Looking Around the Corner

Once again we need to fix our eyes around the corner from the recent banking turmoil. Last week we reviewed the fractional banking system. That was just the start to a deeper review.

The real question I have been asking myself is what the second order effects of the recent banking turmoil are. Outcomes and portfolio positioning will hinge on how we view the current breakdown in the banking system. Is it a systematic problem or just an isolated set of events?

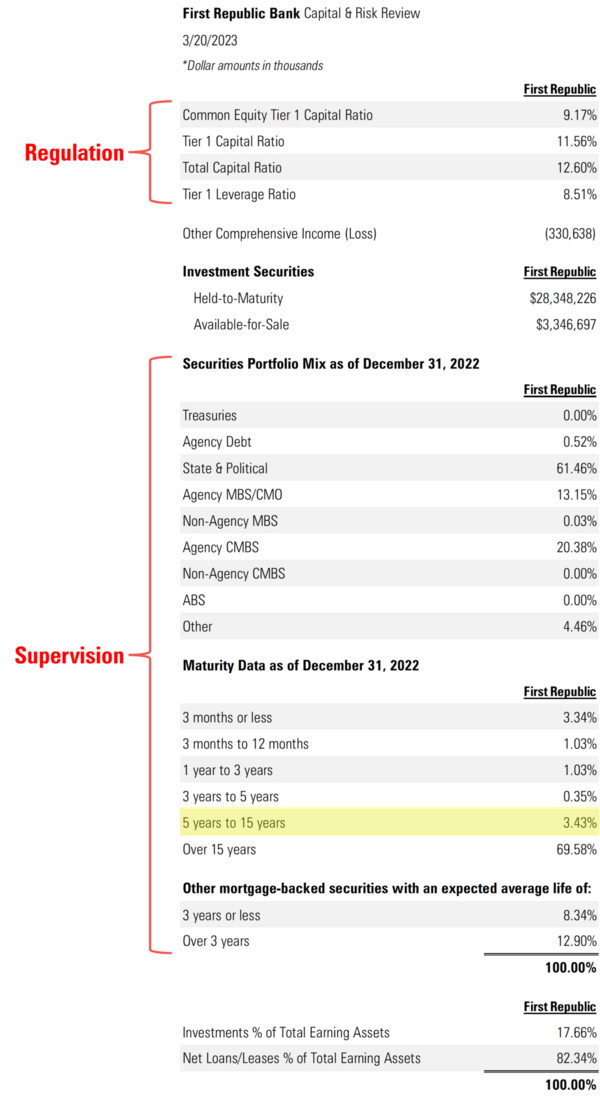

Let’s skip Silicon Valley Bank. They’re gone. Let’s pivot to First Republic Bank (FRC) to do a deep dive. We, at Phillips, developed a forensic tool based upon a bank’s federal filings (FFIEC Form 031) to peak into their portfolio. Here is FRC’s breakdown. 1

Their capital ratios for bank safety are above the regulatory standards. Nothing to see here folks, as far as the regulators are concerned. As you move your eye down into the depth of the forensic data you can see the makeup of their securities portfolio and the systemic failure to supervise.

- 61% of their portfolio is in municipal bonds, and those are not eligible for the new Fed BFTP program.

- 0% of their portfolio is in treasuries and that’s ok.

- However, 69% of their conservative investments are over 15 years in maturity. Wow! That’s far from conservative in a rising rate environment. Recall our explanation on duration last week (link).

Let’s keep going and I will get to the punch line soon enough.

Depending on when FRC bought their bond holdings, they would face substantial losses. If they bought treasury bonds in 2020, they would be facing serious losses. Perhaps as much as 15% to 44%. Being down that much even if it’s only 17.66% of their portfolio is still a path to disaster. 2

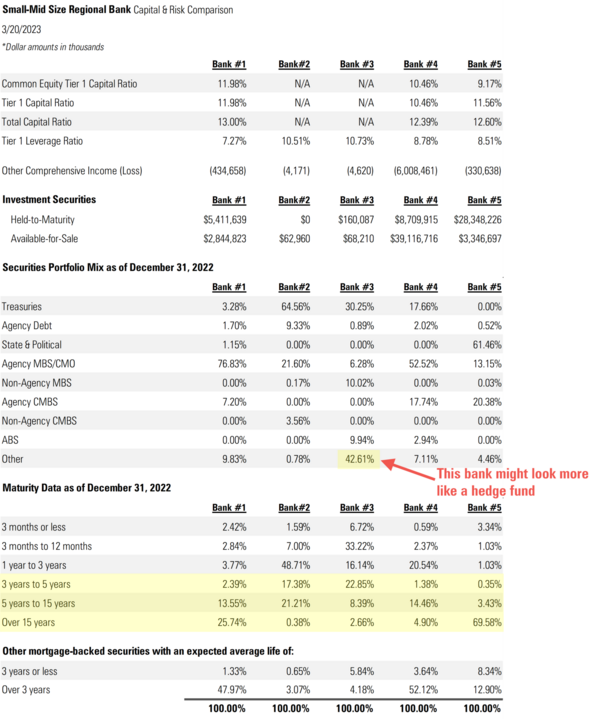

Again, no regulatory breach of capital requirements, but a failure in supervision. Now let’s look at some smaller banks under $250 billion in assets.

As you can see, maturities are on the mid-to-long end, and therefore most banks likely have larger losses embedded in their portfolios.

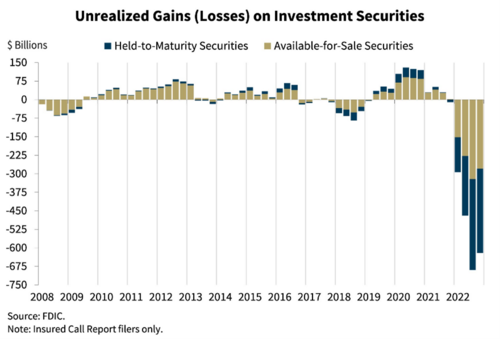

The best I can tell is that the banking system has between $600 billion and $1.8 trillion in mark-to-market losses embedded in their investment books. 3

I am not taking into consideration banks that hedged against interest rate risk with long duration. However those hedges would be very expensive. The counterparty will likely be in serious financial trouble (perhaps that’s another shoe to drop – think AIG during the Great Financial Crisis). Therefore, I am skeptical that many banks have hedges in place to dampen the drawdown.

Unfortunately, for banks, there is likely going to be an ongoing run on their investment stupidity. Depositors may have been asleep for a while, but no longer. It’s not rocket science that a depositor can own a treasury bond with 3.5%-4% yield versus a savings account that has a 1.5% yield. 4 5

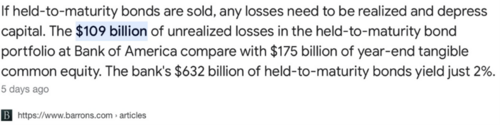

First Republic is going to be hard pressed to hold onto depositors unless they boost their rate. This is a system-wide problem. Here is a clip from Barron’s on Bank of America. 6

It’s hard for a bank to boost their rates when they are sitting on embedded losses for mismanagement of their portfolio. In BofA’s case their bonds yield just 2%. Pretty hard to pay 3.5% on a savings account when you are only making 2% on your investment. Lower Earnings = Lower Rates!

The flight of capital may not be purely about confidence and more about better returns for savers.

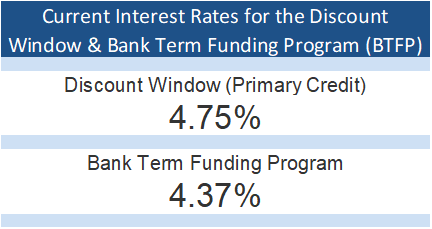

What can banks do? They can pledge their portfolios to the Fed at the Discount Window or use the new BTFP program, but those rates aren’t cheap; currently 4.37%-4.75%. 7

These programs still don’t bail out the bad portfolio management by the banks in the years to come. It just gives them expensive liquidity to stave off any runs by their depositors. Consider this a temporary relief from the current crisis, and I think it should work.

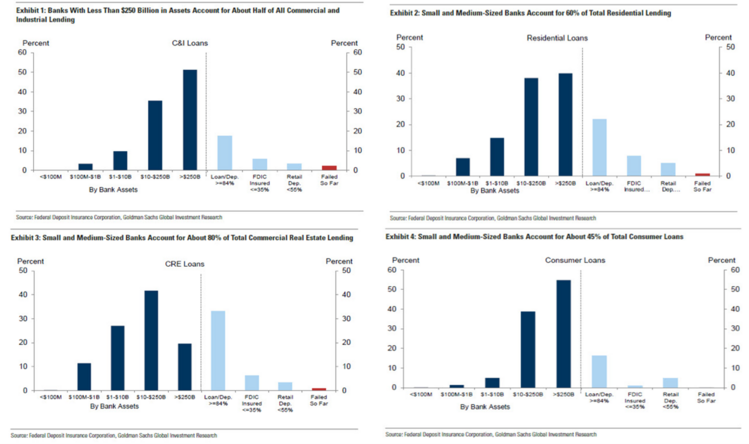

It would appear to me banks, system-wide, might have to clamp down on lending to work through their investment books. Banks were already growing more cautious before their investment debacle according to a recent survey by bank loan officers. 8

Realize, the majority of lending is conducted by mid- and small-size banks across sectors. Commercial/Industrial, residential, commercial real estate, and consumer loans (autos, credit cards) are driven by mostly small- and medium-size banks. Recall the forensics we showed on some small and medium banks at the start of this blog. 9

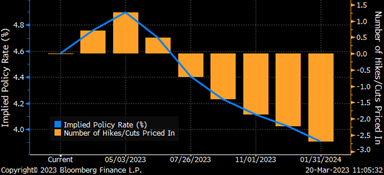

The only thing the Fed can really do to fix the embedded losses in the banking system is cut rates and allow the bonds to recover some value. Is it possible the mismanagement of bank portfolios will create another “lower for longer” scenario for the Fed?

In fact, expectations for interest rates went from no cuts in 2023 to 3 or more cuts this year. 2

Lower rates will work for the economy if bank terms allow for easier lending. Let’s see how the Fed works with banks to make sure they keep credit flowing in the economy so as to not have a hard economic landing.

Slower macroeconomic growth might be ahead, but that could turn out to be good for equity investors.

Looking around the corner might look bad at face value, but investing is counter-intuitive in so many ways. 10

What’s likely to come?

- The Fed will need to stave off any further runs with depositors by lowering rates to balance equilibrium between a bank’s cost of capital and demand deposit rates.

- The Fed will need to recap small and mid-size banks to allow them to loosen lending terms. Perhaps a special swap at very low rates, not the 4.75% discount window rate.

- The Fed will lower the Interest on Excess Reserve Rate (IOER) to below the Fed Funds Rate to force banks to push out their excess reserves to the real economy and not on to the Fed’s books.

I expect the Fed to either raise rates by 25 basis points or pause due to ongoing banking strain. There will be a downgrade of the banking sector and that will be reflected in forward earnings guidance. We remain constructive on equity markets, as a pause in the rate increase cycle will allow for a positive backdrop.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://phillipsandco.com/download_file/4658/

- Bloomberg

- https://www.fdic.gov/analysis/

- https://blogs.tslombard.com/

- https://www.firstrepublic.com/current-deposit-rates

- https://www.barrons.com/articles/bank-of-america-stock-price-bond-losses-5a203a66

- https://www.frbdiscountwindow.org/

- https://dailyshotbrief.com/

- https://research.gs.com/

- https://www.osam.com/pdfs/research/_38_Commentary_Sep17-10.pdf