Courage, Confidence, and the Housing Market

In The Wizard of Oz, the Cowardly Lion needed courage to overcome his fears and build some confidence. Based on recent data, the players in the housing market may be in need of some courage, as there appears to be plenty of signs of doubt with respect to the economic recovery, leading Goldman Sachs to cut its forecasts for U.S. housing and GDP growth.[i]

In her recent prepared remarks to Congress, Fed Chair Janet Yellen noted that the recent recovery in housing had flattened out and requires “close observation.”[ii] She also alluded to concerns about the effectiveness of the Fed’s low interest rate policy to stimulate the economy. The Fed doesn’t hold all of the cards when it comes to the recovery. Let’s look at some other players in this market.

Previous blogs have highlighted the high underemployment rate and low wage growth. These trends have impacted household formation, which has leveled off the past two years.[iii]

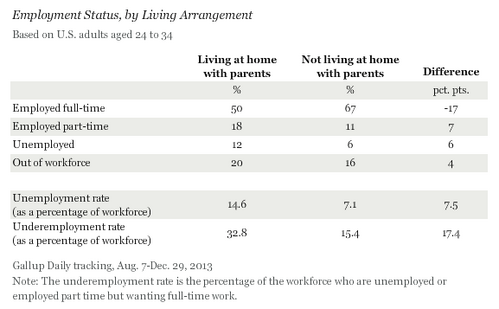

Among employed 25-to-34 year olds, 25% reported living with their parents even though they had full-time jobs in 2013 versus 22% in 2007.[iv] A similar Gallup survey (24-to-34 year olds) illustrated the relationship between living arrangement and employment status. Those living with parents had a higher underemployment rate, with 50% not fully employed.[v] Concerningly, 50% had full-time jobs, so wages are a factor as well.

Until the economy reaches fuller employment and younger Americans feel more confident about job security and wages, purchasing a home may be challenging.

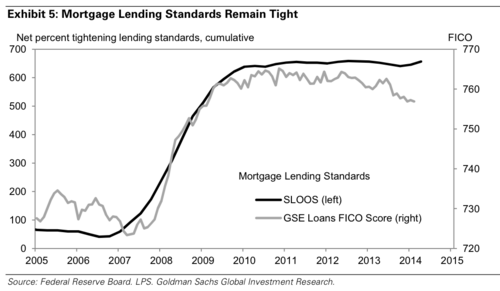

Adding to the difficulty, mortgage credit availability remains tight relative to pre-2008 levels.[vi]

New homebuyers may not qualify for loans and will need to save up for a down payment. While tighter standards help avoid practices that led to the financial crisis, overly strict standards can limit demand, which brings us to the homebuilders.

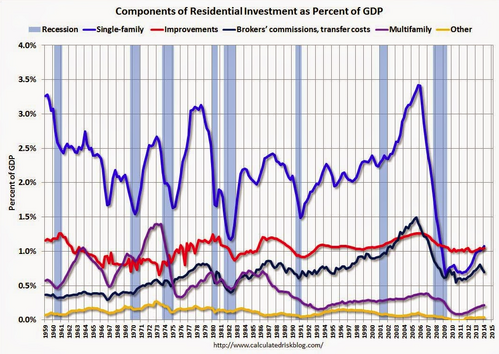

In May, homebuilder confidence fell to its lowest level in a year, and investment in single-family residential property relative to GDP remains at historically low levels (blue line in the graph).[vii,viii]

Historically, single-family home investment contributed around 2.25% of GDP, but since 2009, the contribution has been closer to 1%.

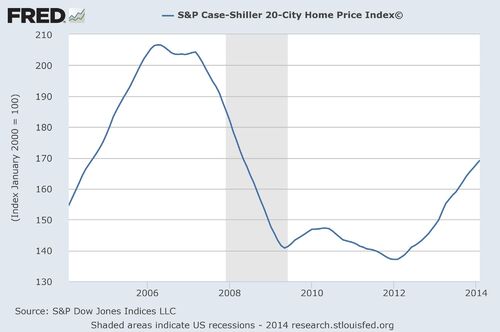

With less single-family home construction, supply is down and home prices have increased 22.5% since January 2012, making homes less affordable.[ix]

The economic impacts are considerable:

- If building activity returned to its postwar average proportion of GDP, growth would jump to 4% from its current 2%+ level; each percentage point of GDP equals around $170 billion.[x]

- This would add 1.5 million jobs and reduce the unemployment rate by one percentage point.[xi]

- The health of the housing market has been linked to consumer spending. As housing prices increase, homeowners feel more wealthy and increase spending. Consumption accounts for over 70% of GDP.[xii]

We seem to be caught in a cycle, where the lack of confidence leads to behaviors that will not help the housing market to grow at a higher rate. In October 2011, former Treasury Secretary Lawrence Summers wrote:[xiii]

“The central irony of [the] financial crisis is that while it is caused by too much confidence, too much borrowing and lending, and too much spending, it can only be resolved with more confidence, more borrowing and lending, and more spending.”

All eyes will be on the Q2 home building figures. A second quarter of contraction suggests a housing recession, while growth could indicate increasing strength in the economy. If there is a decline or low growth, the housing market will be looking for one or more of its participants to find the courage to take actions that break the cycle, increase confidence, and bring about stronger growth.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Jeff Paul, Senior Investment Analyst – Phillips & Company

Tim Phillips, CEO – Phillips & Company (Editor)

References

[i] Ro, S. (May 18, 2014). Goldman Just Hacked Its Forecasts for US Housing and GDP Growth. Business Insider.

[ii] Sanati, C. (May 8, 2014). Janet Yellen reveals concerns for U.S. recovery. CNN Money.

[iii] Number of Households: US (estimate, in thousands). Economagic.com

[iv] Irwin, N. (Apr 24, 2014). Why the Housing Market Is Still Stalling the Economy. The New York Times.

[v] Jones, J. (Feb 13, 2014). In U.S., 14% of Those Aged 24 to 34 Are Living With Parents. Gallup.

[vi] Ro, S. (May 18, 2014). Goldman Just Hacked Its Forecasts for US Housing and GDP Growth. Business Insider.

[vii] Hoover, K. (May 15, 2014). Home builder confidence hits lowest level in a year. Washington Bureau.

[viii] McBride, B. (May 5, 2014). Q1 2014 GDP Details on Residential and Commercial Real Estate. CalculatedRISK.

[ix] Federal Reserve Economic Data.

[x] Ro, S. (May 18, 2014). Goldman Just Hacked Its Forecasts for US Housing and GDP Growth. Business Insider.

[xi] Ibid.

[xii] Federal Reserve Bank of San Francisco. (Jan 2007).

[xiii] Summers, L. (Oct 23, 2011). Why the housing burden stalls America’s economic recovery. Financial Times.