American Consumerism

American Consumerism

Weekly CEO Commentary 1-22-13

Tim Phillips, CEO—Phillips & Company

If the S&P 500 is any guide, the American Economy is back on track. Reuters reported that we hit a five-year high on the index last week, and it also appears we will not have a nasty showdown over the debt limit in the coming weeks—all good news indeed.

The question that still looms large in my mind is will the American Consumer return to his or her normal ways? When I mean normal, I am referring to borrowing and shopping.

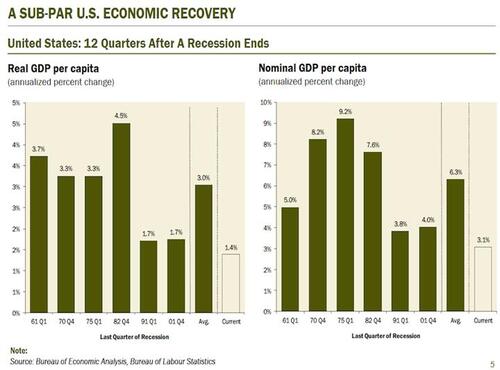

So far, this post-recession recovery has been exceedingly muted. According to Bloomberg, we are averaging about 2.25% in real GDP growth since the economy bottomed out in Q3 2009. While that does not seem so bad, it actually is low when it comes to recession recoveries, which historically have been 3.0% in real terms, and 6.3% in nominal terms.

With 70.4% of our GDP driven by consumption, it's important to ask, has consumer behavior changed—and if so, when will it change back to normal?

Much of what drives consumerism in America is expectations. Consumers that have positive expectations tend to spend more and save less. The best indicator of consumer expectations is from The Conference Board that measures consumer confidence. Unfortunately, consumer confidence dropped last month, and has yet to reach pre-recession levels, according to Bloomberg.

Even more troubling is consumers attitudes towards a return to normal. According to the latest COUNTRY Financial Security Index survey, just 27 percent think the old, pre-recession economy will return. Half of these Americans don’t expect to see it return until 2015 or later.

The survey went on to suggest that 35% of Americans are dealing with the "new normal" by cutting spending or downsizing—not exactly the news you want to hear if you’re betting on a quick recovery in consumption.

According to the Senior Loan Officer Survey from the Federal Reserve, demand for consumer credit weakened a bit in the fourth quarter. A net 8.5% of banks reported stronger demand for credit card loans, compared with 11.1% last quarter. A net 16.9% of banks reported stronger demand for auto loans, compared with 33.3% in the third quarter. And, a net 4.8% of banks reported stronger demand for consumer loans excluding cards and autos, compared with 10% in the third quarter. While we do not want to go back to the extreme levels of debt that got us into the crisis, it is clear that consumer’s appetite to take on credit has weakened to some extent.

Housing

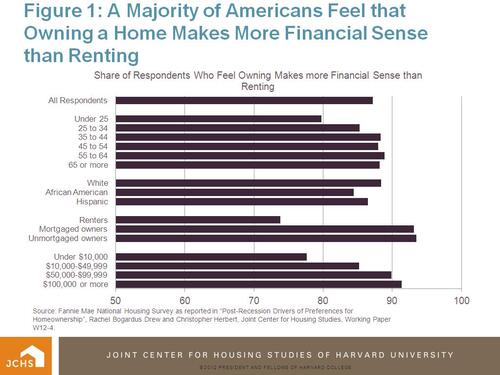

Before we write off American Consumerism as dead, we should test all of this negativity against the largest purchase a consumer makes: their home. It appears home ownership, in spite of the trillions lost and millions of foreclosures, still appeals financially to the vast majority of Americans.

Attitudes and fear appear to be immovable objects when it comes to a return of the American Consumer. I would not bet in the short run on the type of consumption habits that we saw in 2006 or 2007. However, I would also not bet against the long range return of the consumer. I would adjust my holdings to reflect those beliefs as we have done in many of our allocations.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Alex Cook, Associate – Phillips & Company