A Recovery Is Coming

It’s easy to get lost in the day-to-day pain of demand destruction. Living through economic cycles is a discipline of its own for investors. One thing that helps is to reflect on the cause, as it generally provides the path to a solution. In our current case, the cause resides in good intention. 1

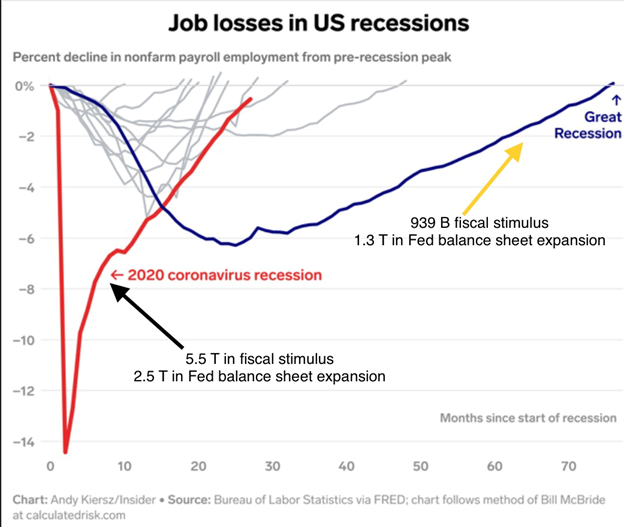

During the Great Financial Crisis, the stimulus provided by the Federal Government and Federal Reserve was limited compared to current fiscal and monetary inputs. The outcome was a painfully slow jobs recovery that took over 70 months.

Lessons Learned

Compare that stimulus to our current fiscal and monetary response to the Covid crisis. There was clearly not going to be another repeat of the past. About 500% more fiscal stimulus was pumped out and there was a nearly 100% larger expansion of the Fed balance sheet.

The outcome was astonishingly positive when considering how ineffective our government can be at times. The jobs recovery has taken about 30 months, or less than half the time as it did during the Great Financial Crisis. It would appear our government has learned from their past.

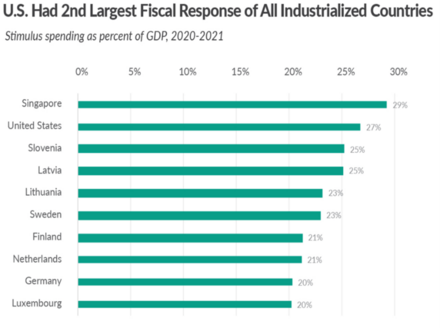

More consumer demand for goods and services, more jobs than workers, higher wages, less supply, and the cycle just goes on. Now consider that the same stimulative impact was occurring all over developed economies around the world. 2

The byproduct of all of that stimulus was an accordion effect on supply and demand, landing us at where we are today, with core inflationary pressures.

In last week’s blog, I wrote that the Fed would need to address their tools to combat core inflation (inflation excluding food and energy) vs. headline inflation. Thankfully, Chairman Powell did exactly that. His statement during the question-and-answer period was unequivocal. 3

“Core inflation is most relevant to our tools. Non-core is outside our tools. We can’t have that much effect [on food and energy inflation], but we are responsible for fighting inflation.”

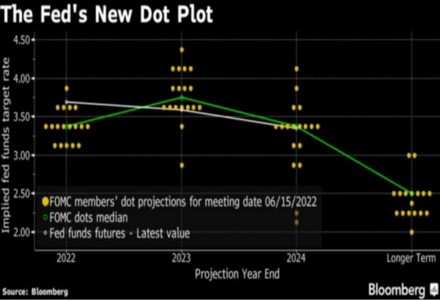

In response to non-core inflation the Fed raised interest rates last week by 75 basis points—that was no surprise. The real headline is in the forward rate expectations by members of the rate setting committee (FOMC).

The dot plot reflects their view on where interest rates are heading in the future and it’s clear the Fed expects interest rates to continue to rise in the coming year.

The median is for the Fed Funds rate to end the year at 3.4% (remember we are around 1.75% now) and top out at about 3.8% by the end of next year. 4

So that’s what the Fed is forecasting as their interest rate glide path. As far as my forecast, I see a much more muted escalation of rates. Perhaps something like this:

- July: 75 basis point increase, taking Fed Funds to 2.5%

- September: 50 bp increase, taking the Fed Funds to 3%

- Pause after that

It’s the why.

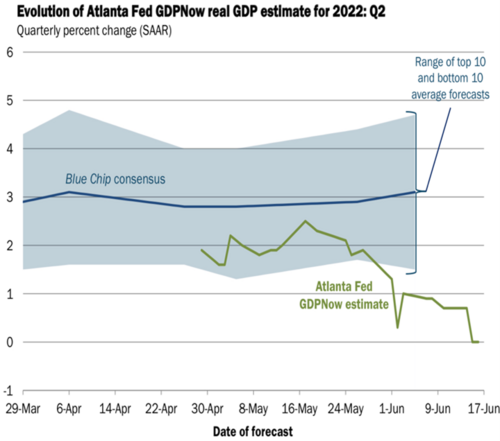

I just don’t believe core inflation will be as sticky going forward, because the Fed has already destroyed demand. We are on the precipice of, or in, a recession now. The Atlanta Fed’s GDP Now forecast is calling for no growth in Q2 and likely a contraction. Combine that with the negative Q1 GDP print and you have a classic recession. 5

How do you hammer rates higher when the U.S. economy is in a recession and the consumer in pause mode? The answer is you don’t.

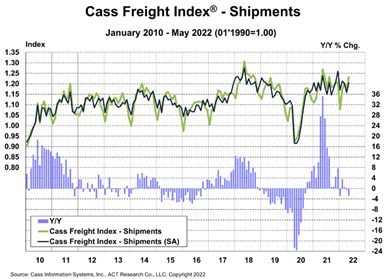

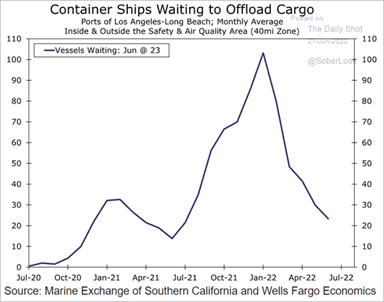

Supply chain disruptions are being resolved. In a recent Moody’s Analytics interview with Gene Seroka, the Executive Director of the Port of Los Angeles, Seroka suggested “we are in the bottom of the fifth inning when it comes to the shipping backlog.” We are actually seeing a drop in shipping freight rates. 6

Here are some critical data points to consider. The dwell times (time cargo sits around) is being dramatically reduced according to Seroka: 7

- Dwell times waiting for trucks (66% of all cargo) went from 12 days down to 4 days, very close to pre-pandemic levels

- Dwell times for cargo waiting on rail is at 6 days and moving back to 2 days

- Dwell times for cargo sitting in warehouses onshore pending delivery is at 8 days, moving back to 3 days

Import prices are showing some small signs of abating. This is all good news for resolving supply chain issues and lowering some costs to the consumer. 8

All of this activity and efficiency is taking place, and will continue to take place, well before the Fed gets to their terminal rate of 3.8% or even perhaps before they get to the 3.4% by year-end.

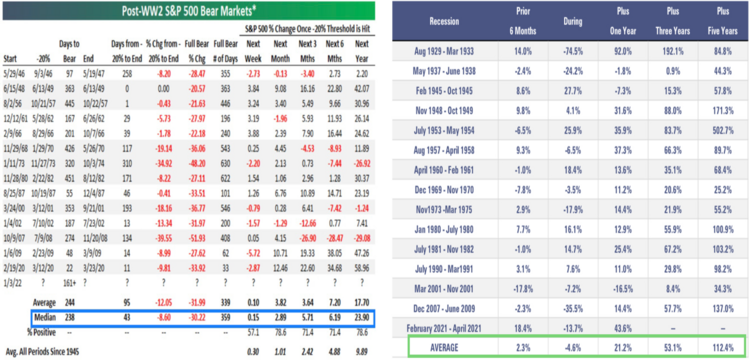

The problem for us as investors is that we are all living in the midst of a cycle change. Regardless of if it’s a recessionary cycle or bear market cycle, it can be painful if you lose sight of the end of the movie.

When it comes to bear markets or recessions it’s critical to realize “this too will pass.” We entered a bear market on June 14th and the median days to end the 20% drawdown is 43 days. Historically, the next year has had a market recovery of approximately 24%. Not too dissimilar to recessions and market recoveries. 9

So, what should investors do in the midst of waiting out this cycle?

- Consider harvesting some fixed income losses and redeploy into better forward rates. You will likely have gains to offset with those losses.

- Re-examine your liquidity and spending needs. You should be in a position to meet spending needs without being forced to sell equites. Perhaps, for as long as a year.

- Watch our recent video with best-selling author Morgan Housel on saving and investing. Perhaps share it with your family or friends. It’s clear our spending can impact our returns as much as our investments can.

It’s been a historically painful year for investors, even conservative ones. The cause of the pain in the form of excess stimulus is waning, supply chains are easing, the Fed’s demand destruction is working, and a recovery is coming.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.businessinsider.com/february-jobs-report-economic-outlook-labor-market-recovery-fastest-ever-2022-3

- https://taxfoundation.org/us-covid19-fiscal-response/

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220615.pdf

- https://www.bloomberg.com/news/articles/2022-06-15/the-fed-s-new-dot-plot-after-its-june-policy-meeting-chart

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/cass-freight-index

- https://about.moodys.io/podcast-episodes/seroka-and-supply-chains

- https://www.bls.gov/charts/import-export/us-import-price-indexes-by-category-12-month-percent-change.htm

- https://www.bespokepremium.com/interactive/research/think-big-blog/