Xi Jinping for Fed Chair

On a global macroeconomic level, two things are occurring simultaneously at opposite ends of the world: President Trump is in the process of selecting someone to chair the Federal Reserve, whereas, in China, the Communist Party is selecting a chair to lead China forward. (Note: There are 90 million Communist Party members trying to control nearly 1.2 billion people.) [i]

Although these two events seem to be polar opposites you might be surprised how connected they really are.

Allow me to lay out a simple economic principle that may explain what’s creating the lack of wage growth in the U.S. economy and perhaps the lack of productivity growth as well. Currently, capital (defined as financial assets, property, plant, and equipment) is relatively cheap compared to labor (defined as wages, benefits, and taxes paid).

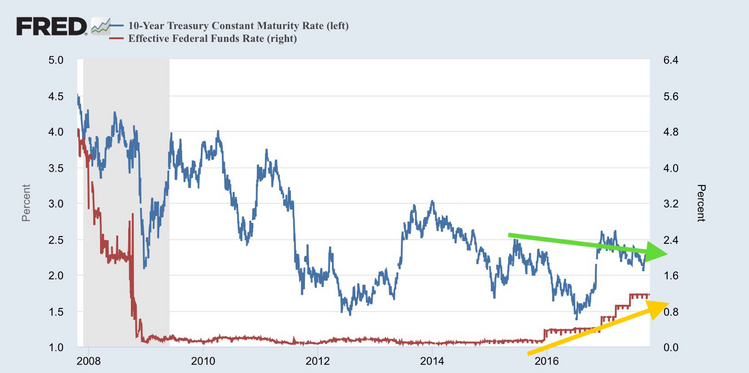

Capital is cheaper than labor simply because long-term interest rates are at historic lows, where they have been for a long period of time. [ix]

This, along with the Federal Reserve's near decade-long interest rate reduction program, which has only recently ended [vii], has made labor the big loser. It’s cheaper for a business to buy automation or invest in efficiency- improving and profit-enhancing capital rather than hiring more people. This usually results in an increase in the cost of labor.

However, President Trump’s pick to lead the Federal Reserve may end up with a pretty boring job because as we will suggest, China may have more to do with U.S. long-term interest rates than the Fed.

In our opinion, here’s how this plays out economically:

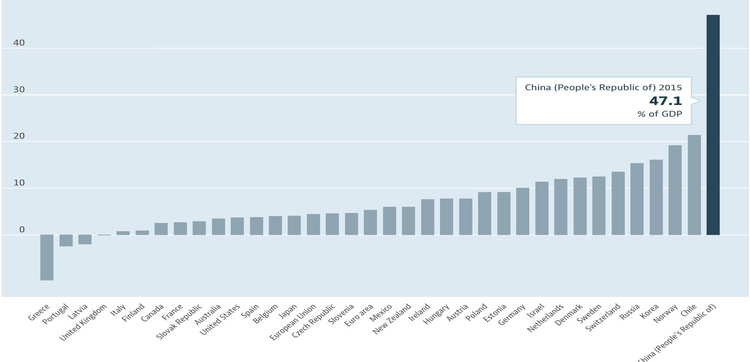

- China has one of the highest savings rates in the history of the world. Chinese citizens save nearly 50 percent of their total GDP as of 2015. [i]

- This high savings percentage of GDP gives Chinese banks tremendous power. It’s important to note that Chinese banks are, in some form, owned and controlled by the government. [ix] In fact, China’s “Big Four” banks are among the largest in the world. [viii]

- China uses this consumer savings bias to lend in two critical areas:

- China-based infrastructure and corporate lending, which can lead to excess reserves [xi]

- Buying U.S. Treasuries, which has a very significant impact in the United States

China is now the largest owner of U.S. Treasuries, surpassing Japan. Since the U.S. dollar began to weaken, China has been able to use its reserves to purchase U.S. Treasuries instead of buying its own currency. [iii]

In turn, China’s purchasing of U.S. Treasuries has likely suppressed long-term interest rates in the United States.

When you compare the Fed Funds Rate increases to 10-year Treasury yields, you can see the opposite occurring: the Fed Funds Rate is increasing; however, the 10-year Treasury yield remains pressured to the downside. [iv]

Unless China is going to take specific actions to provide more social and health security to its citizens, we will likely expect the Chinese consumer to continue saving disproportionately.

From an investor perspective, we may see lower long-term interest rates lasting longer than the Fed might like.

Further, this may continue to spur capital investments and hold wage inflation to benign levels of around 2.5 percent or less. [xii]

This could push corporate profit growth well into 2018 (Q1 & Q2) as profits generally compete with wages. [v][vi]

It would appear that China may have more to say about U.S. interest rate policy, wages, corporate profits, and capital investments than does our own Federal Reserve. So perhaps China’s President Xi Jinping is the de-facto Chair of the Federal Reserve.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://www.statista.com/topics/1247/chinese-communist-party/

ii. https://data.oecd.org/natincome/saving-rate.htm

iii. Bloomberg L.P.

iv. https://fred.stlouisfed.org/series/DGS10

v. https://fred.stlouisfed.org/series/CPATAX;

vi. https://fred.stlouisfed.org/series/A576RC1

vii. https://fred.stlouisfed.org/series/DGS10#0

viii. https://www.statista.com/topics/1552/banks-in-china/

ix. http://economistsview.typepad.com/economistsview/2011/06/karl-smith-capital-vs-labor.html

x. http://www.investopedia.com/articles/economics/11/chinese-banking-system.asp

xi. https://www.ft.com/content/1211215e-f02b-11e5-aff5-19b4e253664a?mhq5j=e5

xii. https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_4Q17.pdf?segment=AMERICAS_US_ADV&locale=en_US