Where Are We?

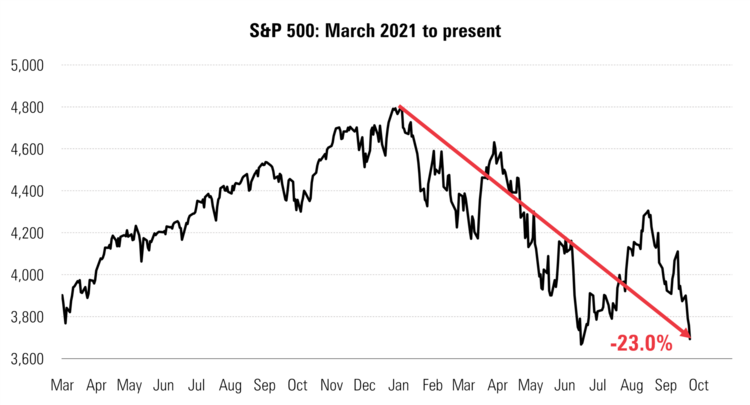

After another painful week on Wall Street a healthy dose of despair might be setting in. The S&P 500 closed near the bear market low and is now down 23% from the peak in January. 1

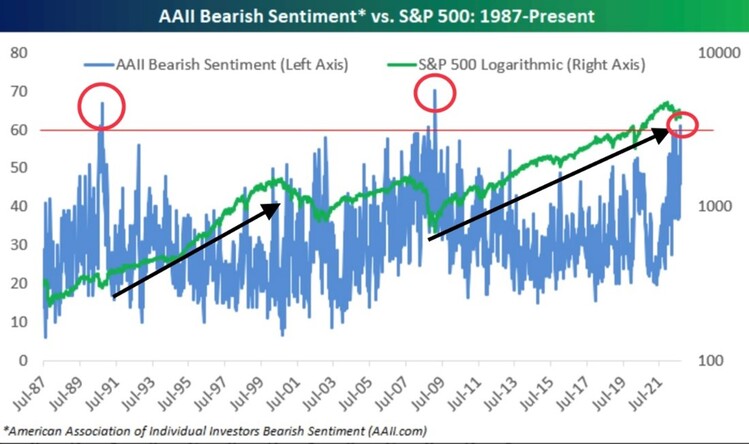

Investor sentiment is now back to Great Financial Crisis levels according to the American Association of Individual Investors (AAII). Investor despair is peaking. However, when individual investors get extremely pessimistic, markets tend to rally. 2

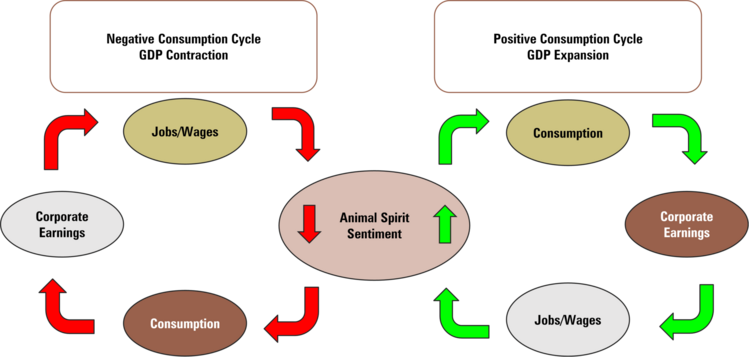

It’s easy to lose track of where we are in the cycle when extreme emotions take over. Here is where I think we are in the current pain cycle:

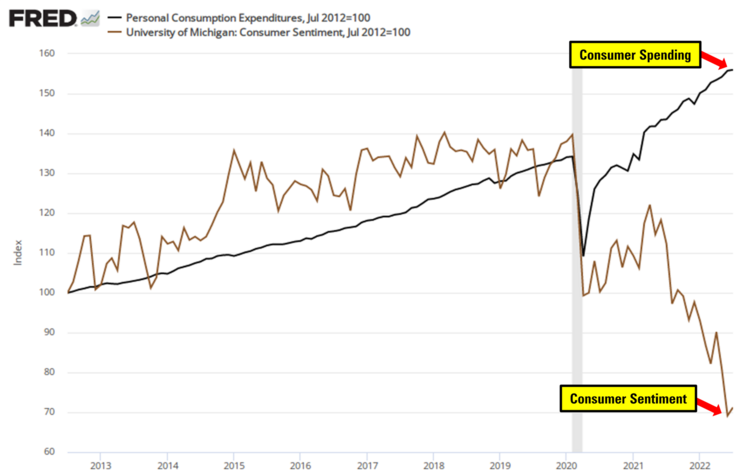

Consumer and investor sentiment is dropping and that should lead to some drag on consumer spending. 3

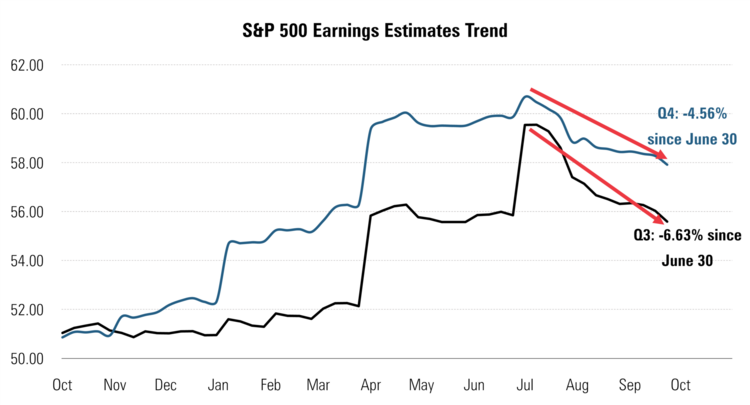

Consumer demand destruction has been pulling corporate earnings expectations lower for Q3 and Q4. 4

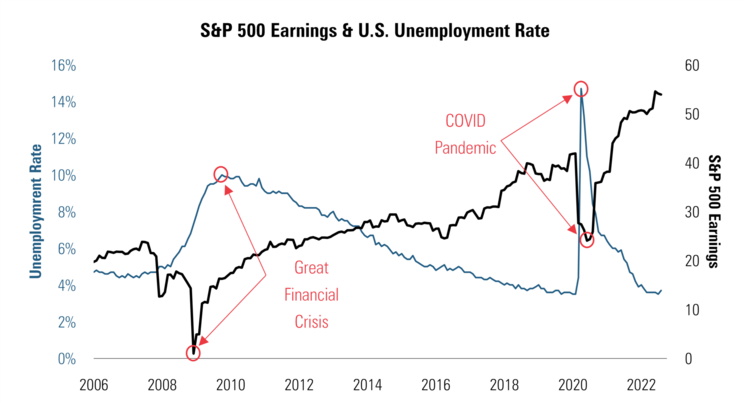

Once we see corporate earnings begin to buckle, we should see jobs lost and a bump in unemployment. 5

While it might seem like we are a long way off from the job loss point in time, those events happen quickly.

Shortly after that we should expect the Fed to cut rates which can – in most cases – reinvigorate the economy and put us back on a growth cycle.

Just remember two things:

- Equity markets discount information several months before actual events. In our current case, investors are likely discounting a U.S. recession if not a global recession.

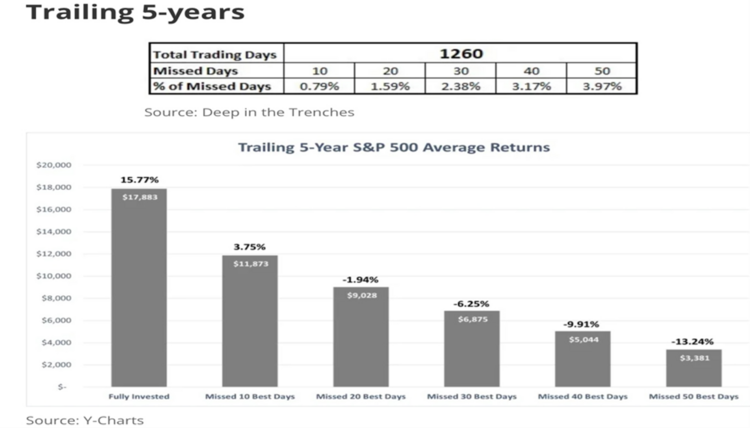

- Trying to time these cycles is a recipe for disaster. I’ve posted the below chart several times in the last few weeks and I can’t emphasize the point enough. Trying to time will lead to disaster. 6

What can you do?

- Review your plan with us.

- Make sure your spending needs are in line with your plan.

- Review your time horizon and risk tolerances.

- Rebalance and tax loss harvest to optimize forward opportunities.

That’s where we are in the cycle!

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: