Flash Update – Emerging Markets

It’s critical during significant times of crisis and market dislocation that we communicate early and often. Our weekly blogs are made for just that purpose. Last week’s blog addresses some of our macro views.

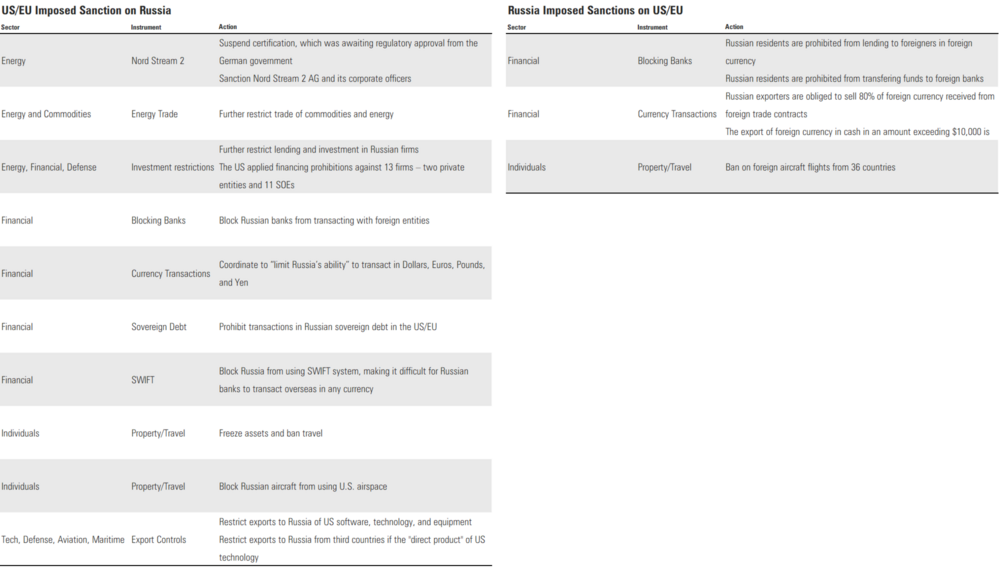

However, with further sanctions impacting Russia we want to make sure you know the latest facts and the implications on portfolios.

Russia recently closed their markets and barred foreign investors from selling holdings. This is in response to the sanctions placed on their country. 1

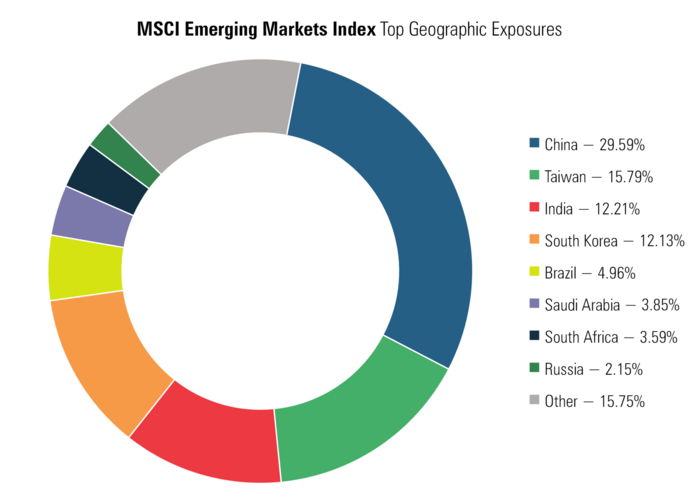

Most of the portfolios we manage have various exposures to emerging markets. On an index basis, the MSCI Emerging Markets Index has ~2.15% exposure to Russia. 2

For our clients, we do not use an emerging markets index in most cases. It’s been our long-held belief that an active portfolio manager can add significant value over a generic, passive index.

Our manager is GQG Partners. They have an outstanding track recorded and impeccable risk management skills. To that end, here are their comments as it relates to Russia:

Highlights on Russia

- We actively reduced exposure to Russia since early January, taking the country allocation within EM from 13.33% at year-end 2021 to 1.17% as of Feb 28, 2022

- Existing securities are in the energy and materials sectors, with no exposure to any financials

- Russian markets remain closed (by Russian Central Bank decree); therefore, our fair value committee has implemented pricing for affected securities

- GQG’s Global strategy Russian exposure went from 3.07% to 0.15%, and the International strategy went from 4.69% to 0.54% from the beginning of 2022 until Feb 28, 2022.

The bottom line is our active manager has minimized our Russia exposure. This is exactly why we use an active manager in this particular asset class.

Needless to say, all emerging markets indexes will confront the valuations issues associated with the various sanctions and countermeasures.

We continue to work with our emerging markets manager to consistently and continually evaluate the risks and opportunities in emerging markets. Please connect with your advisor if you have questions or concerns.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: