The Waiting Is Over

The Waiting Is Over

Weekly CEO Commentary 4-8-13

Tim Phillips, CEO—Phillips & Company

It's finally upon us: earnings season. To me this season is one of the most anticipated in many years. Between the tax increases taking effect on January 1, and the sequestration cuts in government spending, the consequences are highly anticipated.

- Is this recovery stalling?

- Does the consumer have the financial strength to power through in light of tax increases?

- What is the impact on spending cuts from the US Government?

- Ultimately, will companies hire more people?

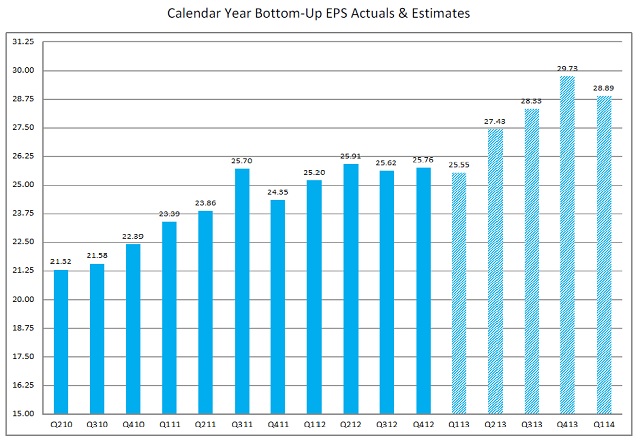

We have for the first time in over a year ended an earnings period that is expected to be quite pessimistic. Between Q3 2011 and Q4 2011, the last period where we saw a significant earnings drop, the S&P 500 dropped -3.67 percent (source: Bloomberg). FactSet shows that analysts expect earnings to shrink slightly this quarter from Q4 2012.

Source: FactSet Earnings Insight

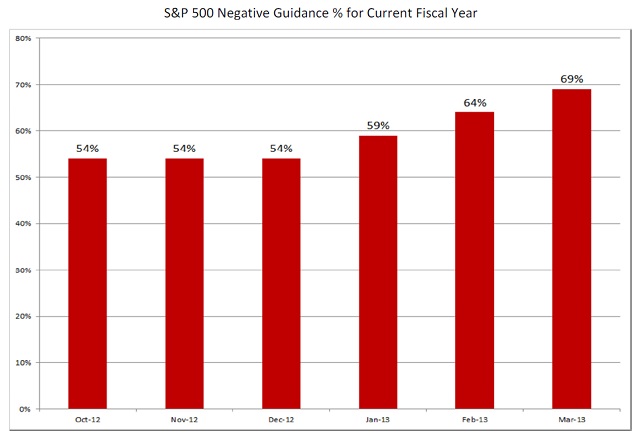

Guidance from companies, a much more reliable source, is also showing signs of extreme caution. You can see from the chart below that negative guidance has been rising from December through now.

Source: FactSet Guidance

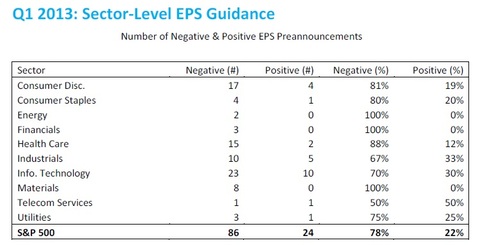

Guidance is particularly pessimistic in the consumer discretionary and health care sectors, as you can see below. Some sectors like energy and financials do not have enough companies issuing guidance yet to get a read on the sector.

Source: FactSet Guidance

The mood amongst professional investors is growing worrisome:

“On a scale of 1-10 measuring asset price ‘irrationality’, we are probably at a 6 and moving in an upward direction.” –Bill Gross, co-CIO of PIMCO from the PIMCO March 2013 Investment Outlook

“In the short-term, if the data are weakening - and I think investor expectations haven't really adjusted to that - there's a chance for the market to consolidate in the short-term.” –Thomas Lee, chief US equity strategist at JP Morgan

A drop in the markets is part of the consensus view in the short term. As we wrote last week, investor sentiment has remained cautious.

At the same time, we are seeing investors grow quite worried about their bond holdings. The talking heads on TV are pitching the "bond bubble" notion (there is some truth to this). Yet, bonds are the general safe haven for a falling equity market.

What do we do?

My strategy is to keep our foot on the brakes and the gas at the same time: focusing on quality fundamentals in equity asset classes and shrinking the duration risk in bonds (click for a definition on duration). While we will certainly miss some of the party on equities, we should reduce our risk on the downside. I emphasize reduce risk—not eliminate it.

I might regret saying this, but I'm glad the waiting is over and we can get on with it. I want some answers to the questions I have.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company