All The Times I Thought I Should Sell: Panic

All The Times I Thought I Should Sell: Panic

Weekly CEO Commentary 12-31-12

Tim Phillips, CEO—Phillips & Company

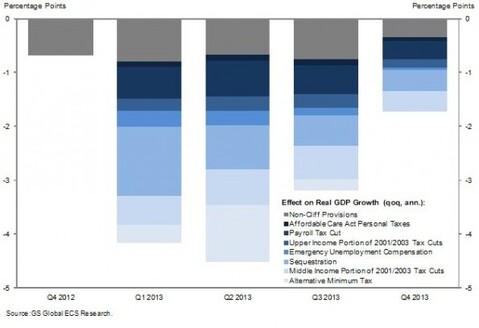

As of this writing (Sunday Night) the Political Class in this country has failed to come to terms with over 500 billion in tax increases and spending cuts that will take place throughout 2013. This chart below from Goldman Sachs shows the projected impact of these measures on GDP next year.

According to Bloomberg, most Wall Street firms are forecasting GDP growth of 2.0 percent for next year, or approximately $316 billion based on the current GDP number of $15,811 billion.

As we wrote previously, Credit Suisse estimates a most-likely case drop in GDP growth by 1.5 percent from the fiscal cliff. It’s just simple math: if our baseline growth is only 2 percent, and if the impact from the fiscal cliff is 1.5 percent, that takes our economic growth down to almost zero.

So, one might think we would fall into a mild recession or a near zero growth economic environment.

As I have said in the past, I am hopeful something permanent will be resolved and allow the US economy to continue to slowly recover. However, there is always a little part of me that thinks, sell. It's only through 27 years of experience that has me fight that bias and reflect on all the times in the past I thought I should sell.

Here’s a table with some of the troubles I have seen in the past, and how much the market has risen since then:

As you can see, after each event, a recovery was forthcoming and those that would have sold and panicked would have paid dearly. In fact, some of the best performance came immediately after the market bottoms.

The rational things to do in times such as this are to assess your time horizon and reconfirm your targeted rate of return. Be certain you know what you’re trying to achieve with your investments and if you are not clear, gain clarity and alignment with your advisor.

Unfortunately, of all the times I thought I should sell, this one seems like the silliest. The political class in this country has become tone deaf and has lost perspective on how much pain and suffering comes from their inaction.

As for specific actions, we continue to favor assets that pay a return while we wait.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Alex Cook, Associate – Phillips & Company