Looking Ahead – Medicine vs. Memory

We just published our Q2 Look Ahead—a 17-minute look forward with a lot of charts. Perhaps too many charts. I suspect you might have some time on your hands and, therefore, additional content was provided. You can watch a video of it by clicking here or just view the presentation by clicking here.

If you’re pressed for time, the entire dataset can be summarized in just a few words: Medicine vs. Memory.

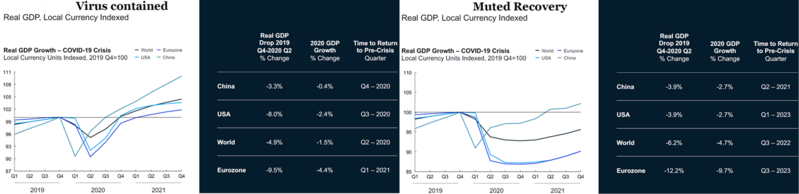

How fast will the economy recover? McKinsey & Company did a nice job trying to frame that answer. You can see more detail by clicking here but, this chart has some data to reflect on. One is a “V” shaped economic recovery and the other is “U” shaped, or maybe Nike “Swoosh” shaped. [i]

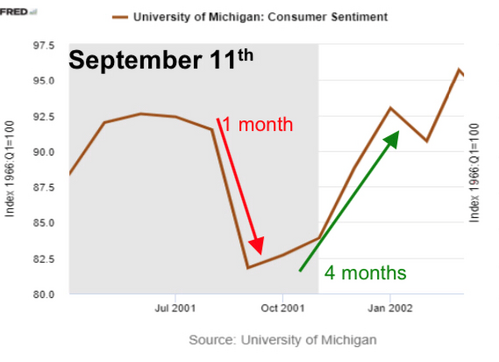

Who can really answer that question? We are in an economic, medically induced coma that poses some challenging questions for investors. The most challenging is how soon will consumers return to normal? We reviewed several periods of time and if you dig into our Look Ahead you can see those as well but, here is just one snapshot example. [ii]

In the case of a traumatic event like 9/11, consumer sentiment crashed only to recover 4 months later.

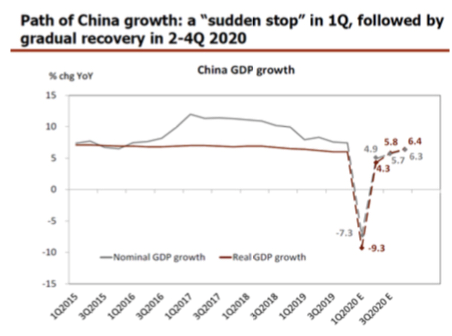

As many of our readers and clients know, we have extensive emerging market research capabilities at our disposal through our China-based research partner CICC. They suggest a V-shaped recovery in China, with a return to growth after a full quarter of contraction. Realize they are T+60 days ahead of us in the virus cycle. Perhaps this is a forward model for America. You can see our full China Look Ahead by clicking here. It has data on China and how it relates to our potential recovery.

Both of our Look Ahead presentations and charts are trying to frame a question and answer. When is the recovery in sight? The simple fact is the answer lies in the thin space between a biological virus versus the collective memory of the American consumer.

The next two weeks will do a lot to shape the American consumer’s psyche as it relates to the tragedy that is about to accelerate in our communities. Beyond that, the protocols to open the economy will depend on extensive universal testing, treatment protocols, and a vaccine. All of this will help assuage our memory and help us return to normal if it occurs sooner rather than later. It’s a race between medicine and memory. We need medicine to work fast so our memories can recover quickly.

Take a look at our Q2 2020 Look Ahead here.

You can also see our Q2 China Look Ahead here.

We stand ready to assist the thousands of clients we interface with—whether a 401(k) plan participant, an executive of a corporation, an institutional investor, or a retiree. I know we have and will continue to reach out to you but, feel free to reach out to us if you need anything. You are in our thoughts and prayers as we work together to get to the other side.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business

ii. https://phillipsandco.com/files/2415/8584/3131/Look_Ahead_-_2020Q2_-_Final.pdf

iii. https://phillipsandco.com/files/5015/8592/7253/China_Quarterly_Report__Look_Ahead_-_Q2_2020_-_20200401.pdf