Too Early to Call a Recession

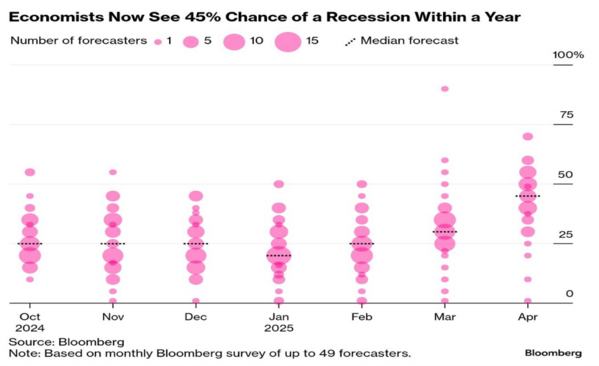

The recent drumbeat for a US recession is mounting and will dominate the news cycle this week. With US economic growth (GDP) releasing on Wednesday, economists will likely increase their probabilities for a recession. According to Bloomberg, forecasters now see a 45% chance of a recession up from a 30% chance in April.1

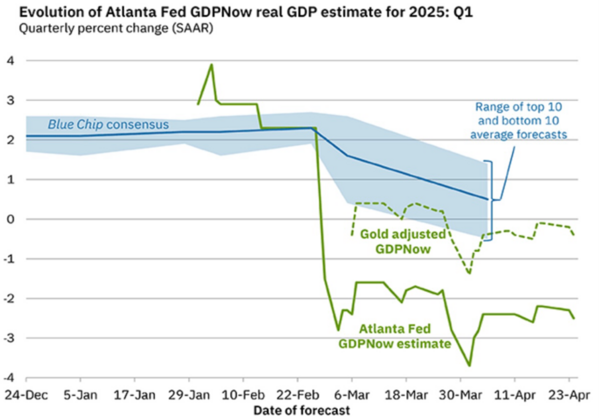

The Federal Reserve Bank of Atlanta’s GDPNow forecast estimated Q1 economic growth coming in at -2.1%, compared to a slightly positive growth rate projected by Blue Chip forecasters.2

The culprit for the Q1 slowdown was the threat of tariffs, which induced a massive import boom into the US. Net imports pull from economic growth.3

The culprit for the Q1 slowdown was the threat of tariffs, which induced a massive import boom into the US. Net imports pull from economic growth.3

If there is a recession, and that’s still a big if, averages would predict corporate profits to shrink by 11%, while GDP growth would shrink by 2.3%.4

We will know much more on Wednesday, but here is why I did not see a recession starting in Q1 or even in Q2.

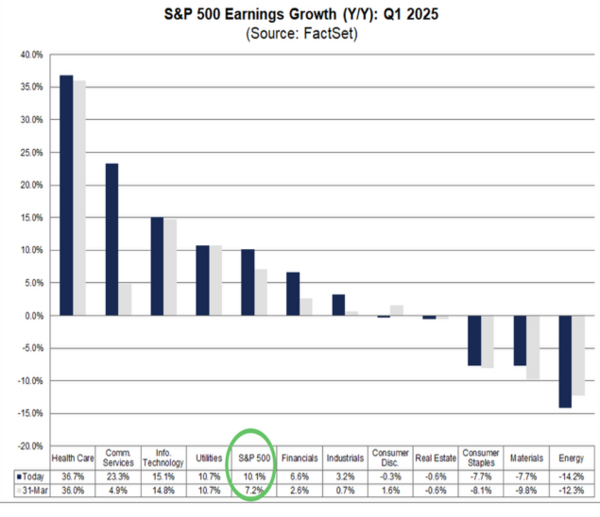

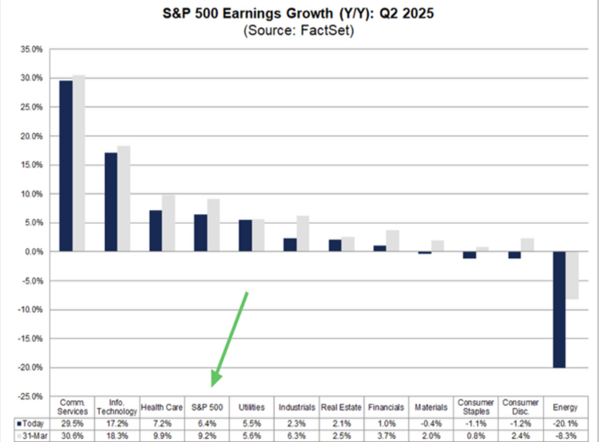

Corporate earnings reports were strong in Q1, according to FactSet. 36% of companies reported earnings per share growth over 10% with 73% beating estimates. It’s hard to anticipate a recession in the near term with corporate earnings results and estimates so strong. Q2 earnings expectations are still positive and fly in the face of a traditional recessionary earnings decline.5

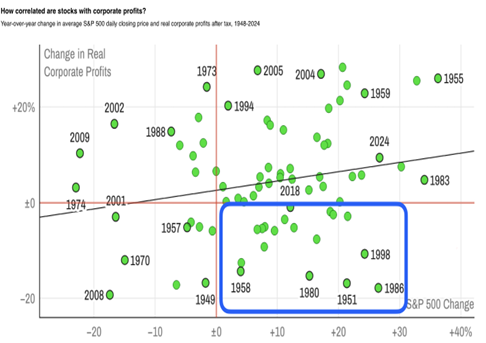

If recessions are traditionally accompanied by corporate earnings declines, you might not see it reflected in equity prices. There are plenty of cases when earnings decline and equites rally.7

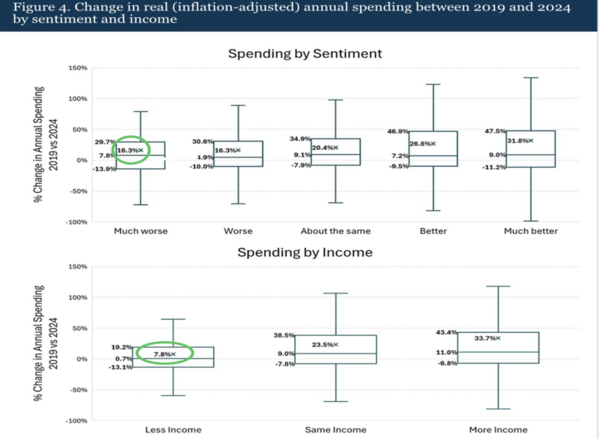

The challenge I have highlighted in past blogs is consumer sentiment being so negative. Negativity can easily lead to the belief we are heading toward a recession. It leaves the question; would the consumer cut back on spending when their attitudes were so negative? We finally have an empirical answer. A recent study by the Federal Reserve answered this exact question (link here).

Consumers continued to increase spending even as their attitudes worsened.8

Annual spending increased by 16.3% for those that said things were much worse in 2024 compared to 2019. Even those that reported less income spent 7.8% more than they did in 2019. The study highlights a few things that drove consumer sentiment down while they expanded their spending.

- The more people thought the prices they paid rose faster than their incomes, the worse they said they were doing.

- Consumers were more likely to overestimate than to underestimate the inflation they experienced. Those consumers who overestimated their verified inflation said they felt worse about economic conditions.

- Most respondents reported higher household incomes in 2024 versus 2019 but still said they did not feel good about the economy due to the effort they exerted to adapt to the economic environment.

In summary, consumers’ attitudes are biased by the effort to adjust for inflation over their rising real wages.

Here is what the study might look like in a simple chart. Consumer Sentiment drops from 2019 to 2024 (blue line) while their real (net of inflation) spending increased (red line). I have added a green line that shows their wages (net of inflation), which have grown at a slightly higher rate than inflation.9

It’s just too hard to call it a recession when people are working, wages are growing, and workers continue to spend. However, I believe we only have a couple of months to see one of three things before we experience some kind of shock to our economic system.

1) Tax cuts - which the Speaker of the House believes can be wrapped up by Memorial Day. Policy watchers seriously doubt this is possible so quickly.

2)Tariff deals - the first bi-lateral tariff deal needs to be cut with one of our larger trade partners, perhaps Japan. This will provide investors with a road map to evaluate future deals.

3) Rate cuts - interest rates need to be cut to at least signal to the consumer and investors there is a rational institution looking out for them.

We can certainly debate the strength or weakness of the US Dollar, the threat of tariffs on the US brand and the likelihood of a recession. The one thing that provides an answer to all these questions is the strength of the US Consumer--even the President admits that. Without the enduring strength of the US consumer, we have no brand and no negotiating power (We should also add our national security apparatus to our brand strength). Brand America is down but it is not out.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Alpha Picks Weekly Market Recap | Seeking Alpha

- (21) Andy Constan (@dampedspring) / X

- US economy showed signs of weakness even before trade tensions escalated | World News - Business Standard

- Take a look at the chart below from Apollo, showing that GDP (on average)… | Christian Ryberg Jørgensen, M.Sc.

- Euro Surges Against The Dollar Amid Tariff Turbulence - FastBull

- FactSet Insight - Commentary and research from our desk to yours | Earnings

- MarketWatch: Stock Market News - Financial News - MarketWatch

- The Fed - Tracking consumer sentiment versus how consumers are doing based on verified retail purchases

- Consumer expenditures in 2022 : BLS Reports: U.S. Bureau of Labor Statistics

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.