pitted against each other – between optimism and pessimism, classic buyers vs. sellers. The two overarching themes of our current environment are interest rates and inflation. Over 35 years of professional investing, I’ve seen a multitude of themes that drove macro sentiment – from a currency crisis, fraud, and a credit crisis to terrorism, pandemics, and now excessive inflation. Whatever the catalyst, I’ve believed it’s our job to help investors navigate the transitional waters. Managing trends is easier than managing transitions.

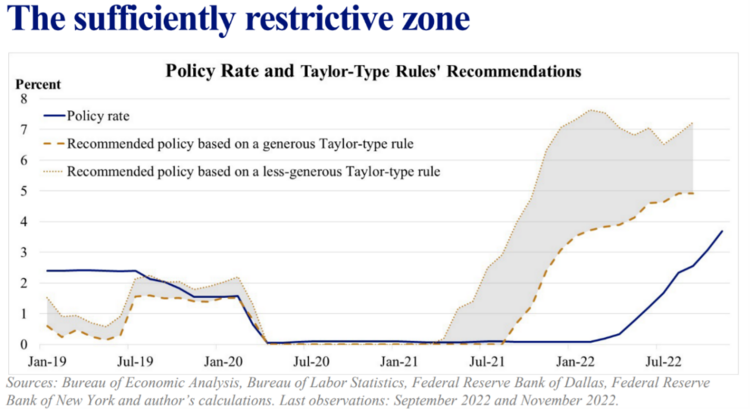

Every day there are new data points along the continuum of the bull-bear struggle. In our current inflation-focused narrative, we had Fed Governor James Bullard suggest the Fed Funds rate might need to reach as high as 7% to tame inflation. While grounded in sound economic principle, that was clearly a very bearish comment for all. 1

Explicit forward guidance through official Federal Reserve press releases or speeches from Federal Reserve Governors all serve the same purpose. They are designed to anchor the public’s expectations well before some official Fed action takes place, like raising rates.

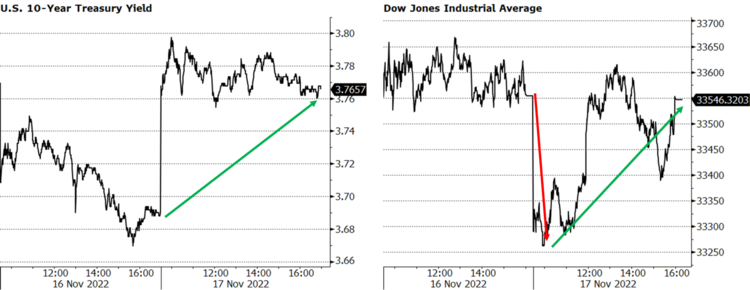

In the case of Bullard, he certainly lowered any pivot to a neutral interest rate stance and splashed some cold water in investors’ faces. U.S. 10-year Treasury yields rose following Bullard’s comments last week, while U.S. equities sold off initially before making up some ground later in the trading session. 2

Investor Note:

The good news is, this is why we have been focused on bulleting fixed income using short-duration U.S. treasuries vs. allowing more active managers to move duration higher.

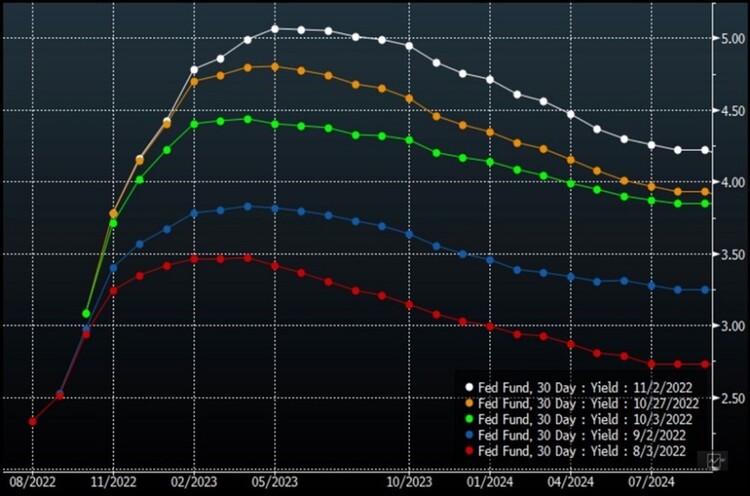

No one really knows anything in the short run when it comes to where the Fed will land; not even the Fed. Just look at the various terminal rate projections since August. We can’t even plot Bullard comments on this particular chart: 3

However, when bulls and bears align, it makes for strange bedfellows.

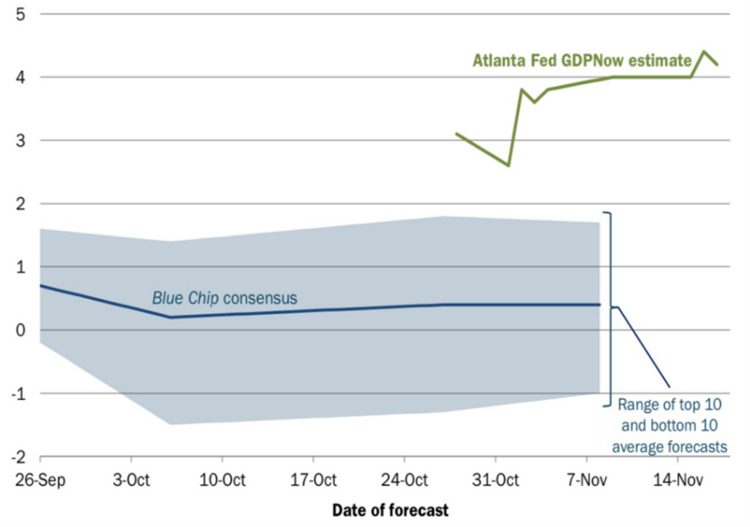

Here’s what I am talking about. The U.S. economy is on a rip-roaring tear in most segments of the economy other than housing. GDP growth is currently expected to come in at over 4% in Q4 according to the Atlanta Fed. 4

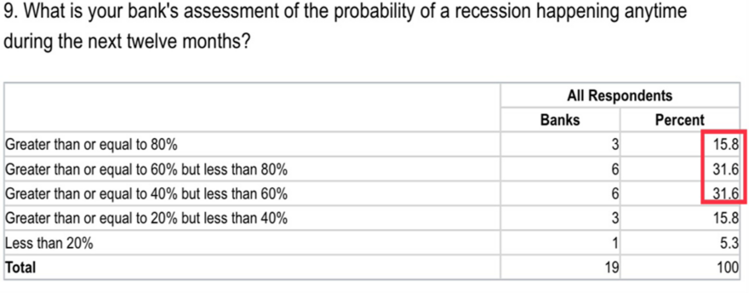

At the same time, Senior Loan Officers at banks are growing more bearish about the economy, with almost 80% surveyed suggesting there is an exceedingly high probability of a recession in our near future. 5

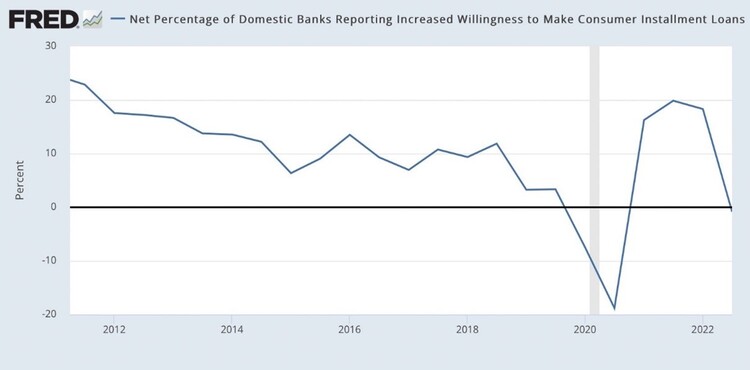

As a result, banks are tightening lending standards, which will likely starve the economy of necessary credit on the consumer side of the business. 6

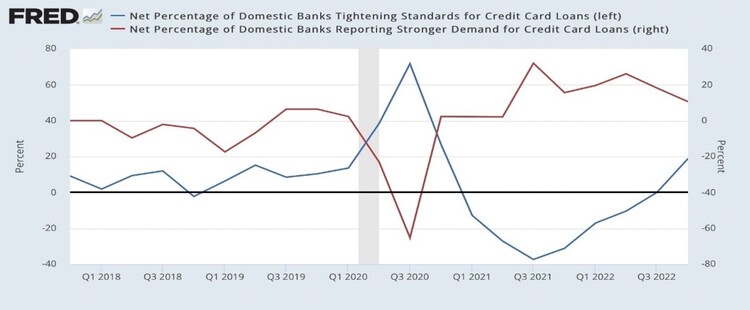

With banks tightening lending standards, consumer demand for credit cards is moderating. This will certainly put the brakes on some of the frothy consumption driving up inflation. 7

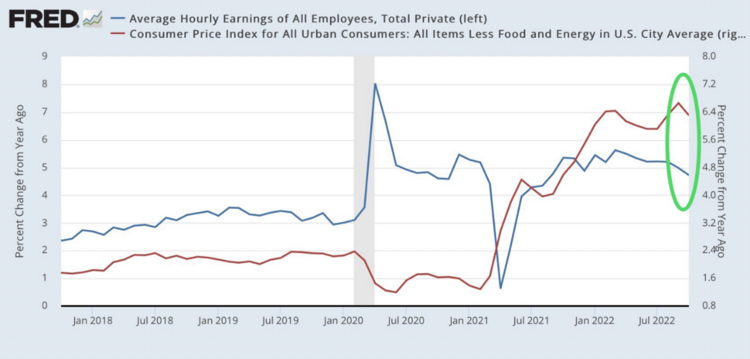

As one result, wages and consumer prices are curling over and that should also create the conditions for a possible economic soft landing – as long as wage growth moderates less than inflation. 8

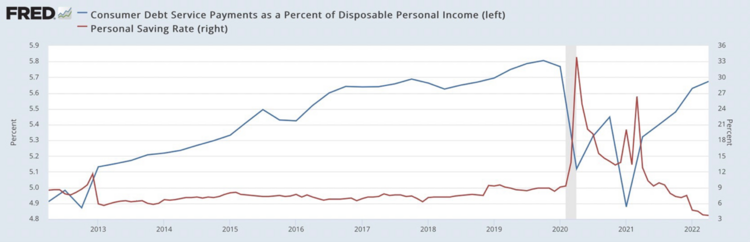

Consumer debt service payments have been rising rapidly as a percent of disposable personal income. Concurrently, consumers have been saving less on their monthly paychecks. (note: this does not include the accumulated savings from COVID stimulus) This should also put the brakes on consumption. 9

I understand none of this looks bullish on any front. However, over decades of investing I have found the seeds of a bullish trend are buried in the depths of bearish behavior. I dare not predict the timing of any of this but as consumers get less credit access and banks pull in the reigns on lending, the economy should slow. The Fed will react in an equal and opposite trend.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/files/pdfs/bullard/remarks/2022/nov/bullard-louisville-17-nov-2022.pdf

- Bloomberg

- https://thedailyshot.com/

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.federalreserve.gov/data/sloos/sloos-202210-table-2.htm

- https://fred.stlouisfed.org/graph/?g=WDZr

- https://fred.stlouisfed.org/graph/?g=WDZL

- https://fred.stlouisfed.org/graph/?g=WE09

- https://fred.stlouisfed.org/graph/?g=WE1a