Getting the Message

If you are a short-term trader captivated by the ups and downs of markets and the twists and turns with the Federal Reserve, this is a great blog for you. Read on.

If you’re a very long-term investor this great article on one of my favorite restaurants, The Old Bull, might be more enjoyable.

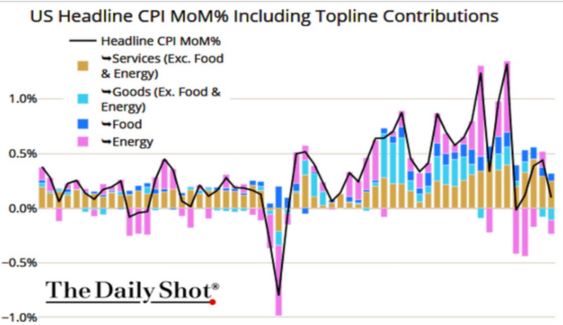

Last week’s report on inflation suggested the Fed’s demand destruction cycle was making some progress. Headline CPI, on a month-over-month basis, was up 0.10%, which translates into a year-over-year inflation reading of 7.12%. 1

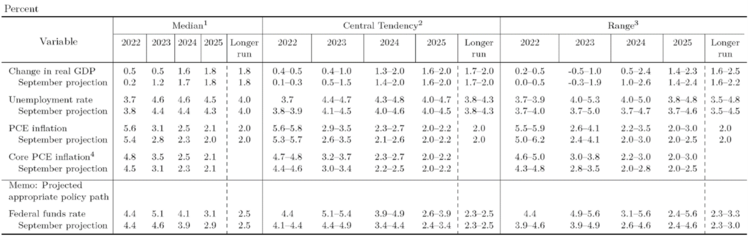

One day later, the Fed came out with their expected rate increase of 50 basis points and economic forecasts. 2

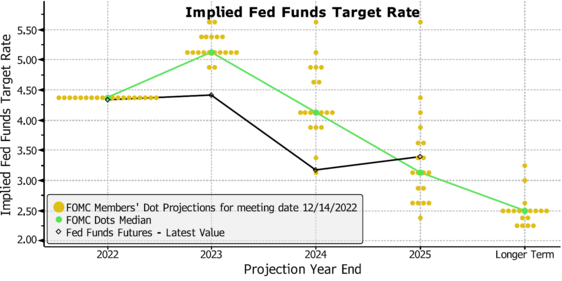

They also published their forward look at interest rates. 3

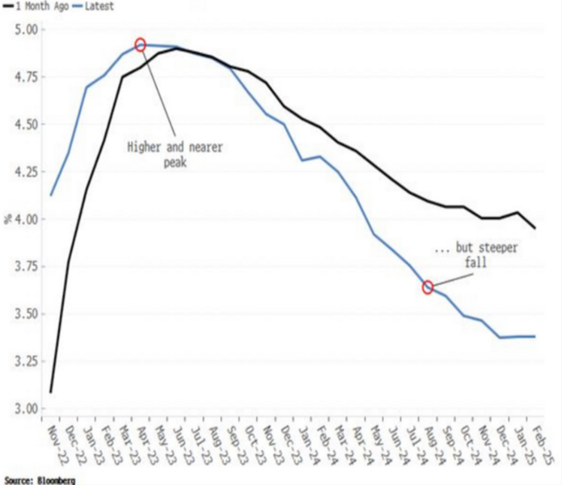

As we anticipated in last week’s blog, The Teeter-Totter, the Fed is expecting to raise rates a little higher than investors expected and hold those rates a little longer. The Fed Funds rate is anticipated to peak at above 5% with no rate cuts until 2024.

The equity rally in October and November prematurely anticipated a lower and shorter rate increase cycle. 4

That was clearly put to rest based upon the Fed’s comments.

Chairman Powell in his accompany statement made it abundantly clear that they were not done with their rate hiking cycle and will need to see much more economic moderation. 5

“Inflation remains well above our longer-run goal of 2 percent. Over the 12 months ending in October, total PCE prices rose 6 percent; excluding the volatile food and energy categories, core PCE prices rose 5 percent. In November, the 12-month change in the CPI was 7.1 percent, and the change in the core CPI was 6 percent. The inflation data received so far for October and November show a welcome reduction in the monthly pace … but it will take substantially more evidence to give confidence that inflation is on a sustained downward path.”

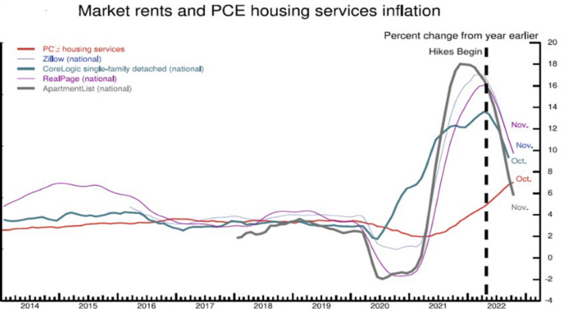

Some of that evidence is coming in the form of rents. They are expected to moderate. 6

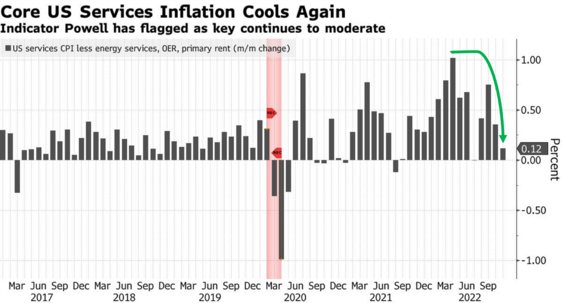

When it comes to one of the Fed’s most important inflation indicators, core services other than housing, we are seeing some great progress. 7

Here is what Chairman Powell said about this indicator during a recent speech: 8

“This spending category covers a wide range of services from health care and education to haircuts and hospitality. This is the largest of our three categories, constituting more than half of the core PCE index. Thus, this may be the most important category for understanding the future evolution of core inflation.”

If we get more moderation in core services (ex-housing) inflation without damage to employment, a soft landing is well within the realm of possibility.

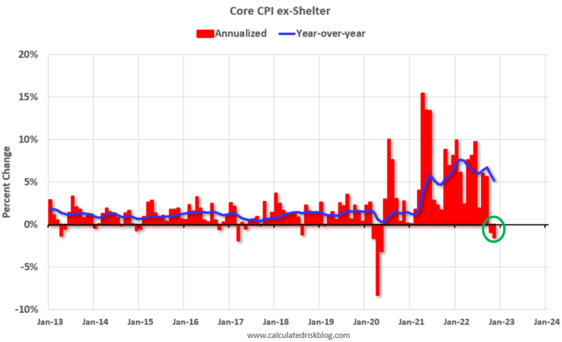

If you put goods and services together (ex-housing), we are seeing some deflation. 9

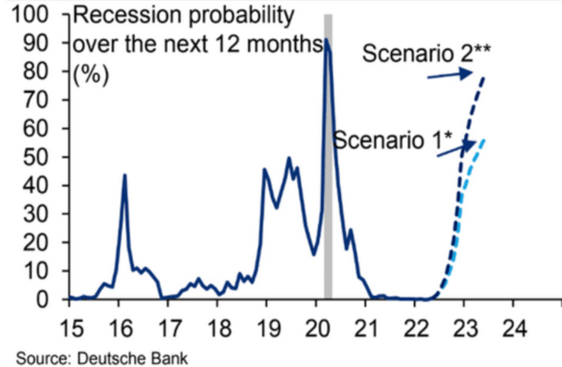

Few are expecting a soft landing as expectations for a U.S. recession are between 60%-80% according to Deutsche Bank. 1

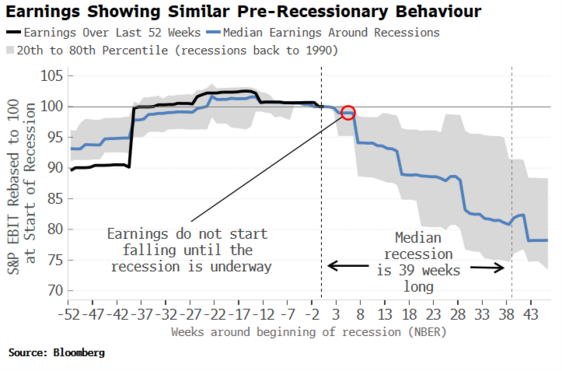

If recession is in the wind, then we would see an accompanying preemptive earnings recession and that’s what market participants are likely reacting to now. 10

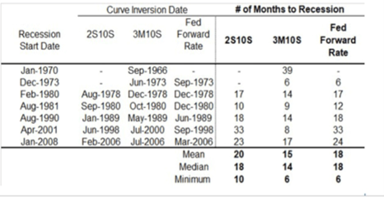

However, if core services inflation (ex-housing) moderates with a Fed Funds rate at just above 5%, the Fed might have time to manage a soft landing before the onset of a recession. Remember, it takes quite some time before a recession rears its ugly head. 1

Fourteen to eighteen months is the median timeframe. I suspect this particular group of Fed Governors can react quickly to any damage rippling into the jobs market. I’m still in the camp of a soft landing, with an activist Fed on both the upside of growth and inflation as well as the downside of job losses.

Let’s see if we get the Fed’s message in the coming months.

Our message to you and your family is for a holiday filled with family, friends, and good health.

We wish you a wonderful holiday season and a very Merry Christmas.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://dailyshotbrief.com/

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20221214.pdf

- https://www.bloomberg.com/news/articles/2022-12-14/fed-downshifts-to-half-point-hike-sees-5-1-rate-next-year

- Bloomberg

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20221214.pdf

- https://www.cato.org/blog/why-fed-further-inverting-yield-curve-4

- https://www.bloomberg.com/news/articles/2022-12-13/powell-s-most-important-us-inflation-indicator-cools-again

- https://www.federalreserve.gov/newsevents/speech/powell20221130a.htm

- https://www.calculatedriskblog.com/2022/12/housing-inflation-and-why-fed-should.html

- https://www.bloomberg.com/news/articles/2022-10-07/recession-beat-grows-louder-with-slower-earnings-weaker-economy