Contrarian Viewpoint

Contrarian Viewpoint

Weekly CEO Commentary 4-1-13

Tim Phillips, CEO—Phillips & Company

It's quite common when markets achieve new highs to see lots of headlines, and typically the individual investor plows money into the market. When the individual investor chases market returns, they typically get burned. Contrarian investors and value investors are constantly on the watch for the emotional investor to buy things that are overvalued and sell things that are undervalued. Greed and fear can take over for rational thinking.

I know this seems counterintuitive and if investors were truly rational, you wouldn't see such mispricing in asset classes.

The question today, as we are at all-time highs on the S&P 500 and Dow Jones, is how much irrationality is in the market? There are a few things you can look at besides pure valuations to get a sense of irrationality.

Contrarian indicators

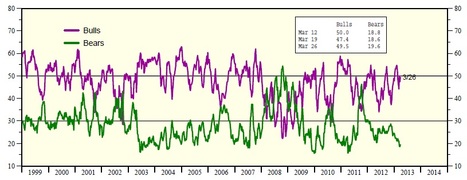

The Investors Intelligence Bull and Bear indexes are surveys of investment newsletters, and if their recommendations are bullish or bearish.

Image source: “Stock Market Indicators: Fundamental, Sentiment & Technical” Yardeni Research

Investors Intelligence noted that in times of heavy bullish or heavy bearish recommendations, markets tend to do the opposite.

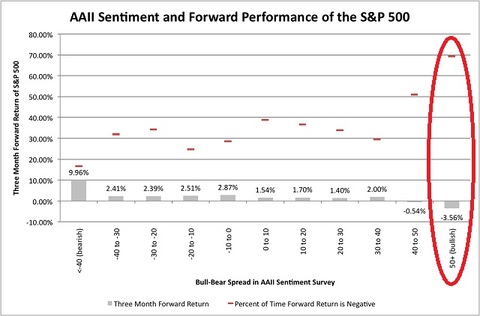

As another example, below is a chart by Avondale Asset Management of historic investor sentiment from the American Association of Institutional Investors (lots of people using discount brokerages), and how actual market performance has been during bullish and bearish levels of sentiment.

Image source: Avondale Asset Management

You can see from the chart that the individual investor is typically wrong. When the individual investor is very bullish (right portion of chart), there is historically a 70% chance they will lose money. Conversely, when they are extremely bearish, they historically have had only about a 15% chance of losing money, and in fact the average return was a positive 9.96%.

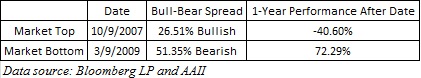

Just to prove how reliably wrong the individual investor tends to be, take a look at where sentiment stood during the last market bottom and also where it stood at the prior peak:

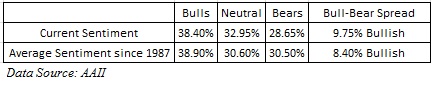

If you look at the table below, you can see we are nowhere near an extreme bullish sentiment by the individual investor.

Perhaps because the last negative experience was so traumatic, investors are being cautious. This bodes well for continued positive trends in the market, if you follow the contrarian models.

None of this is to say that it’s easy sailing ahead. In my opinion, there are real world worries to consider:

- Stagnant European Union growth

- Flattening in US Corporate earnings growth

- A soft landing in China

- Federal Reserve monetary withdrawals

- Rising US interest rates

- US Government spending cuts

Perhaps that's why the individual investor is so cautious, and perhaps that's why valuations are in the fair range and not extremely overpriced. Perhaps that's also why the market might move higher because the individual investor has not been in full chase mode.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company