Where Do We Go From Here?

Where Do We Go From Here?

Weekly CEO Commentary 3-11-13

Tim Phillips, CEO—Phillips & Company

The Dow hit an all-time high of 14,397.07 on Friday. Bloomberg shows that since the market bottom on March 9, 2009, when the Dow was at 6,547.05, the market has rallied 146.33 percent. Year to date, the Dow is up 10.8 percent. On one hand, it’s comforting that we have come a long way since the depths of the financial crisis. On the other hand, hitting an all-time high is sometimes a cue to take a step back and make sure that the market has not gotten over-extended.

One of the tools that we use to value stocks and markets as a whole is called mean reversion. The idea is that performance of stocks and markets tend to converge to a long-term average, or a “mean.” If you flip a coin and get heads, it doesn’t necessarily mean that you will get tails on the next flip, but over the long run, you will probably get close to 50 percent heads and 50 percent tails. It’s a similar idea with markets; over enough time, high valuations will probably come down to average levels, and likewise low valuations will probably come back up to historic averages.

Where we are at now

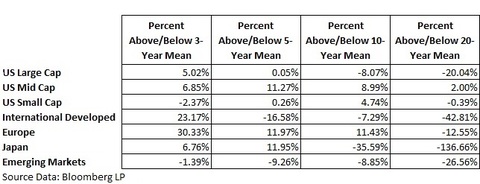

Here is a table showing how much over or under P/E ratios from various markets are from their historic levels:

Compared to long-term averages, markets are still undervalued, with the most extreme example being Japan. What this all means is that some profit taking or a correction is possible, as markets have been rallying, but markets are still trading at valuation levels below historic averages.

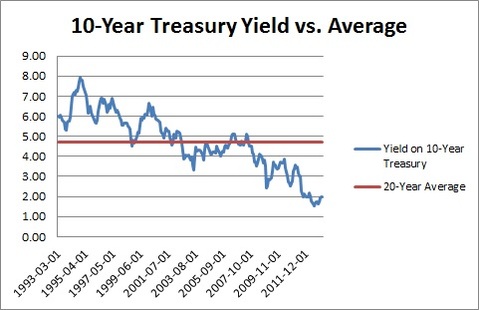

We also looked at fixed income, by looking at the 10-Year Treasury data from the Federal Reserve, and seeing how its yield compares to historic averages.

It is clear that Treasury bonds yields are far below historic average levels, which is why we have been positioning out of long-term Treasuries and have been exploring other options in fixed income.

Important caveat

It’s worth noting a quote from Benjamin Graham: “It is absurd to think that the general public can ever make money out of market forecasts.” We do have to remember that mean reversion is simply a tool to help value markets, and it is not a crystal ball. This is why we have written previously that we look at forecasts, but we take them with a grain of salt. Using mean reversion and P/E ratios can be helpful for positioning or making tilts, but we do not make all in bets either in or out of the market.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company