Precisely Inaccurate

Precisely Inaccurate

Weekly CEO Commentary 1-7-13

Tim Phillips, CEO—Phillips & Company

This is the time of year when firms roll out their predictions for 2013. Honestly, if they were so accurate they wouldn't need clients, nor would they share their information. It would be too valuable.

However, firms understand one thing about investors; they love predictions. I call it the "Prediction Addiction". There is plenty of behavioral science research that supports this phenomenon, and mostly it comes down to our preference for certainty—even when it means inaccuracy.

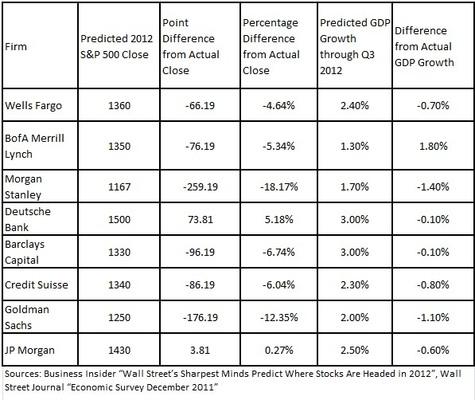

Just take a look at the last year's market forecasts of top firms. Remember that the S&P 500 closed at 1426.19 at the end of December 31, 2012, and GDP growth through Q3 2012 (the most recent set of data available) was 3.1%. How accurate were these forecasters?

Perhaps the collective wisdom of all the firms, by looking at the average predictions among them, is the best relevant tool. Regrettably though, when you look at last year’s average prediction among those eight firms, it was also inaccurate. The average among those firms was 1341—off by 85 points, or 6 percent. That may not seem like much, but keep in mind that the S&P 500 was up by 13.42 percent last year, according to Bloomberg. A miss of 6 percent is a miss of almost half of the S&P 500’s returns.

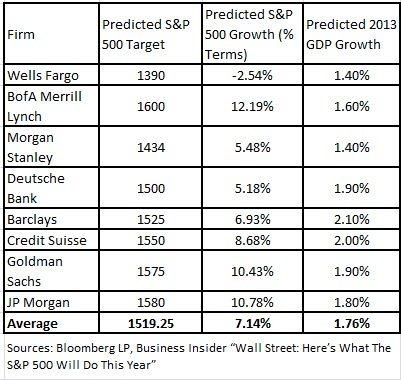

In light of this repetitively inaccurate exercise in forecasting, we thought we would simply publish others attempts at guessing where the market would end and how much GDP would grow this year.

The bottom line is very few of us will profit from these parlor tricks. Making a very precise prediction may sound good; however, the more precise a prediction is, the less likely it is to be accurate.

Our predictions:

- Diversification will be rewarded this year as correlations among equity asset classes decouple.

- Emerging Markets finally have a recovery and outpace US equities, especially China and Russia.

- International Developed and Emerging Small Cap stocks will have the biggest risk to reward opportunities, especially Japan.

- Emerging Market Debt and International Developed Debt will offer better upside than US High Yield.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Alex Cook, Associate – Phillips & Company