Is This the Perfect Landing?

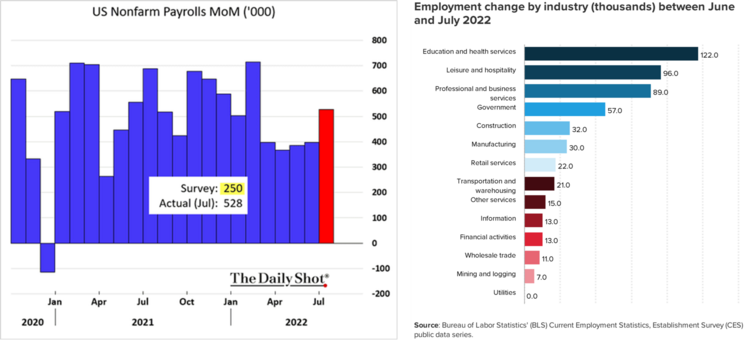

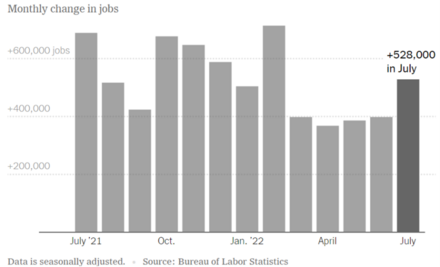

The latest jobs report for July crushed all estimates. The U.S. economy added 545,000 total jobs last month, with almost every category adding jobs. 12

The number of jobs added per month over the last year has been a remarkable 526,000 on average. 3

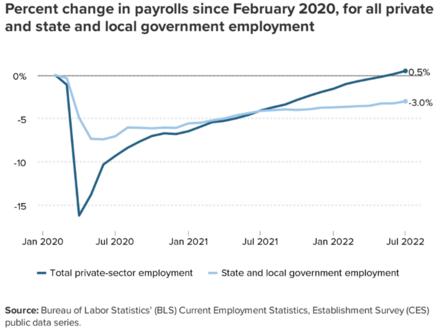

This latest report confirms the full recovery in private sector jobs post-pandemic. 2

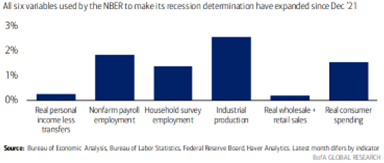

As we noted in our blog last week, it’s hard to declare a recession with such strong employment. In fact, when using the NBER definition, we can’t come close to declaring the U.S. economy in a recession. All six variables they use to measure a recession are still in the expansion phase. 4

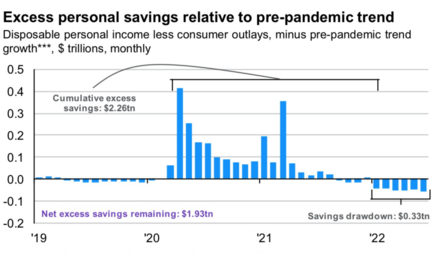

While the consumer is spending down their savings from the pandemic, they are still sitting on $1.93 trillion in excess savings according to J.P. Morgan. That’s equivalent to 7.8% of annual GDP. A recession, if any, might be well off on the horizon. 5

The debate that will consume Wall Street this week is whether this incredible jobs report will force the Fed to raise rates even more than anticipated.

I don’t think so and here’s why.

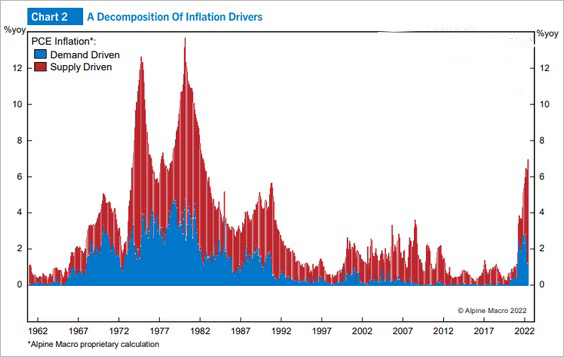

First, we know from a recent Federal Reserve study that 66% of inflation is supply driven and cannot be tamed by rate hikes. 6

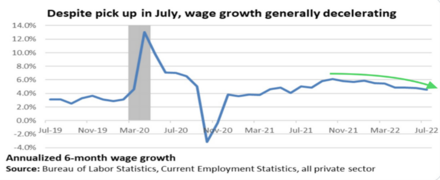

Second, while jobs are being added at a rapid pace, wage growth is moderating and that should help. 4

Third, job openings are declining at one of the fastest paces on record. Losing job openings is optimal versus losing actual jobs in the economy. 7

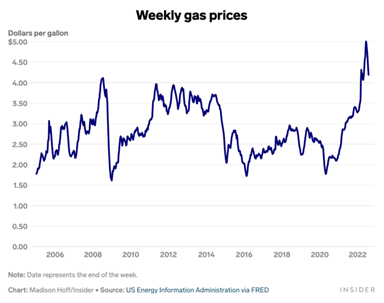

Further, gas prices have been deflating rapidly and that should also help cool headline inflation. 8

Considering the Federal Reserve’s dual mandate for price stability (2% PCE inflation) and full employment (what we have now), they are very close to their mandate.

To complete the mandate, we just need to see prices moderate and not see jobs crushed. The Fed can pull off the perfect landing if they can protect jobs and allow supply side inflation to cool with just slightly higher rates.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://thedailyshot.com/

- https://www.epi.org/blog/jobs-report-doesnt-show-signs-of-recession-yet-as-labor-market-remains-strong-the-fed-should-still-be-wary-of-raising-interest-rates-much-further/

- https://www.nytimes.com/live/2022/08/05/business/jobs-report-july-economy

- https://markets.ml.com/

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

- https://alpinemacro.com/

- https://research.gs.com/

- https://markets.businessinsider.com/news/commodities/gas-prices-2021-demand-fuel-energy-pandemic-driving-destruction-inflation-2022-8