It's Never Quite What You Expect

It's Never Quite What You Expect

Weekly CEO Commentary 12-10-12

Tim Phillips, CEO—Phillips & Company

If you followed your instincts and sold out of your equity positions 3 weeks ago, you would have missed a 2.25% return. Certainly you would have been reacting to your instincts that tell you the political class in this country will not resolve our fiscal issues without a messy fight.

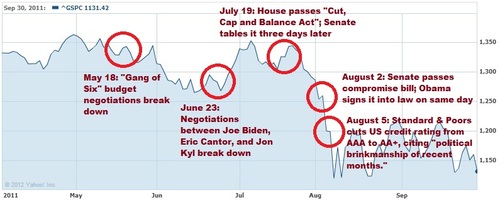

Your instincts would have also told you the last time we saw such a fight—the summer of 2011 with the debt ceiling—our markets dropped precipitously. We saw a drop of 16.5% from May 18, when negotiations started to break down, to August 8, the Monday after the US credit rating got downgraded.

Your next thought might be to simply sell out and avoid a possible drop. The problem is that now you’re in the slippery slope of market timing, and we all know where that leads.

The political class has been playing chicken with a very fragile economy, destroying the confidence of business and consumers, and the media has been painting a doom and gloom scenario. But, the reaction of market participants has been quite the opposite from what you would expect. They have been buying.

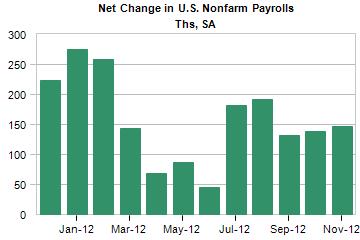

Could it be the underlying economic data suggests something else is occurring? When you look at the recent jobs report, you see a fairly stable picture of employment. While the participation rate in the labor force is indeed down, companies are still hiring—albeit at a very slow and steady rate. According to Dismal Scientist, US companies added 147,000 jobs in November, just enough to keep up with new entrants to the workforce.

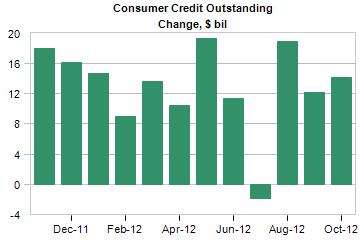

Consumers are certainly willing to take on more credit to express their desire to spend. Our recent report on Consumer Credit contained some interesting data.

According to Dismal Scientist, Consumers borrowed 14.2 billion dollars in October with 3.4 coming from revolving credit (basically things you buy on your credit cards). Overall this reflects a 6.2% increase on a YOY basis. What is really impressive is the consumer is willing to make non-revolving purchases on things like homes and autos. On a non-revolving basis, consumer credit expanded 7.1% on a YOY basis.

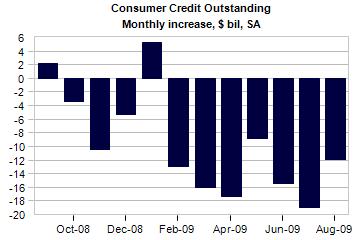

While this data reflects on behavior from two months ago, and I certainly expect a slowdown to some degree, it's not likely the consumer will shut down like we saw in the last recession. Between a decent jobs report and consumers feeling confident enough to borrow, the de-leveraging trend we have seen in household balance sheets might be easing and allow for some economic tailwinds.

Perhaps that is what market participants are seeing as they bid up stocks despite the incredible uncertainty surrounding the circus in Washington DC.

My recipe for working through the next several weeks is quite simple: look past volatility, be ready to deploy any dry powder during a significant pull back in valuations, and don’t anchor your investment timeframe on political noise.

Of course, you could continue to buy in defensive sectors like consumer staples or healthcare, as well as income paying assets. However, nothing is really safe from the circus in the short run. It only takes one clown nowadays to make a circus and we have a wide variety of actors to choose from.

Panic and emotional reactions are not an investment strategy, and besides, we have all been fooled plenty of times as the markets never react quite the way we expect them to.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Alex Cook, Associate – Phillips & Company