Why Earnings Still Matter

There’s an old saying in markets: “In the long run, stock prices follow earnings.”

That’s as true today as it was a century ago — maybe even more so.

After another strong start to earnings season, the data remind us that corporate America’s profit engine remains remarkably durable, and that durability explains a lot about why equity prices continue to hold firm despite persistent macro noise about valuations.

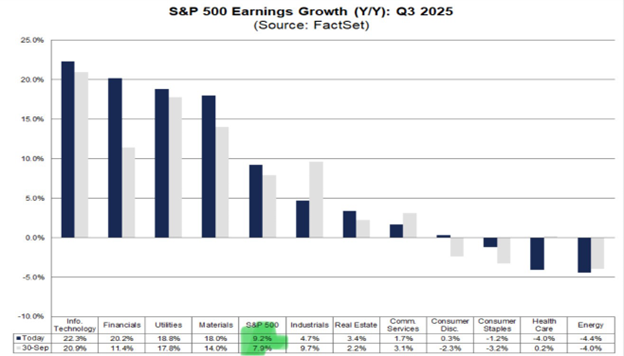

FactSet’s latest Q3 2025 data show S&P 500 earnings growing over 9% year-over-year, up from 7.9% just a few weeks ago.

More importantly, this isn’t just a one-sector story — Information Technology, Financials, and Utilities are all posting double-digit growth.

This broadening of earnings leadership contrasts sharply with the narrative that only a handful of mega-cap names are driving returns. Yes, the “Magnificent 7” are powerful, but the chart makes it clear: profits are expanding across the economy.

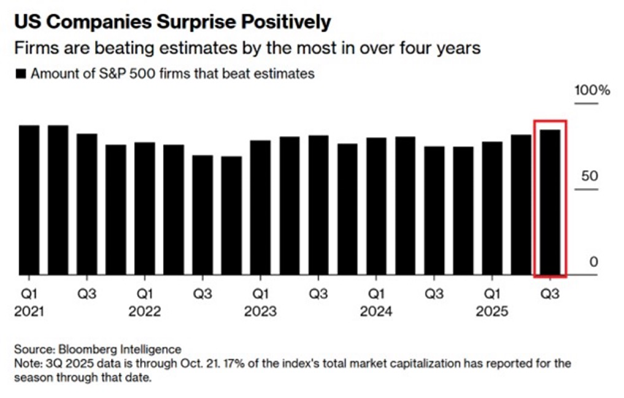

Further data show that U.S. companies are beating estimates at the highest rate in over four years.

That matters because it tells us analysts continue to underestimate corporate resilience — even after two years of rate hikes, geopolitical tension, and slowing global growth. These positive surprises help explain why markets remain well-supported: every earnings beat resets expectations, reprices future cash flows, and reinforces the fundamental story beneath stock prices.

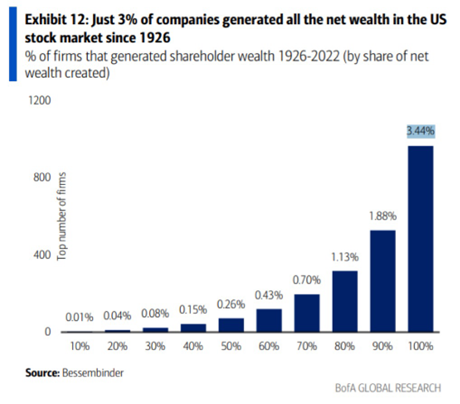

Realize that just 3% of companies have created all the net wealth in U.S. stock market history. That might seem very odd but that’s not an accident — it’s how capitalism works.

A handful of world-class innovators consistently generate outsize returns, driving most of the market’s wealth creation.

Today’s “Magnificent 7” — Apple, Microsoft, NVIDIA, Amazon, Alphabet, Meta, and Tesla — sit squarely in that lineage. Concerns about market concentration have always been a part of the economic landscape.

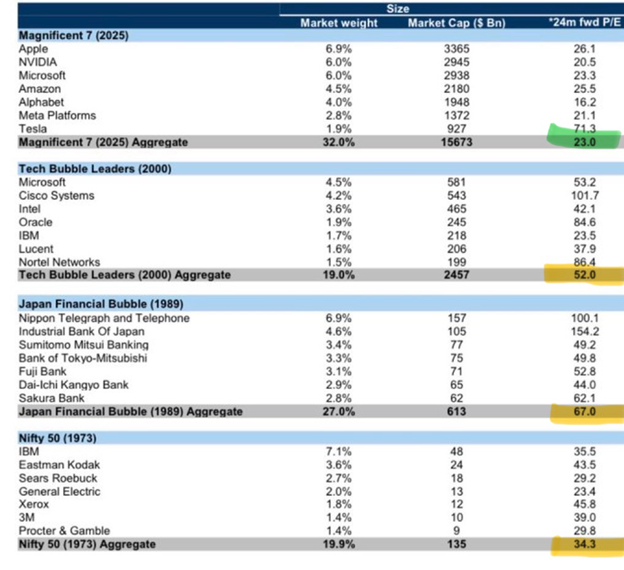

The easy narrative says today’s market is “too expensive.” But context matters.

- In 2000, the tech bubble traded at 52× forward earnings.

- In Japan’s 1989 boom, valuations hit 67×.

- Today’s Magnificent 7 trade closer to 23× forward earnings — despite producing record profits, maintaining pristine balance sheets, and dominating global productivity.

When you pair these valuations with double-digit earnings growth, the case for “overvaluation” looks much weaker. Put simply: the market may look expensive on price, but it’s not when you factor in the earnings.

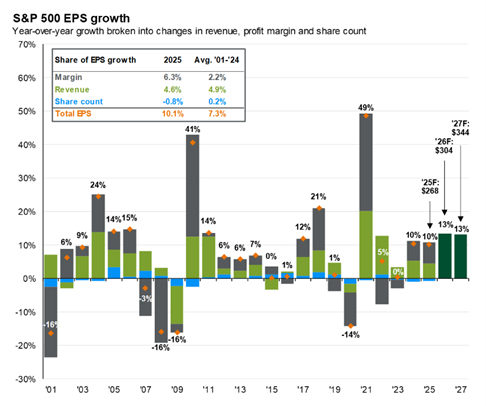

Earnings per share (EPS) growth is being driven by both revenue and margin expansion, not just financial engineering or share buybacks.

For 2025, total EPS growth is projected at 10.1%, well above the long-term average of 7.3%. That growth is coming from 6.3% margin gains and 4.6% revenue increases, while share count changes actually detract slightly — meaning companies are earning more, not just shrinking their share bases.

That's real, fundamental improvement — the kind that justifies valuations and supports long-term compounding.

At the end of the day, prices follow profits. Whether you look back to 1973, 1989, 2000, or today, the lesson is the same: markets reward earnings power, not hype.

And today’s earnings power — broad, margin-driven, and globally diversified — explains much of the market’s strength.

Earnings are not just an accounting line — they’re the foundation of ownership. They tell us where value is being created, who’s winning, and why the long-term compounding story of equities remains intact.

So, if you’re going to obsess over anything in this market, make it the E in P/E. Because that’s where the truth — and the opportunity — really lies.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.