Who’s Going to Pay?

As we enter another busy week of economic brinkmanship with tariffs, tax proposals, and spending cuts, it might be time to frame the mathematical challenge.

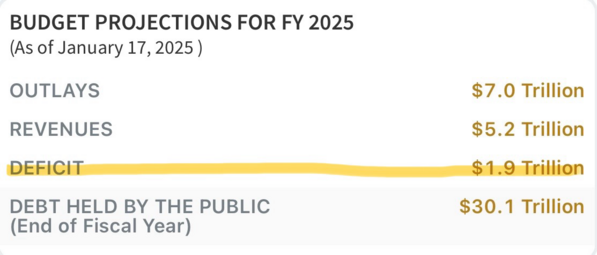

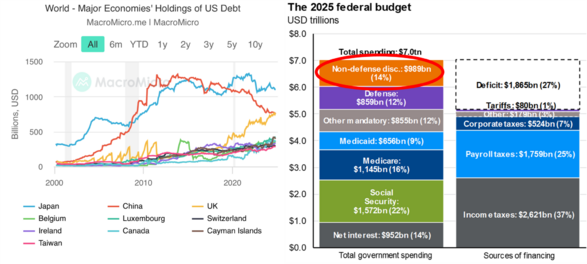

The Federal Government is spending about $1.9 trillion more than they take in. 1

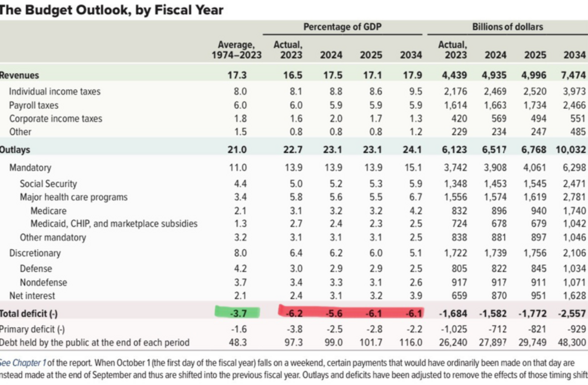

At 6.1% of GDP, this deficit stands at an all-time record high – nearly double the long-run historic average. To return to the long-run average of 3.7% of GDP would require cutting the fiscal deficit by more than $900 billion. Alternatively, GDP would need to grow an additional 2.2% (over 4% overall) if we're going to maintain current spending levels. That growth is not likely. 1

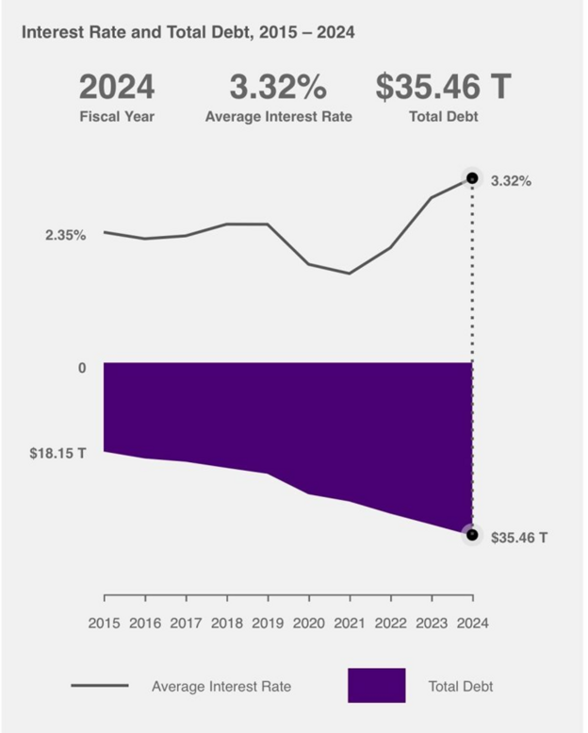

The challenge gets a little harder when considering the cost of servicing existing debt, which currently stands at 3.1% of GDP, or $870 billion. The average interest rate on the $35.5 trillion in debt is approximately 3.3% – a relatively low rate on a very large sum of money. 2

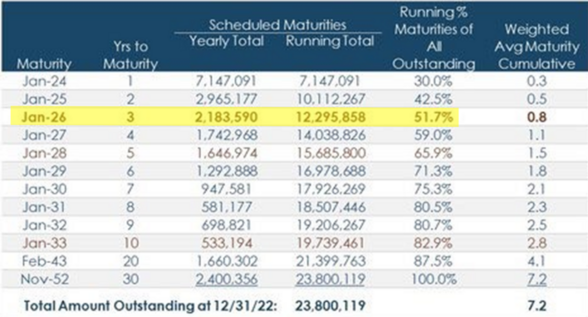

Allow me to add one more element to consider before we look at how this will all play out. Like anyone that carries debt, you have to refinance it when it matures. In the U.S. government’s case, over 51% of their debt is maturing 2024-2026, with 12% maturing this year alone. 3

The simple math looks like this:

In 2025, we face $10 trillion in debt to refinance plus $1.8 trillion in new debt to cover government spending – totaling roughly $12 trillion. Then in 2026, we'll need to refinance another $12 trillion, along with whatever additional spending the government can’t cover.

Our foreign friends are no longer buying our debt and in fact have been trimming their holdings. Tariffs will only cover about $80 billion in revenue per year under the current proposals and spending cuts. DOGE, or whomever, only has $989 billion to dig around for cuts in non-defense discretionary spending. (footnote: there are reports of somewhere between $50 billion and $100 billion a year in fraudulent Social Security payments but those will be hard to get to) 4 5

Let’s cut to the chase: this might look like a credit crisis in the making. However, if spending cuts and tariffs can’t make up the difference, the buyer of last resort of this debt is going to be the Federal Reserve. Only the Treasury Department can print money via issuing more debt and the Fed can buy that debt to keep credit flowing.

They just spent the last few years reducing their post-Covid balance sheet by $2 trillion and they will likely need to get back to buying debt in the coming years if we can’t find ways to cut $900 billion in deficit spending. 5

The investment implications are as follows:

- Expect the Federal Reserve to maintain higher interest rates for longer periods to control fiscal spending.

- Stay flexible on fixed income duration.

- Focus on equity investments in productivity enhancement companies such as AI, medical technology, industrial reorganization and technology, utilities, and MLPs.

- Avoid companies that need to issue large amounts of debt due to higher debt servicing costs.

- Expect ample debt availability from alternative sources, including private credit markets with over $1 trillion in available liquidity.

The outcomes for long run investing will ultimately be shaped by who is going to pay for the deficit. I suspect it will be the Fed. The lessons from past credit crises are still way too present to allow that to reoccur.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.cbo.gov/topics/budget

- https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

- https://horizonkinetics.com/app/uploads/Q4-2022-Commentary_FINAL.pdf

- https://en.macromicro.me/charts/81306/top-10-countries-holding-us-debt

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=economy/gtm-fedfinances

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.