You Can’t Eat Forecasts

Last week in our blog “What Else Can Go Wrong,” we accurately predicted several outcomes that would increase equity market volatility.

The S&P 500 did, in fact, post another quarter without any earnings growth, as corporate America officially enters an earnings recession. [xi]

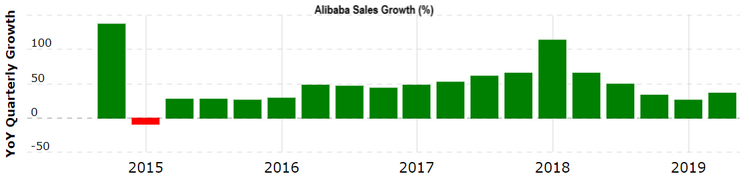

Simultaneous to that, both Walmart and Alibaba posted impressive year-over-year growth figures in terms of revenue. [i] [ii]

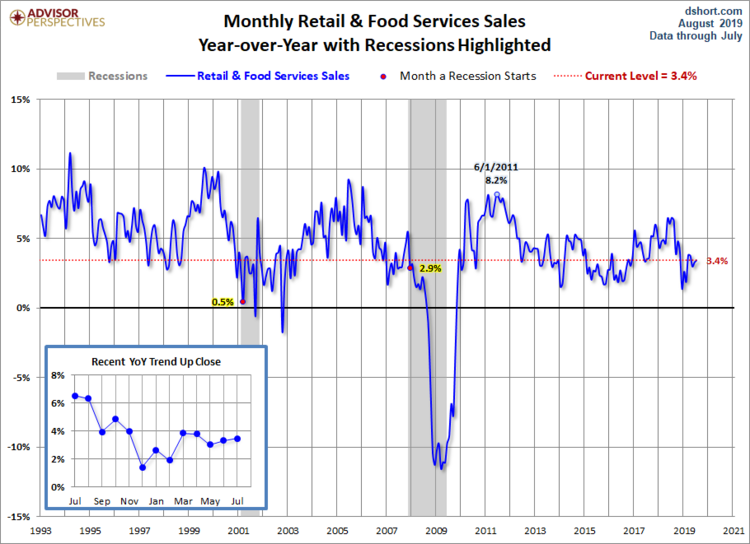

Further, July retail sales data confirmed that the U.S. consumer continues to shop and spend; remaining unswayed by Trump’s trade tantrums. [iii]

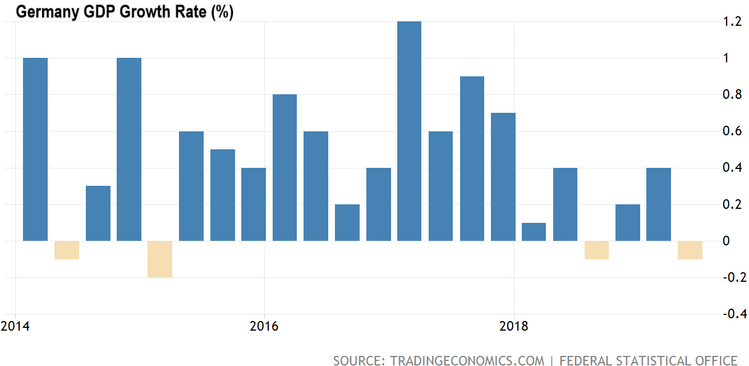

Finally, we forecasted Germany (Europe’s largest economy) would show a decline in GDP, pushing it closer to a recession. [iv]

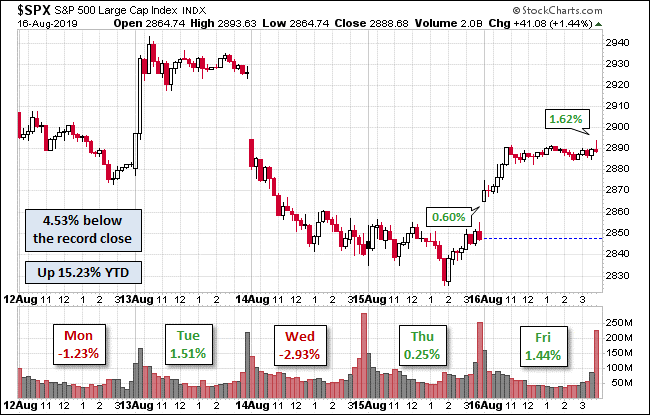

All of this incongruous data led to a wild week on Wall Street. [v]

While we were perfect in last week’s blog, I will say that as a professional investor for the past 30 + years, I do know one thing: you can’t eat a forecast. Forecasts are only worth what they can help you run toward or away from. Forecasts can inform on an allocation or perhaps even provide guidance as to where we are in an economic cycle; at least, that’s what I use them for.

For what it’s worth, I am not one that thinks a recession is imminent, unlike what the bond market and TV pundits are calling for.

First, as you can see in the chart above, U.S. retail sales are still very strong and the consumer is doing just fine, realizing about 70% of our economy is predicated on consumption.

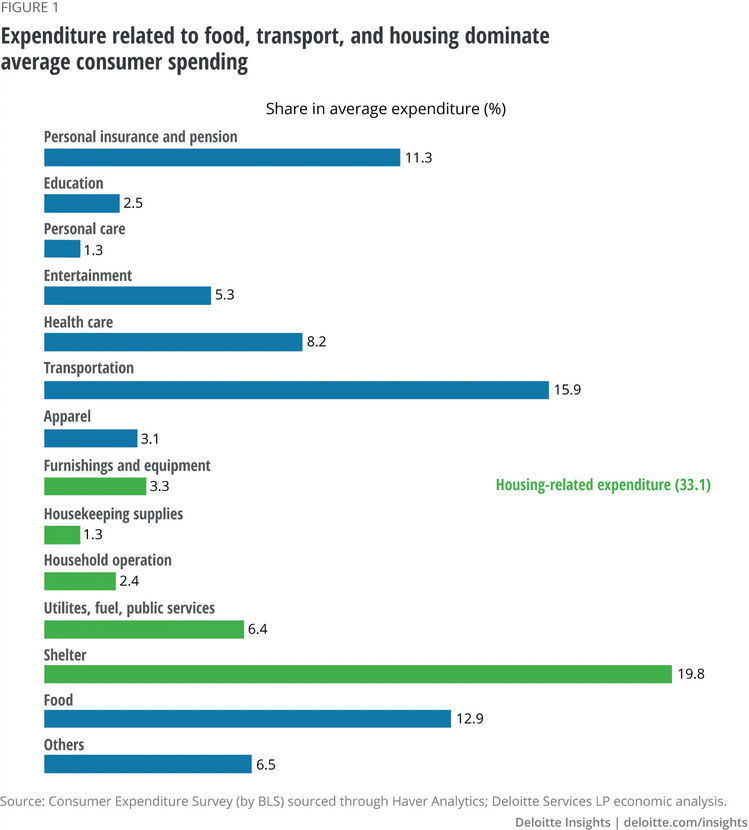

Second, the two biggest consumption items, household expenditures and autos, are both doing well. Housing-related expenditures make up about 33% of consumer spending and transportation absorbs another 16%, meaning that nearly half of our consumption is spent on these two categories.

Let’s take a look at how both household expenditures and transportation are doing.

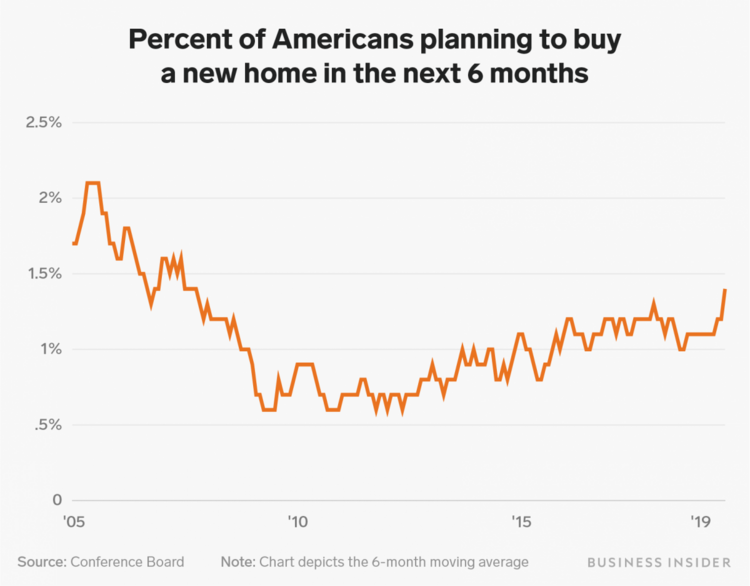

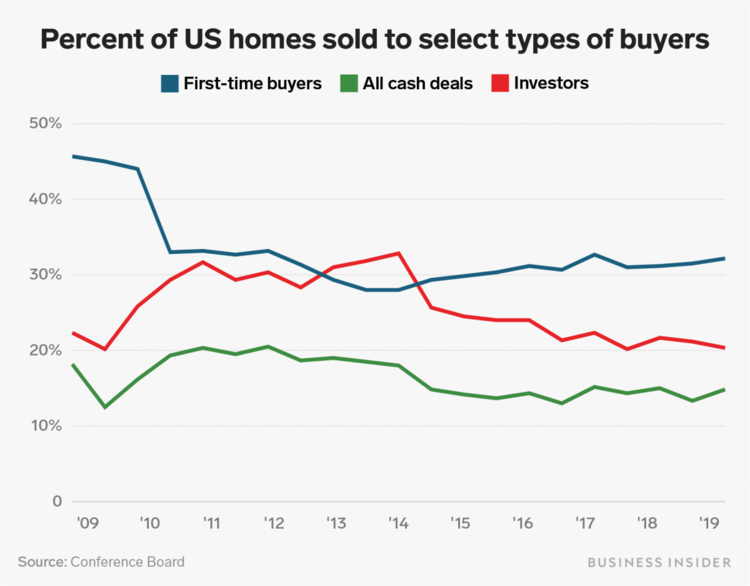

According to The Conference Board, there was an uptick in Americans planning to purchase a home in the coming six months. [vii]

Further, first-time homebuyers are on a multi-year uptick. [vii]

It’s not all simply doom and gloom when it comes to the largest component of our consumption patterns. Granted, the consumer can be fickle and shut down quickly, yet by all indications, they are continuing to show tremendous confidence in their jobs and the health of our economy.

As an anecdotal aside, we manage money for some large regional homebuilders and they too are reporting strong sales.

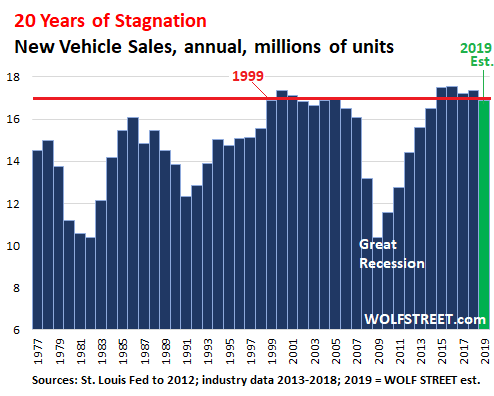

Pivoting to auto sales, the data is equally hopeful. Here’s the latest commentary from Market Lines:

“U.S. new vehicle sales of 1,395,816 units for the month of July represented an increase of 7.7% from June and a 1.5% increase from July 2018. July’s passenger car sales fell 9.2% to 398,546 units, while SUV and truck sales increased 6.5% to 997,270 units.” [viii]

While expectations point to stagnant auto sales, we are not seeing recessionary levels of activity. [ix]

There is no doubt in my mind that increased market volatility has had an impact on the consumer’s psyche and that’s also clear to President Trump. Last Tuesday, the president came out and said the following regarding the trade war with China:

“We’re doing this for the Christmas season. Just in case some of the tariffs would have an impact on U.S. customers. So far they’ve had virtually none, but just in case they might have an impact on people, what we’ve done is we’ve delayed it, so that they won’t be relevant to the Christmas shopping season.” [x]

We have also forecasted that postponement in this commentary.

You can’t eat forecasts; however, a great asset allocation plan that reflects your needs, with sufficient time to withstand the vagaries of equity investing are unbeatable.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.macrotrends.net/stocks/charts/BABA/alibaba/revenue

ii. https://www.macrotrends.net/stocks/charts/WMT/walmart/revenue

iii. https://www.advisorperspectives.com/dshort/updates/2019/08/15/retail-sales-up-0-7-in-july-at-3-4-yoy

iv. https://tradingeconomics.com/germany/gdp-growth

v. https://www.advisorperspectives.com/dshort/updates/2019/08/16/s-p-500-snapshot-after-a-volatile-week-still-up-15-ytd

vi. https://www2.deloitte.com/insights/us/en/economy/spotlight/economics-insights-analysis-11-2018.html

vii. https://www.businessinsider.sg/us-housing-market-mortgage-rate-troubles-overblown-opinon-2019-8/

viii. https://www.marklines.com/en/statistics/flash_sales/salesfig_usa_2019

ix. https://wolfstreet.com/2019/07/03/new-vehicle-sales-fell-in-q2-sales-for-2019-to-drop-to-1999-level-20-years-of-stagnation/

x. https://www.cnbc.com/2019/08/13/trump-says-he-delayed-tariffs-because-of-concerns-over-christmas-shopping-season.html

xi. https://insight.factset.com/earnings-season-update-august-9-2019