Diversification Finally!

Diversification Finally!

Weekly CEO Commentary 1-14-13

Tim Phillips, CEO—Phillips & Company

For the last couple of years, investors that followed the easiest thing in finance, diversification, were not properly rewarded. In fact, a heavy emphasis on US Large Cap stocks was a fairly rewarding experience. From January 2009 to December 2011, the S&P 500 had an annualized return of 14.12 percent, according to Bloomberg.

For many wealth management firms and "Too Big To Fail" banks, this was a particularly rewarding experience. Most of these institutions have a bias toward US Large Cap because it's easy to research and clients generally don't question what they know: large, familiar US companies. Behavioral scientists call this a “home bias”.

Unfortunately, my concern is investors have become complacent with the previous wonderful US Large Cap returns.

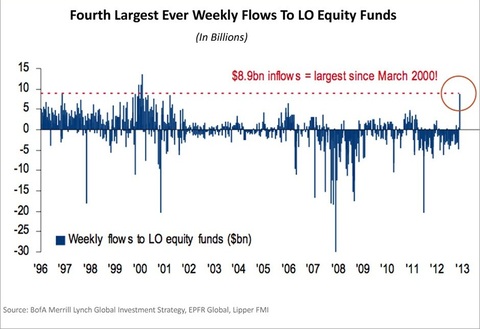

This past week might have marked a return to rewarding diversification, where we saw the largest flow of funds into long-only equity funds since March 2000, according to Business Insider. Bloomberg also reported that last week was the 18th-consecutive week that emerging market stock funds showed inflows, showing that investors have been moving into asset classes aside from just US Large Cap.

Why diversification works

What makes diversification work is something called correlation: the way in which asset classes move in the same direction and to what degree. The highest possible correlation is 1, meaning the asset classes are moving in the exact same manner. As investors, we want to see low correlations, meaning our portfolio isn’t as affected by a swing in one of our holdings.

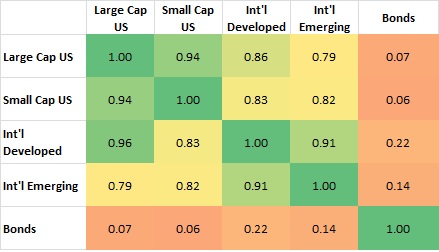

In 2008, we saw correlations come together. It's what you would expect when markets are under so much distress; investors sell everything and move to cash, so correlations tend to get closer to 1. Below is a table of correlations in 2008 from Bloomberg:

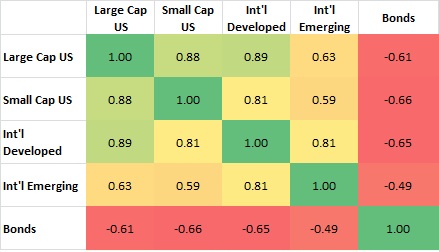

Now, here is another correlation table from Bloomberg for the second half of 2012. When you compare the two, you can see asset classes are starting to decouple—hopefully rewarding diversification.

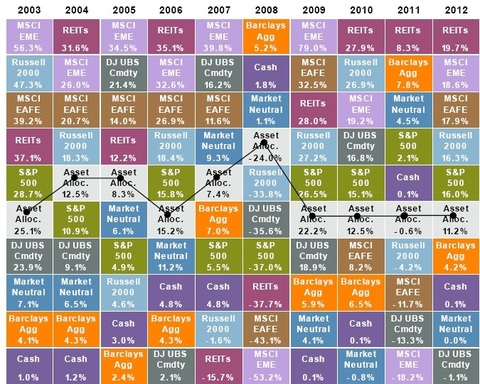

It's important to remember that in any given year, there will always be at least one asset class that outperforms a diverse portfolio. For example, if you rolled the dice and invested heavily into real estate investment trusts in 2006, your portfolio would have easily beaten a diverse portfolio. REITs returned 35.1%, whereas a sample diverse portfolio only returned 15.2%, according to JP Morgan. Unfortunately, in the following year, REITs were the worst performing asset class with a drop of -15.7%, whereas diversifying across asset classes gave positive returns. Below is a table from JP Morgan illustrating this:

The "Free Lunch" of diversification comes in the form of reduced risk and smoother returns in the long run. Investors may have piled into US Large Cap equities because they are familiar—and because they have indeed performed well in the last few years—but our expectation is diversification will be rewarded over concentration going forward.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Alex Cook, Associate – Phillips & Company