Will Consumerism Collapse before the Fed Pauses

At the heart of the economic debate surrounding inflation is consumer demand. I’ve argued that around 60% of inflation is supply driven, but that’s not part of the current conversation. The argument goes something like this: if inflation moderates the Fed can pause rate increases and investors can develop a better picture of future earnings.

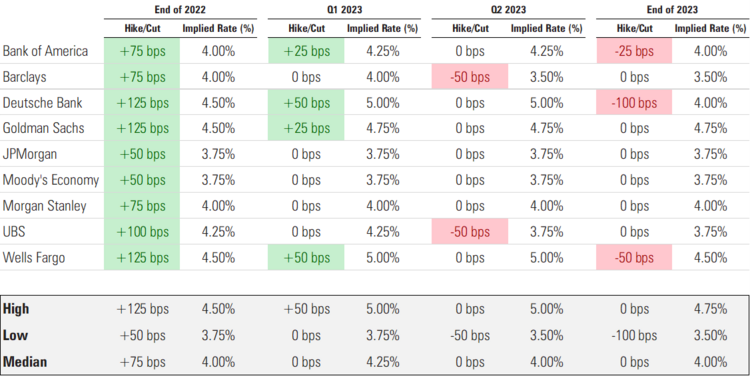

Currently the expectation for the Fed (you can find more data in our Q4 Look Ahead) is for two more rate increases this year and maybe one more next year before a pause. 1

Will this be too much to crush consumer demand and ultimately corporate earnings?

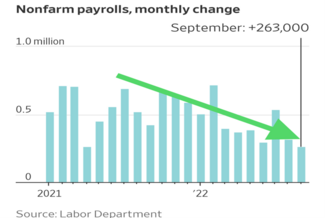

Currently with the Fed Funds rate at 3%-3.25% and a very rapid liftoff from 0% in March, we have started to see some moderation in job growth. According to the latest jobs report, the U.S. economy only added 263k jobs in September. That’s well off the 12-month average of 470k. The Fed should feel somewhat reassured in their path. 2

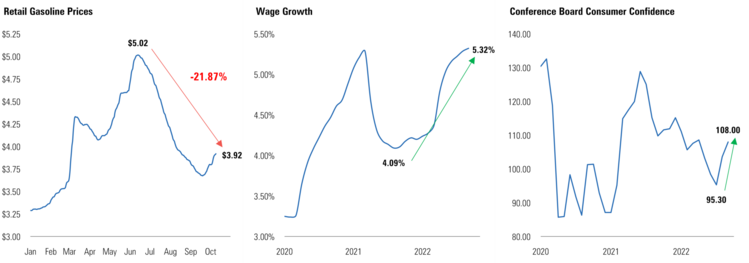

Simultaneous to the jobs slowdown, is an optimistic consumer, according to the Conference Board’s reading on consumer sentiment. In fact, it’s at the highest level since April, largely reflecting the drop in gasoline prices and strong wage growth. 3 4 5

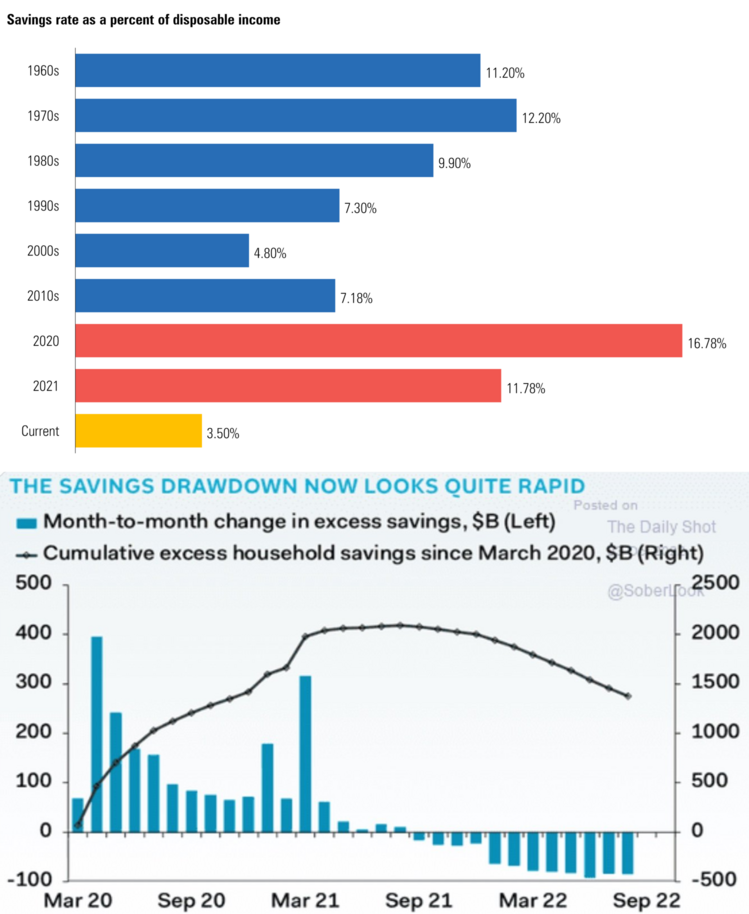

The consumer should remain resilient for a few more months, probably driven by their excess savings. The pandemic gave consumers a chance to pay off debts and save some of the money provided by the government. While the current savings rate dropped below the pre-pandemic averages, excess savings is still being spent down. 6 7

The excess savings of about $1.4 trillion is equivalent to 5.54% of GDP. At the current spend down rate, we may not see that return to zero until August or September 2023. That’s a lot of fire power.

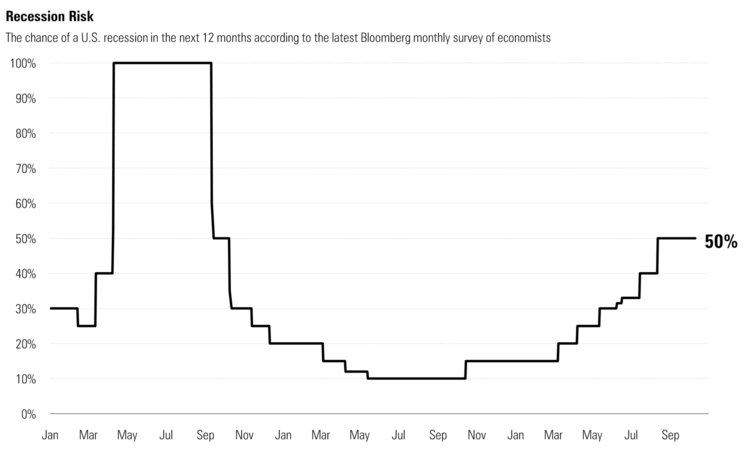

A recession is still a 50/50 proposition and I believe the markets and corporate earnings expectations reflect that. 8

It would appear the consumer can remain resilient and in decent shape while the Fed raises rates. The path to a soft economic landing is still in play as long as jobs moderate in the coming months, supply side inflationary pressures abate, and the Fed pauses early next year. Both can be true: Consumption can progress and the Fed can pause.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://PHILLIPSANDCO.COM/files/7716/6456/1821/Quarterly_Look_Ahead_-_Q4_2022_-_Final.pdf

- https://www.bls.gov/news.release/empsit.nr0.htm

- https://gasprices.aaa.com/

- https://www.bls.gov/news.release/empsit.t19.htm

- https://www.conference-board.org/topics/consumer-confidence

- https://www.bea.gov/data/income-saving/personal-saving-rate

- https://www.pantheonmacro.com/

- Bloomberg