When Hope Catches Reality

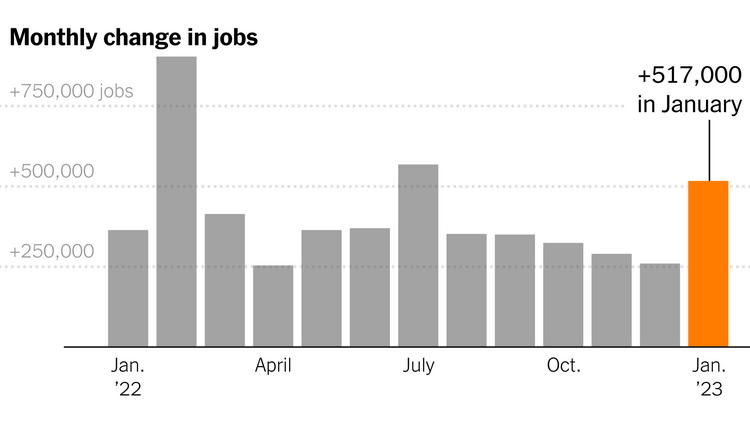

Equity market volatility has spiked since the robust jobs report in January. Recall the U.S. economy added 517,000 jobs in January, kicking off the start of investor hope running into reality. 1

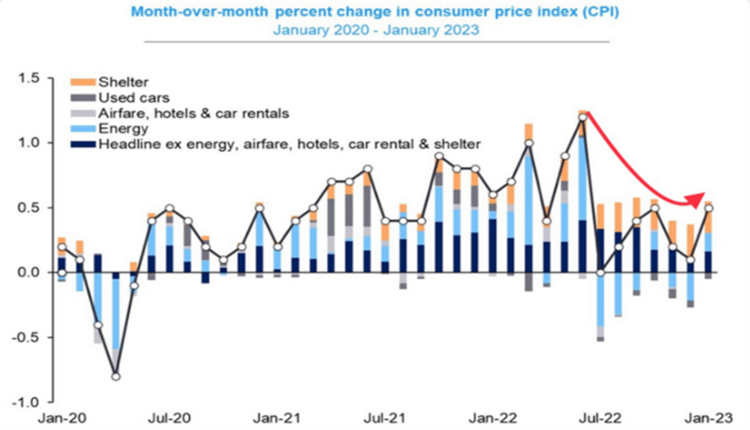

Since that announcement, we have had a Consumer Price Index reading reflecting inflation is not abating. 2

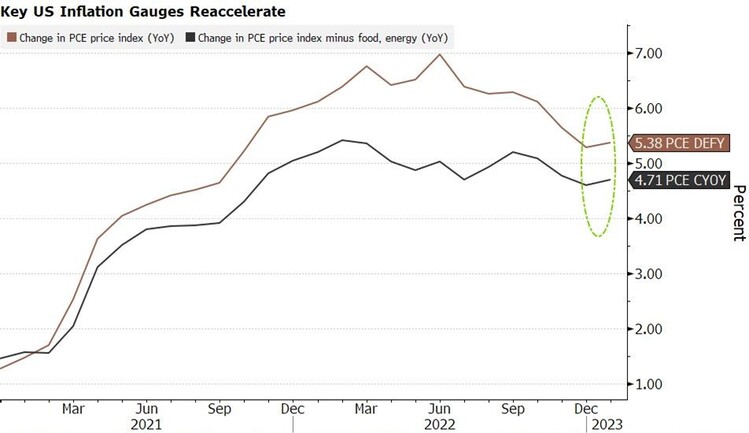

Last week we had the Personal Consumption Expenditure report, a favorite inflation index of the Federal Reserve, flashing stronger than anticipated inflation. 3

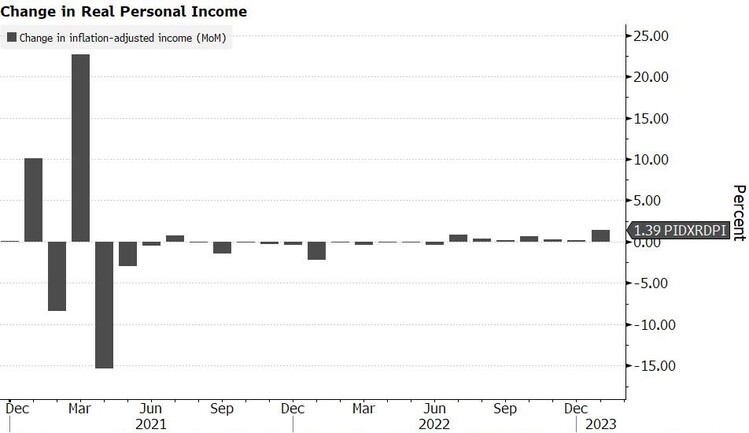

We also had a strong reading on personal income, reflecting the simple fact that the recent spate of interest rate increases has yet to impact wages and income. 3

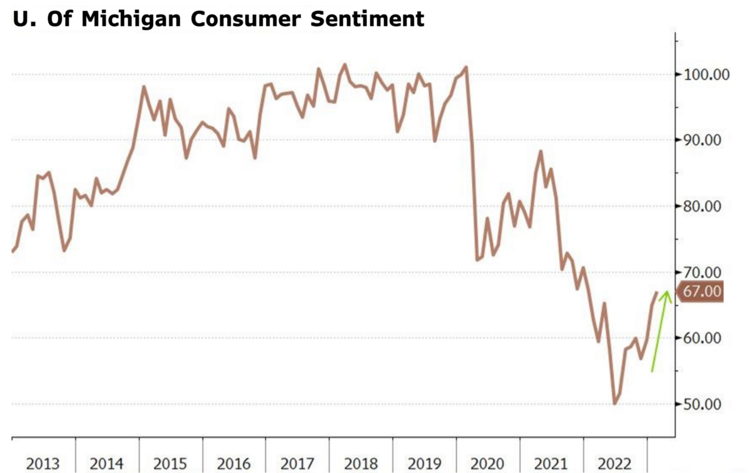

Further, consumer sentiment as measured by the University of Michigan consumer sentiment index reinforces some pretty strong sentiment. 4

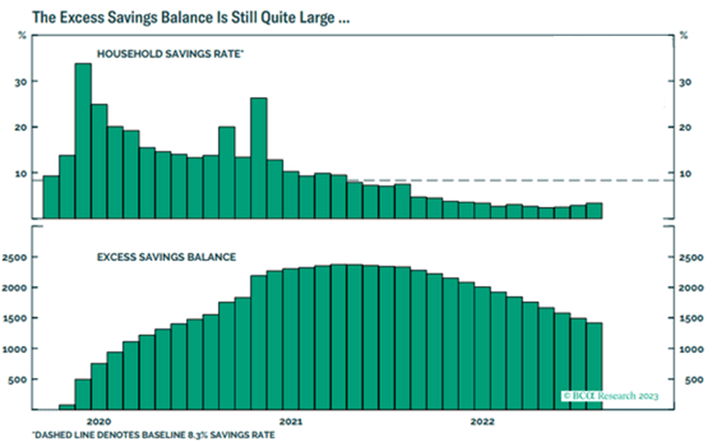

Sentiment might be driven by the persistent level of excess savings amongst Americans. 5

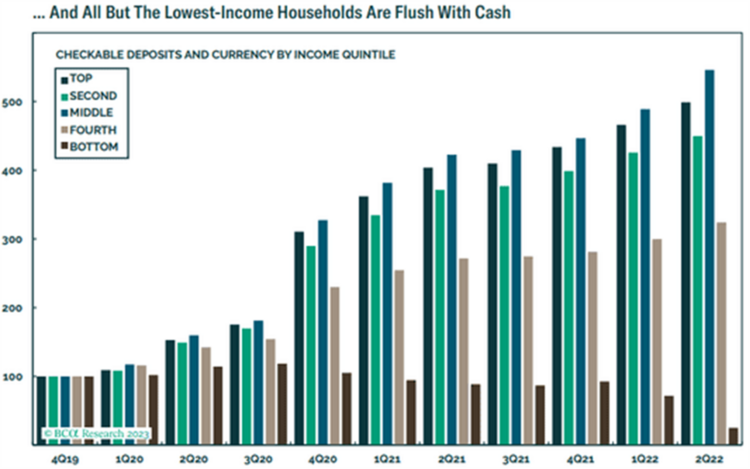

Other than the lowest income cohort, everyone else is still sitting on a pile of cash. 5

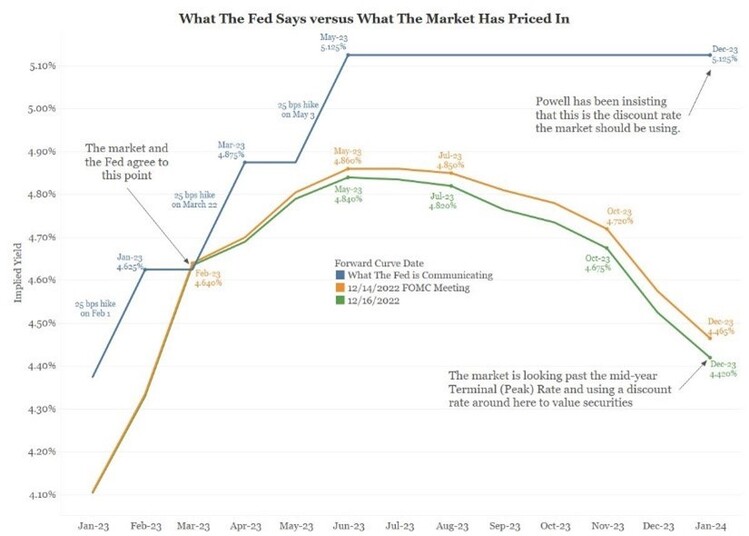

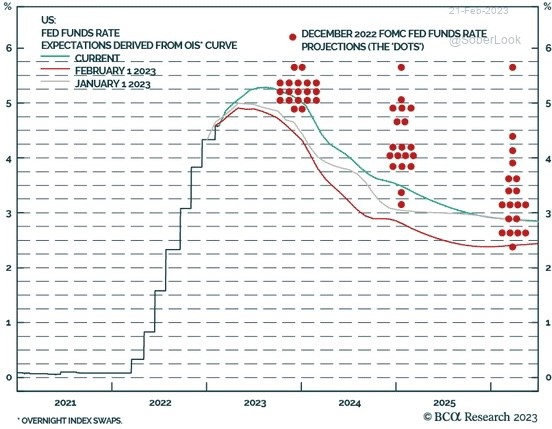

If we gaze back to the start of the year, we pointed out the inconvenient truth that investors expected the Fed to limit their interest rate policy to below 5% and cut rates before year end. 6

All the while, the central tendency published by the Fed was for a Fed Funds rate above 5% and no rate cuts till 2024.

Clearly investors were hopeful, but we maintained the Fed would not be done with their work until the Fed Funds rate was above 5% and got closer to matching inflation sometime later this year. The consumer was, and still is, simply too strong.

It appears investors’ hope finally accepted reality that the Fed would raise rates higher than anticipated and hold them there longer. 5

So, what happens when hope finally runs into reality? Stock prices adjust as they have and will continue to do.

The good news is when we reach an equilibrium between hope and reality with interest rates, equity prices can reflect the value of earnings more accurately.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.nytimes.com/2023/02/03/business/economy/jobs-report-january-2023.html

- https://www.bls.gov/news.release/cpi.nr0.htm

- https://www.bloomberg.com/news/articles/2023-02-24/us-pce-inflation-accelerates-adding-pressure-for-more-fed-hikes

- http://www.sca.isr.umich.edu/

- https://www.bcaresearch.com/insights

- https://www.biancoresearch.com/