Who’s On the Sidelines?

It might be easy to get distracted by the above expectations Jobs Report on Friday. After all, it could and should signal more interest rate hikes ahead by the Fed. However, the real story might be the unintended consequences of the unlimited debt ceiling passed by Congress and signed by the President.

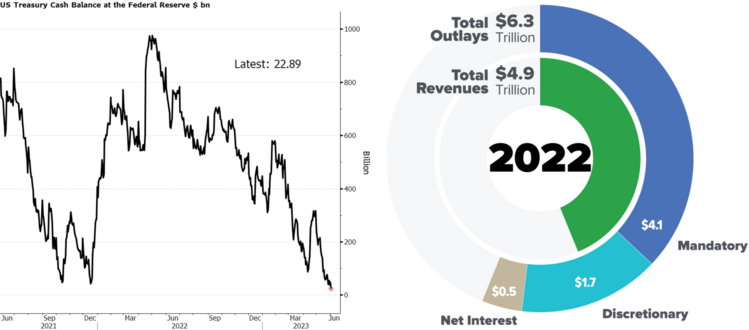

The “down to the wire” approach by the political class left the U.S. Treasury with little in the way of cash reserves. Beginning today, and over the course of the next several months, the U.S. Treasury will start to auction off what is anticipated to be $1.4 trillion in Treasury debt to fund the U.S. budget deficit. 1 2

Who’s going to lend that much money to fund our fiscal budget deficit?

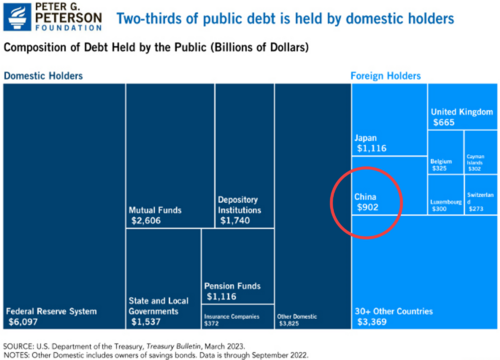

Looking at who’s traditionally been buyers of our debt provides for a nice framework for who’s going to be in the debt auctions and who might take a pass.

Two-thirds of our federal debt is held by domestic buyers. One-third is held by foreign central banks and buyers. 3

It’s not hard to contemplate China not being eager to overpay for our debt – meaning they may extract higher rates at auction for their participation. There is always a price to pay for trade wars, technology restrictions, and geopolitical challenges. As a debtor nation, we need countries with trade surpluses to fund our consumption. We might find out the real cost of decoupling from China soon enough.

On the domestic front, it’s not necessarily going to be a walk in the park at the auctions for the U.S. Government (We The People). The breakdown looks something like this: 3

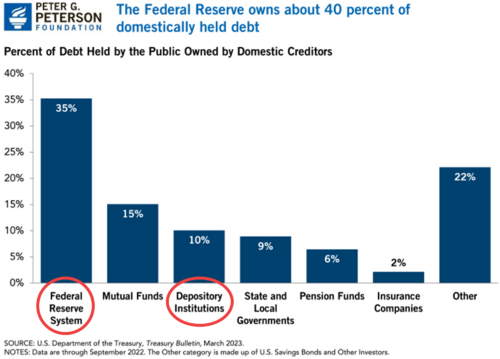

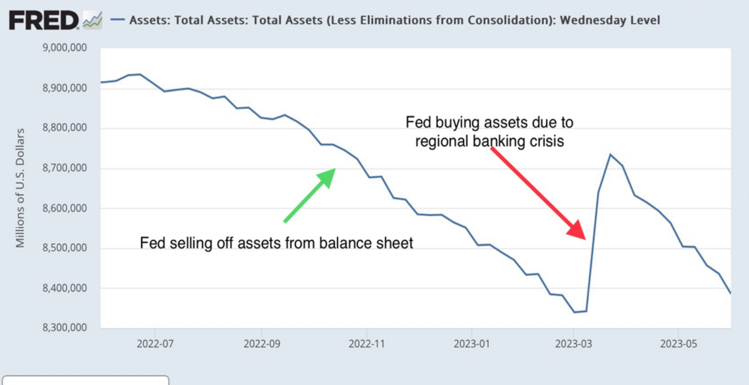

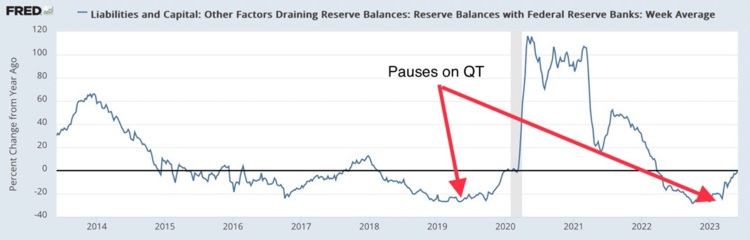

The Federal Reserve would be a natural buyer as they hold 35% of outstanding domestic debt. Unfortunately, they are supposedly in the midst of Quantitative Tightening (QT) or selling their debt holdings not withstanding some temporary purchases when the regional banking crisis kicked off in March. 4

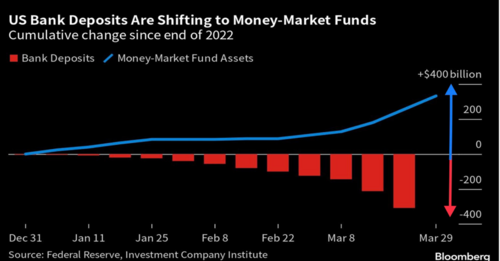

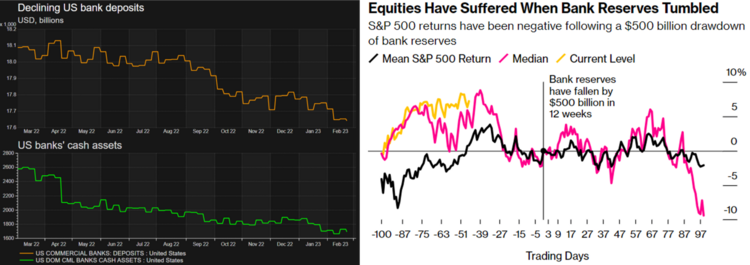

Let’s move to the next buyer on the sideline, depository institutions (banks). With the massive outflow of deposits from banks into money markets/mutual funds, the banks are likely going to be largely reluctant to do much in the way of buying debt. With uncertainty around deposits, it’s hard to blame them. 5

When bank deposits fall, as they have been, by over $500 billion, the pain points can be felt not just in bond prices but also in equity pricing. That’s something few are talking about. 6 7

With China holding 4% of total public debt, the Federal Reserve holding 35% of domestically-held debt, banks holding 10%, and all facing unique constraints; it’s not hard to imagine rising rates to be the consequence outside anything the Fed might contemplate at their next rate hike meeting. A rate hike would be a policy mistake at this juncture without knowing who’s buying our debt.

Not to fear, the Fed has shown very little in the way of balance sheet discipline in the face of credit constraints. The recent pause in QT was discussed above. The 2019 termination of QT was driven by bank reserves drying up, potentially leaving corporate credit abandoned. 8

While China and banks might largely sit out these auctions, the Fed will likely have to pause QT and provide liquidity to the banking system to allow for more capital to flow. We might see a dip in equity returns but the return of liquidity to the system will provide a powerful relief. Especially as we wade our way into a better earnings picture in 2024.

It’s all about who’s going to sit out the auctions and who’s going to demand higher rates to participate. Perhaps the savior is going to be We The People with our ongoing purchases of money market mutual funds.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://fiscaldata.treasury.gov/datasets/daily-treasury-statement/operating-cash-balance

- https://www.cbo.gov/publication/58888

- https://www.pgpf.org/blog/2023/05/the-federal-government-has-borrowed-trillions-but-who-owns-all-that-debt

- https://fred.stlouisfed.org/series/WALCL#0

- https://www.bloomberg.com/news/articles/2023-03-31/us-bank-deposits-decline-sharply-for-a-second-straight-week

- https://www.reuters.com/markets/us/declining-us-bank-reserves-add-wrinkle-contentious-debt-ceiling-issue-2023-03-10/

- https://www.bloomberg.com/news/articles/2023-06-03/trillion-dollar-treasury-vacuum-is-coming-for-wall-street-rally

- https://fred.stlouisfed.org/graph/?g=15RgF