Soft Landings

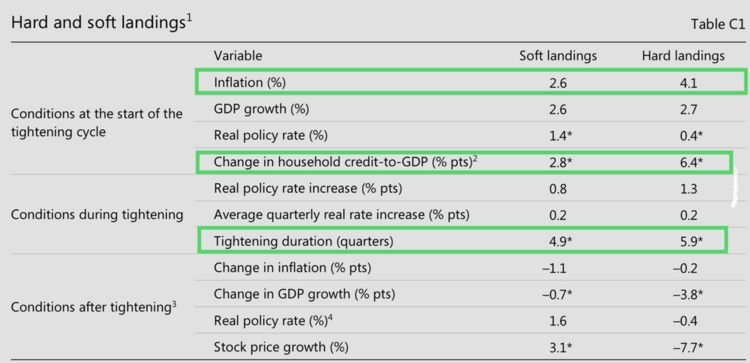

The Fed wants to orchestrate a “soft landing” for the U.S. economy, one in which job losses, wealth destruction, and credit contractions are minimal while inflation reduction is impactful. How do we frame this and measure this? The good news is the Bank of International Settlements recently publish a report that does just that. The report measures a history of recessions associated with central bank interest rate polices. It’s a long report (link) but this slide captures some key points.

Key Takeaways:

- Starting at a lower inflation rate (this works against the Fed in our current circumstance)

- Limit the duration of rate increase cycles (with rapid increases we could see this rate increase cycle end before the end of the year)

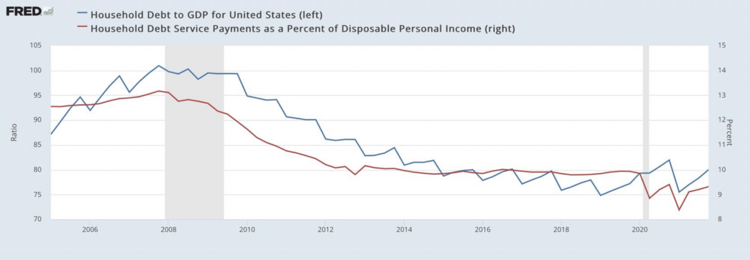

- Household credit relative to GDP, or debt service levels, matter (we are in very strong shape) 3

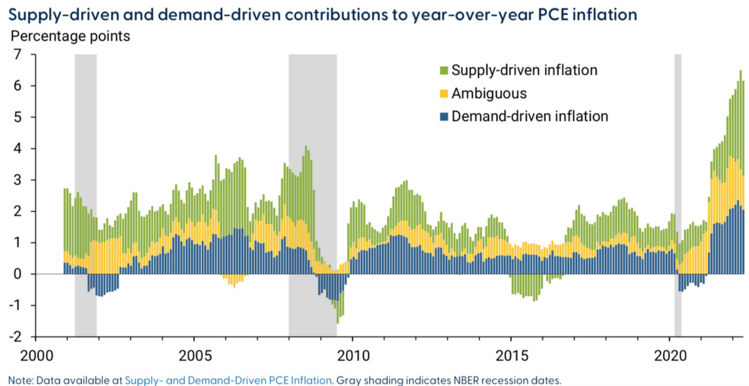

For the Fed to move quickly, they have to know what type of inflation they are trying to tame and what type of inflation they can tame. We know that food and energy prices are outside of their toolkit.

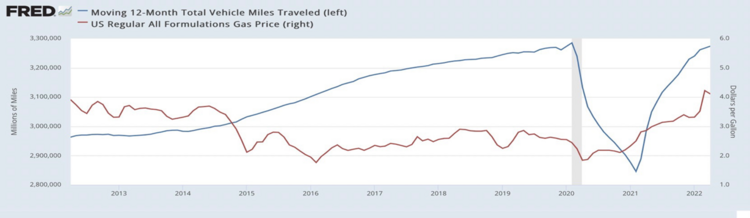

In past posts (6/13/22, 5/31/22, 5/2/22),I’ve highlighted the fact that food and energy inflation is incredibly hard for monetary policy to address. For example, consumers don’t drive that much less with higher gas prices. 1

The Federal Reserve Chair Jay Powell already said they have little impact on food and energy prices. 4

“Core inflation is most relevant to our tools. Non-core is outside our tools. We can’t have that much effect (on food and energy inflation), but we are responsible for fighting inflation.”

He further stated they have limited impact on supply constraints. 4

“What [the Fed] can control is demand, we can’t really affect supply with our policies…”

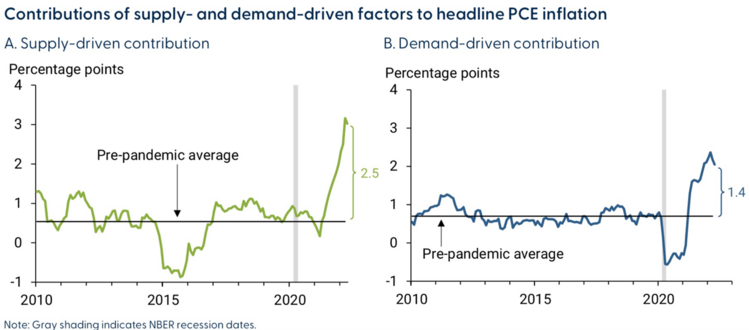

So how much inflation is driven by supply and demand? According to a recent Federal Reserve Board of San Francisco Study (link) the supply side is a major driver. 5

In fact, less than 33% of current inflation can be attributed to demand side impacts. 4.8% of current inflation above pre-pandemic levels is driven by supply-related issues, much of which are out of the reach of interest rate policy. 5

With supply chain bottlenecks abating, especially around transportation (see last week’s blog post), I believe the Fed can move quickly on its rate cycle and create the right conditions for a soft landing. Price stability and maximum employment will benefit from a soft landing and that’s the Fed’s mandate.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://fred.stlouisfed.org/graph/fredgraph.png?g=R0fe

- https://www.bis.org/publ/arpdf/ar2022e.pdf

- https://fred.stlouisfed.org/graph/fredgraph.png?g=R0ft

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220615.pdf

- https://www.frbsf.org/economic-research/indicators-data/supply-and-demand-driven-pce-inflation/